Solicitud De Arrendamiento Withholding

Description

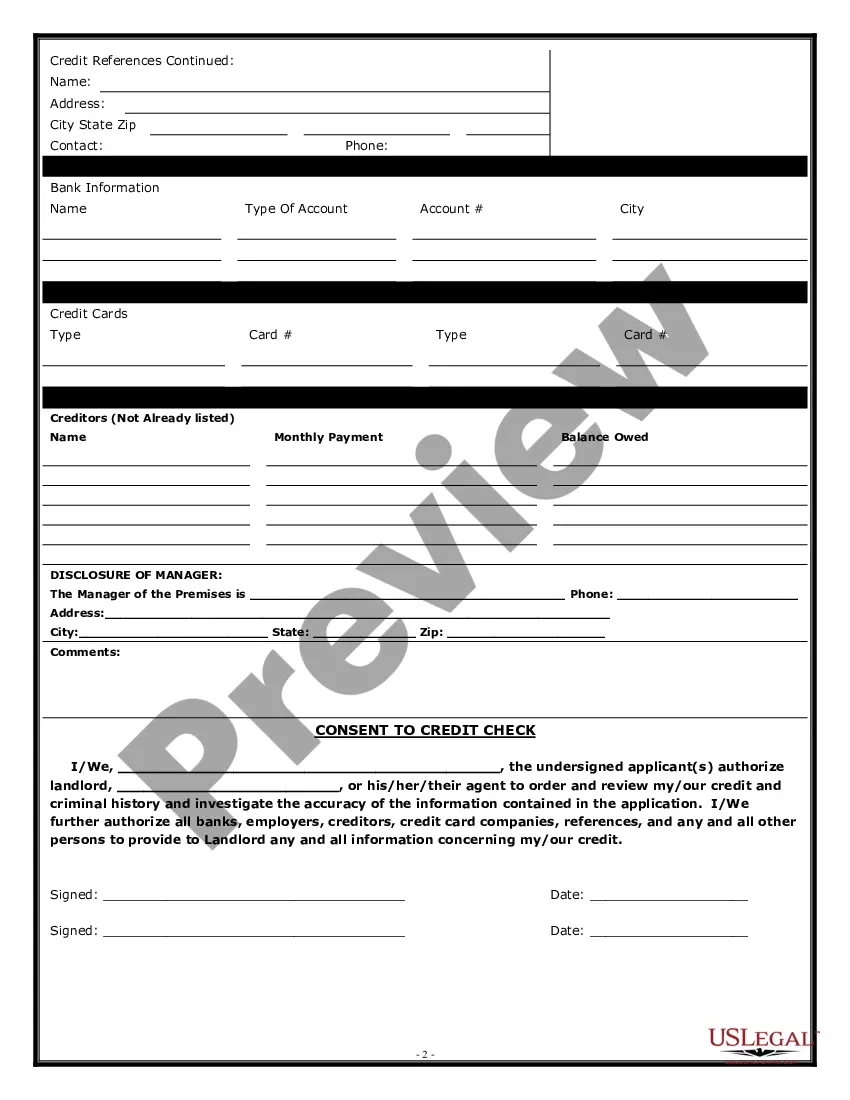

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

Acquiring legal documents that comply with the national and local regulations is essential, and the web provides many selections to choose from.

However, why spend time looking for the suitable Solicitud De Arrendamiento Withholding example online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates prepared by attorneys for any commercial and personal scenario.

Explore the template using the Preview feature or via the text outline to confirm it fulfills your requirements.

- They are straightforward to navigate with all files organized by state and intended use.

- Our experts keep abreast of legal changes, so you can always trust that your document is current and compliant when obtaining a Solicitud De Arrendamiento Withholding from our platform.

- Acquiring a Solicitud De Arrendamiento Withholding is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the correct format.

- If you are new to our site, follow the steps outlined below.

Form popularity

FAQ

To reclaim FIRPTA withholding, you must file Form 843 with the IRS along with supporting documents, like your original Form 8288. Essentially, you are requesting a refund for the withheld amount if you qualify for it. Understanding the solicitud de arrendamiento withholding entails knowing this recovery process to ensure you're not overtaxed. USLegalForms provides resources to help guide you through these claims.

To request withholding of federal income tax for real estate transactions, you need to indicate this requirement on Form 8288. This action informs the IRS of the need to withhold taxes from the transaction. Properly managing the solicitud de arrendamiento withholding ensures you meet your federal tax obligations. Consulting USLegalForms can provide clarity on the requirements.

Filing withholdings involves completing the required IRS forms accurately, primarily Form 8288 for FIRPTA. Ensure you include all relevant information about the transaction and the amount withheld. Completing the solicitud de arrendamiento withholding process correctly protects you from future tax complications. Resources available on USLegalForms can guide you through this process.

Reporting FIRPTA withholding requires filling out Form 8288, where you'll provide specific details about the transaction and withheld amounts. You must submit this form to the IRS, maintaining a copy for your records. Knowing how to handle the solicitud de arrendamiento withholding efficiently simplifies your tax responsibilities. USLegalForms offers additional tools for a smooth reporting experience.

You submit the withholding by filling out Form 8288 and making the payment along with the form. It's essential to do this within 20 days of the transaction date to avoid penalties. Properly handling the solicitud de arrendamiento withholding helps maintain compliance with IRS regulations. You can find guidance on submission processes through platforms like USLegalForms.

To file FIRPTA withholding, you must complete Form 8288 and provide pertinent information about the transaction. This form reports the amounts withheld from the foreign seller. By submitting timely and accurately, you ensure that your obligations regarding the solicitud de arrendamiento withholding are met. USLegalForms offers resources to aid in this process.

Choosing between claiming 0 or 1 for tax withholding depends on how much tax you want withheld from your paycheck. Claiming 0 means more tax will be taken out, which may help prevent owing taxes at year-end, while claiming 1 will reduce the amount withheld. Review your financial circumstances to make this important decision. The Solicitud de arrendamiento withholding section on US Legal Forms can provide insights tailored to your situation.

Correctly filling out your withholding form starts with gathering your personal information and understanding your financial situation. Make sure to provide accurate data about your income, deductions, and credits. Utilize the assistance and resources found in the Solicitud de arrendamiento withholding feature on the US Legal Forms platform to support you in this simple process.

On your W-4 form, you place 0 or 1 in the section that indicates the number of allowances you are claiming. Claiming 0 means that more tax will be withheld, while claiming 1 reduces your withholding. Take time to evaluate your financial situation to make the best choice for your needs. Reviewing the Solicitud de arrendamiento withholding guidance on US Legal Forms can help clarify this process.

Filling out your tax withholding form involves entering personal details and estimating your tax situation carefully. First, provide your name, address, and Social Security number. Then, consider your tax credits, deductions, and allowances. If you find yourself needing assistance, the US Legal Forms platform offers the Solicitud de arrendamiento withholding feature to help simplify this process.