Colorado Name Change With Irs

Description

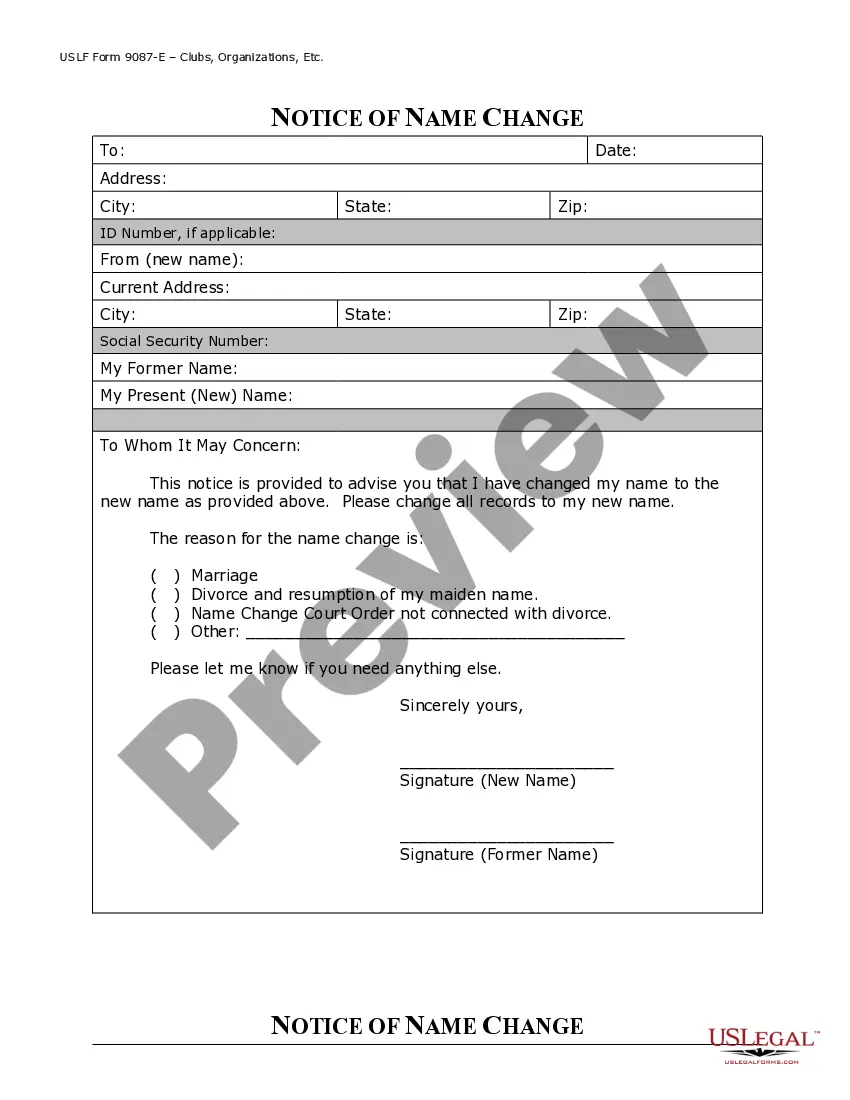

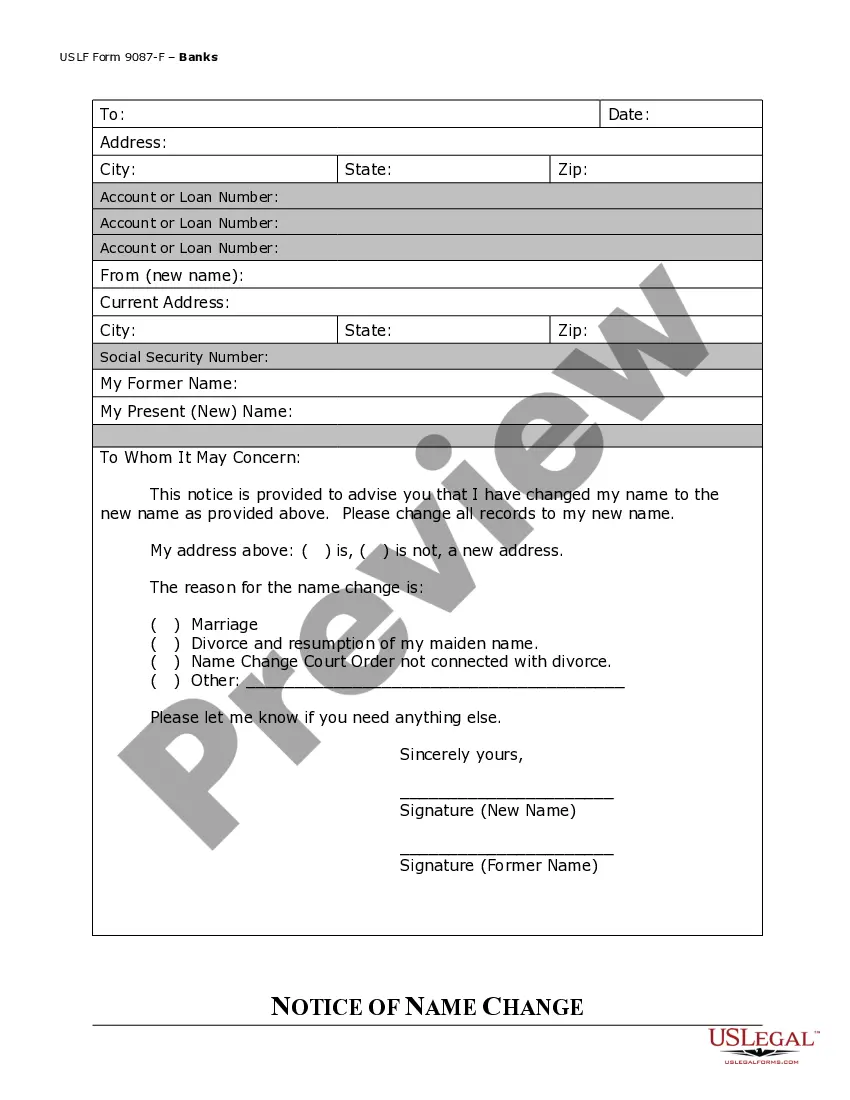

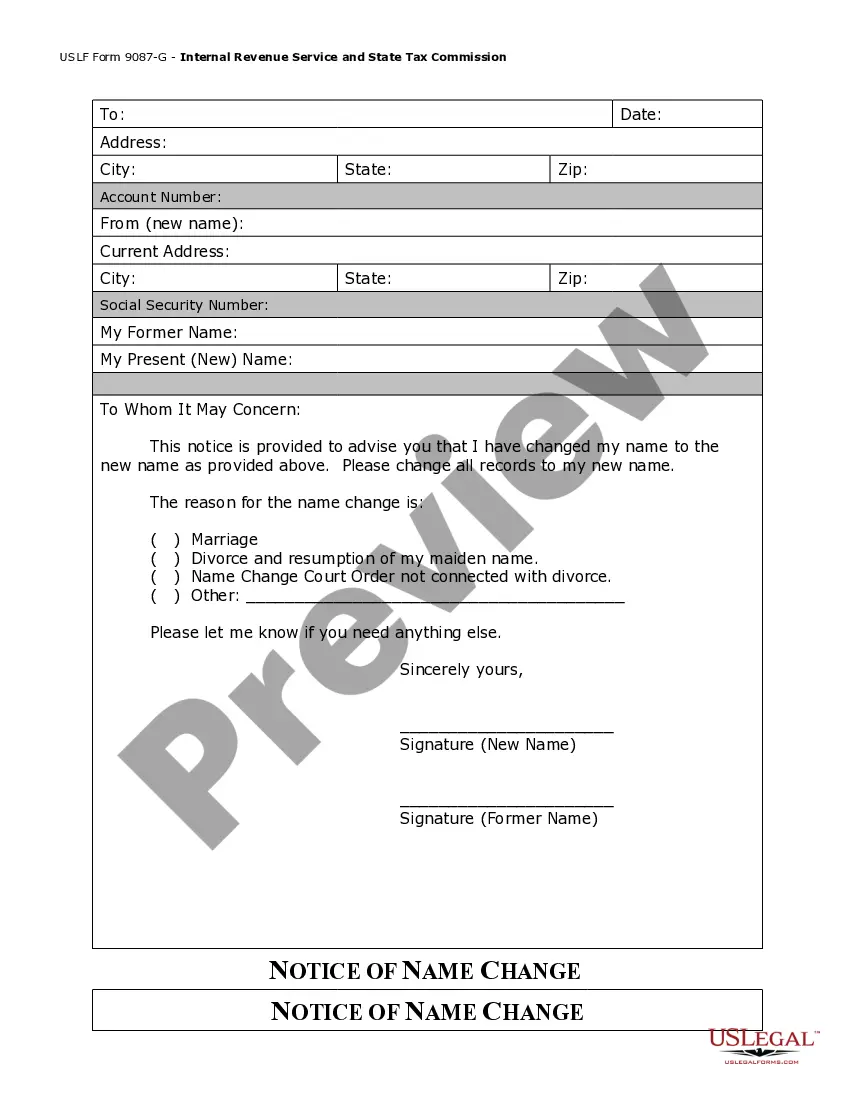

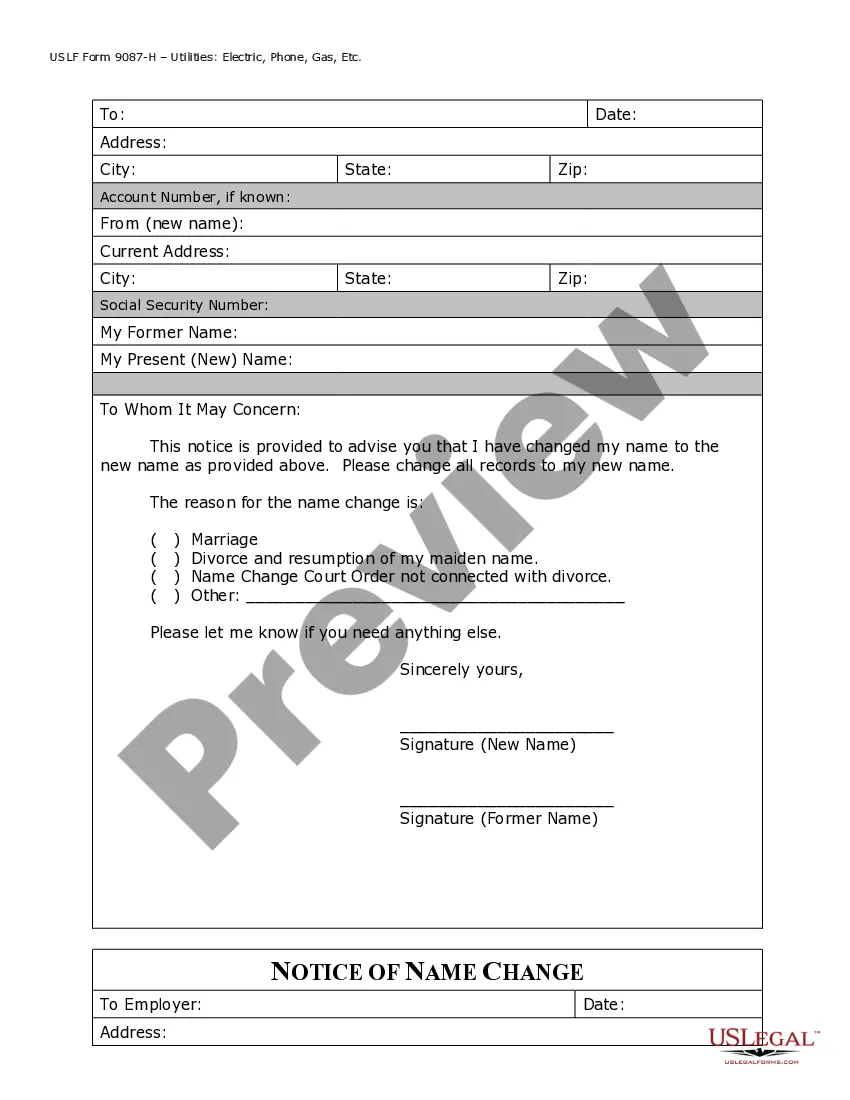

How to fill out Colorado Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Creating legal documents from the ground up can frequently seem overwhelming. Specific situations may require extensive research and significant financial investment.

If you are looking for a simpler and more cost-efficient approach to producing Colorado Name Change With Irs or other forms without unnecessary hurdles, US Legal Forms is consistently available to assist you.

Our online collection of over 85,000 current legal templates covers nearly all aspects of your financial, legal, and personal affairs.

With just a few clicks, you can promptly obtain templates that comply with state and county regulations, carefully crafted for you by our legal professionals.

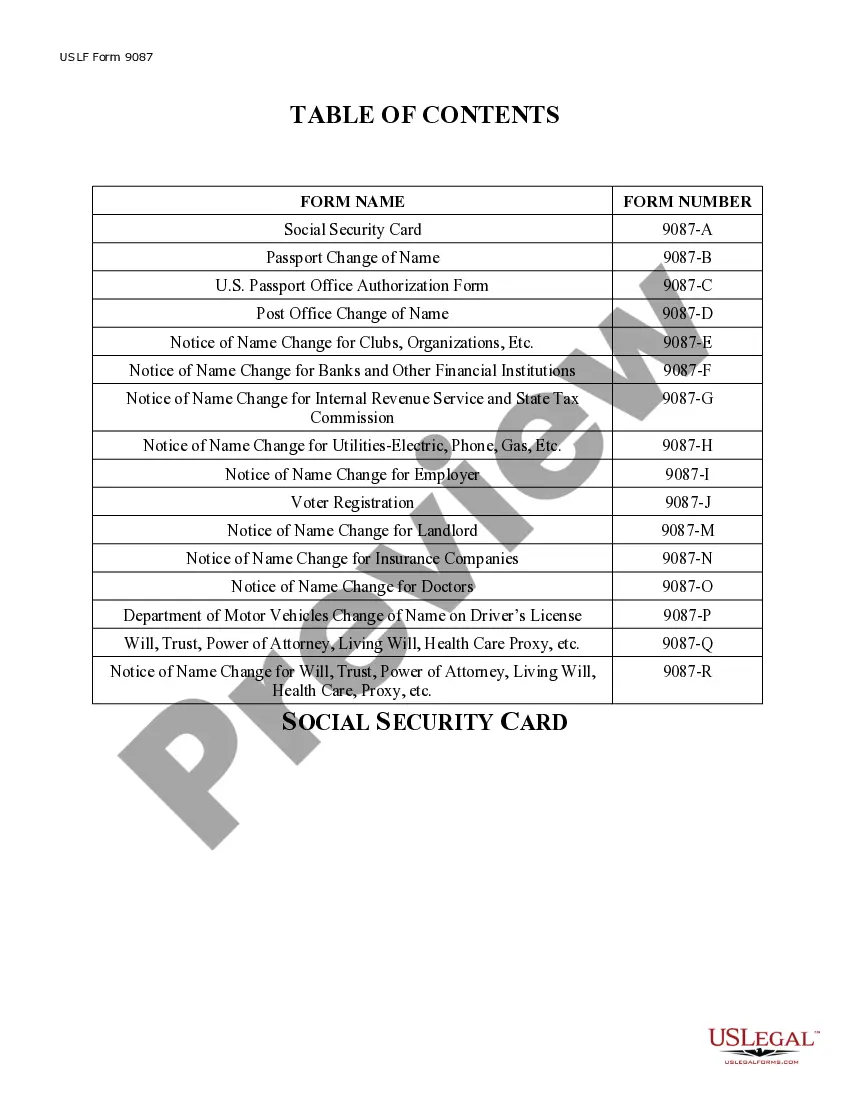

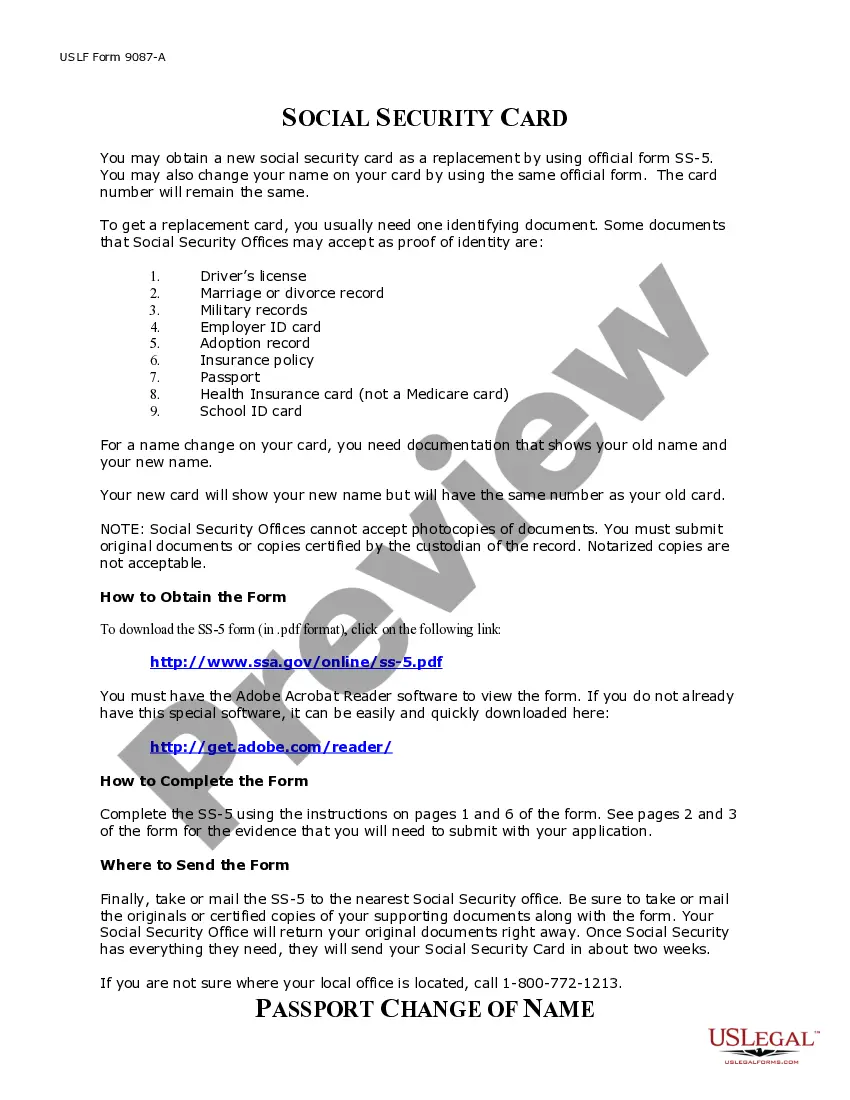

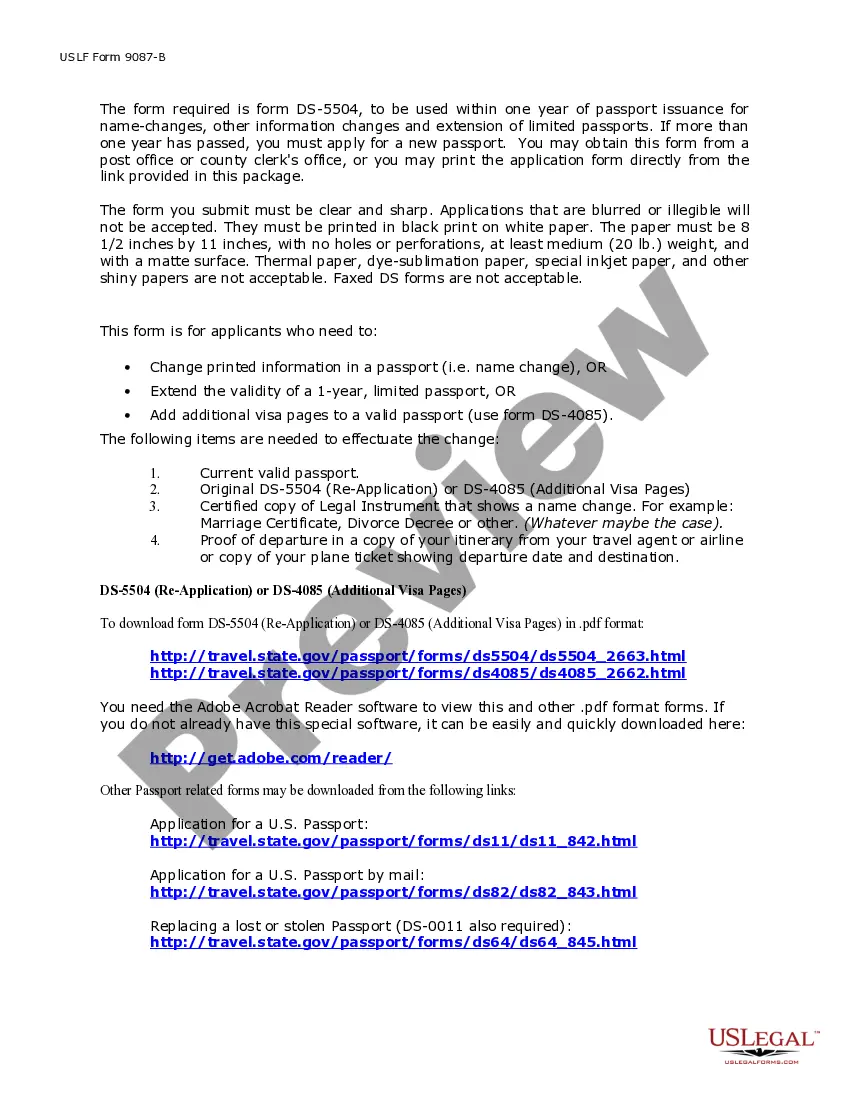

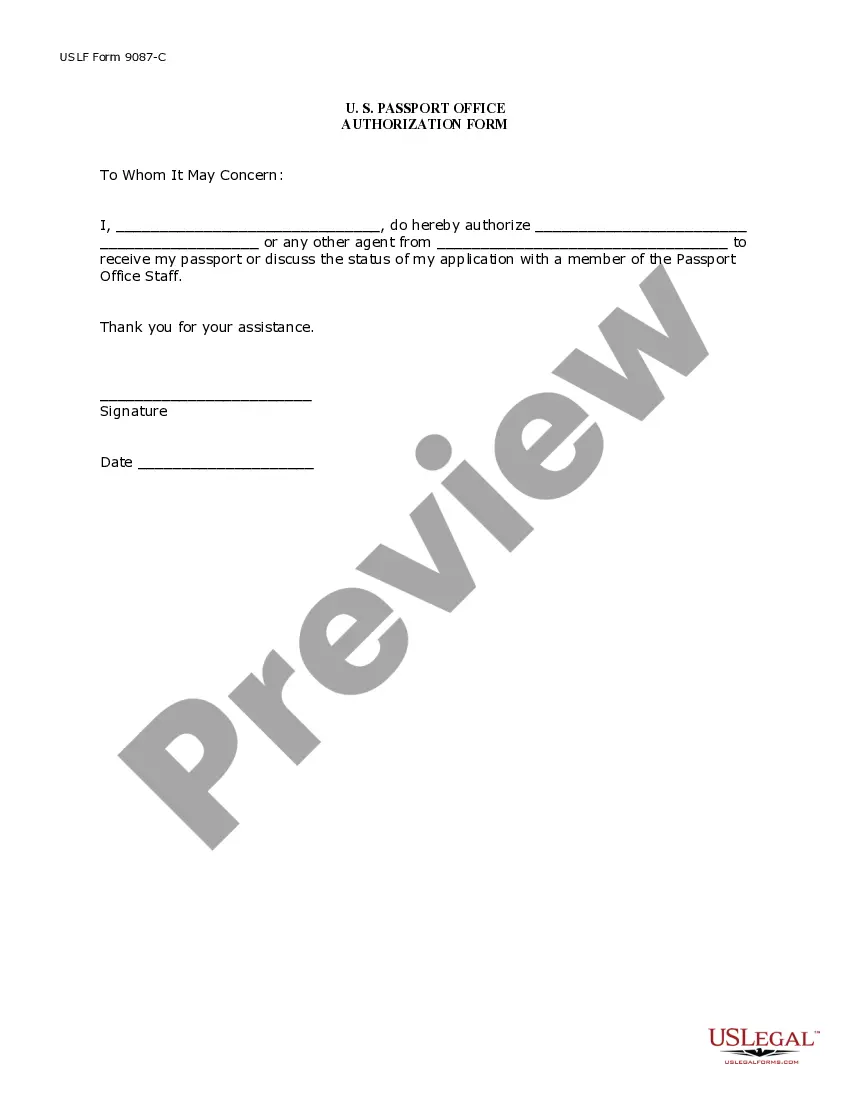

Examine the document preview and descriptions to confirm that you have located the correct form. Verify that the template you choose meets the standards of your state and county. Select the appropriate subscription option to acquire the Colorado Name Change With Irs. Download the document, then complete, certify, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make form completion a hassle-free and efficient process!

- Utilize our website whenever you require dependable and trustworthy services to quickly find and download the Colorado Name Change With Irs.

- If you are familiar with our services and have established an account, simply Log In, choose the form, and download it or re-download it anytime from the My documents tab.

- Not registered yet? No worries. It only takes a few minutes to sign up and browse the catalog.

- However, before diving straight into downloading Colorado Name Change With Irs, consider these suggestions.

Form popularity

FAQ

How to Order a Certified Copy of Articles of Organization or a Certified Copy of Articles of Incorporation from Alabama Secretary of State By Phone: Call (334)242-5324 and request your certified copy. ... By Email: ... By Mail: ... By Fax: ... In Person: ... Counter Service: ... Expedited processing: ... Normal processing:

You can check your S corp status relatively easily by contacting the IRS. If you have properly submitted your S corporation form to the IRS and have not heard back, you can call the IRS at (800) 829-4933 and they will inform you of your application status.

S Corp Approval Letter (CP261 Notice) The CP261 Notice officially confirms that your S Corporation has been established. Going forward, your S Corporation's business activity will be reported on the 1120s Business Tax Return.

How long does the process take? Typically, you will get a verdict on your form 2553 application within 60 days of submitting it to the IRS. If you have not heard back in that timeframe, reach out to the IRS directly. You can call the IRS at (800) 829-4933 to check the status of your application.

As long as you are listed as a qualified legal party with the authorization to do business on the corporation's behalf, you should be able to request the information. The IRS will mail a copy; you can request a faxed copy in addition to the mailed letter. You can't check S corp status online.

Yes, a composite return may be filed by the S corporation to report the income and pay the tax for the nonresident shareholders. Use Form PTE-C. Does Alabama recognize the federal election to be treated as an S corporation? Yes, use Form 20S.

How to call the IRS and determine if your LLC is taxed like an S-Corp Call the IRS at 1-800-829-4933 (the ?business and specialty tax line?). Press option 1 for English. Press option 1 for Employer Identification Numbers. Press option 3 for ?If you already have an EIN, but you can't remember it, etc.?

Step 1: Name Your Alabama LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Alabama Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Alabama S Corp Tax Designation.