Affidavit of Labor or Materials Furnished - Individual or Corporate

Note: This summary is not intended to be an all-inclusive discussion of Colorado's construction lien laws, but does include

basic provisions.

When and By Whom A Lien May Be Filed

Colorado law recognizes that when a person,

or corporation, provides labor, materials, or laborers for a construction

project or improvement of land, that party shall have the legal authority

to assert a lien against the property being improved. Central to

properly obtaining a lien is the filing of a construction contract or a

memorandum describing the contract with the county recorder prior to the

commencement of work. If a memorandum is used, it should describe

all of the parties involved in the contract, a description of the property,

a description of the work to be done, and the total amount to be paid under

the contract and under what terms. Failure to file the contract or

memorandum results in the parties providing labor or materials to the construction

project being presumed to have a lien for the value of the labor or materials

provided. C.R.S.§38-22-101.

Notice of Materials or Labor Furnished

Any party entitled to a lien, except the principal contractor,

may at any time give to the owner, or other person responsible for disbursing

funds, a written notice advising that the party giving the notice has provided

or will provide labor or materials to the project. This written notice

serves to advise the party funding the project that the party serving the

notice is entitled to be paid and is someone who could potentially file

a lien. The notice includes the estimated or agreed value of the

labor or materials that have been supplied or will be supplied. Properly

served, this notice requires the parties financing the construction project

to withhold the amount of value of these labor or materials from the principal

contractor to satisfy the claim or lien. C.R.S.§38-22-102.

Filing a Lien Statement

To file a lien, the party claiming the lien,

(the lien claimant), must file a lien statement in the office of the county

clerk and county recorder. Before a lien statement can be filed the

lien claimant must serve the property owner and principal contractor with

a notice of intent to file a lien at least ten days before the lien statement

is filed. C.R.S.§38-22-109(11).

A lien statement must contain the property owner's

name, if known, as well as the name of the lien claimant, and the contractor

for whom the lien claimant worked if the lien claimant is a subcontractor.

In addition, the notice must contain a property description and a statement

of how much the lien claimant is owed. C.R.S.§38-22-109(1).

Timely Filing of Lien Statement

Lien statements claiming payment for labor or

work by the day or piece must be filed within two months of the completion

of the project. Otherwise, the lien statement must be filed within

four months of the day the last work was performed or materials supplied

by the lien claimant. C.R.S.§38-22-109(4)

Filing a Notice of Intent to File a Lien

To extend the amount of time within which to

file a lien statement, the lien claimant may file with the county clerk

a Notice of Intent to File a Lien. This notice contains a property

description, the lien claimant's name, address and telephone number and

the name of the party the claimant has contracted with. The filing

of this notice extends the time the lien claimant may file a lien statement

to four months after completion of the project or six months after the

filing of the notice, whichever comes first. C.R.S.§38-22-109(4)-(10).

Duration of a Notice of Intent

A Notice of Intent to File a Lien automatically

terminates six months after filing. However, if improvements are

not yet complete, prior to termination of the notice the claimant may file

an amended notice and extend the notice an additional six months from filing

or four months from completion of the project. C.R.S.§38-22-109(10).

Duration of a Lien Statement

Regardless of when the lien statement is filed,

no lien statement shall remain effective longer than one year from filing

unless within thirty (30) days of the one year anniversary of the filing

the claimant files with the county recorder an affidavit stating that improvements

on the property have not been completed. C.R.S.§38-22-109(9).

Assignment of a Lien or Claim

It is possible for a lien claimant to assign

in writing his claim and lien to another party. That party then has

all the rights and remedies provided by law of the original lien claimant for

the purposes of filing and enforcing the original lien claimant's lien.

C.R.S.§ 38-22-117.

Satisfying a lien

After the lien has been filed, the property owner

may have the lien removed by paying the amount of the lien together with

the costs of filing and recording the lien. After payment, the property

owner may demand that the lien claimant file with the county recorder an

Acknowledgment of Satisfaction, which attests to the fact that the lien

has been satisfied. A lien claimant who does not file an Acknowledgment

within ten days of the property owner's request shall forfeit the amount

of $10.00 per day. C.R.S.§38-22-118.

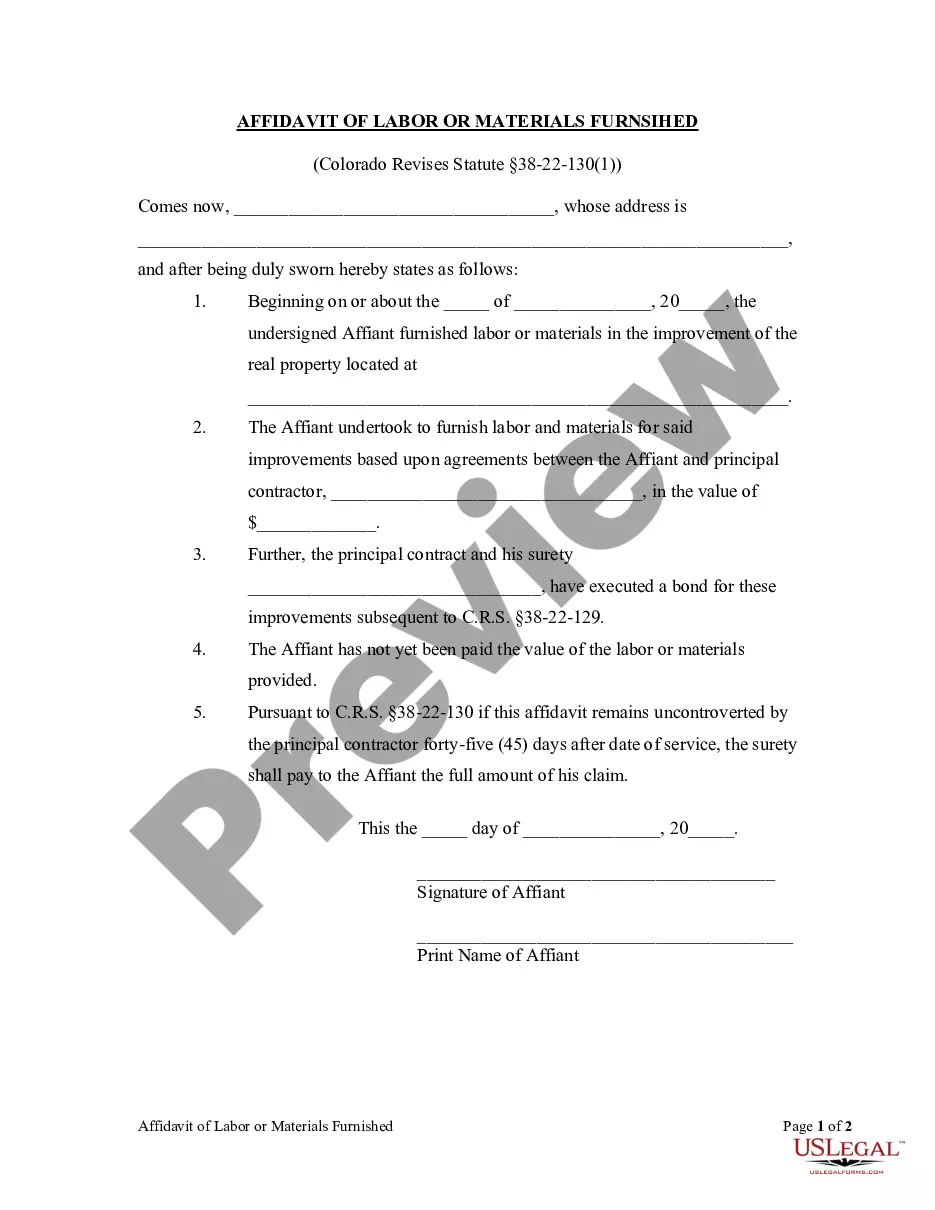

Use of a Bond to Prevent the filing of a Lien

The Colorado statute that allows a party who

supplies labor or materials to place a lien on the improved property does

not apply where the principal contractor and his surety execute a performance

bond and a labor and materials bond, each in excess of 150% of the contract

price. Parties who would otherwise be entitled to a lien may pursue

the contractor and his surety directly, but must file suit within six months

of completion of the project. C.R.S.§38-22-129(2).

In order for a bond to prevent the filing of

a lien, the principal contractor must file a notice of the bond with the

office of the county recorder. The principal contractor should also

make copies of the bond available to subcontractors, materialmen, and laborers

upon request. C.R.S.§38-22-129(3)

It is possible for a lien claimant to file a

lien statement when the principal contractor has a bond in place.

If the contractor and surety execute a notice acknowledging the existence

of a bond and that the lien claimant is entitled to benefit from that bond,

the lien shall be deemed released. Under statute, if the property

owner requests that the contractor and surety execute an acknowledgment,

they must do so within thirty (30) days. Failure to execute the acknowledgment

within thirty (30) days will permit the lien claimant to file his lien

as normal. C.R.S.§38-22-129(4).