Security Deposit With A Lease

Description

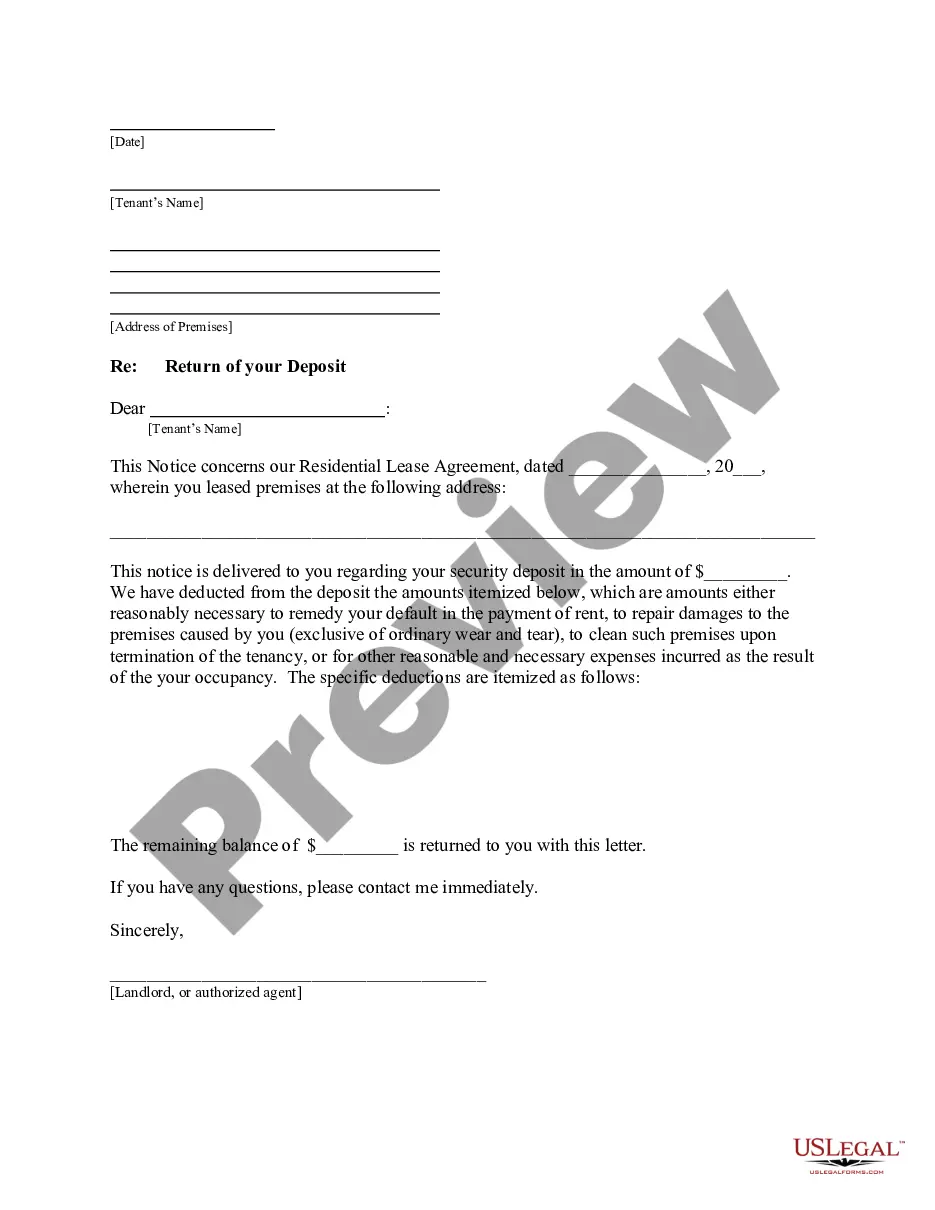

How to fill out Colorado Letter From Landlord To Tenant Returning Security Deposit Less Deductions?

It’s clear that you cannot transform into a legal expert instantly, nor can you learn how to swiftly create a Security Deposit With A Lease without a distinct set of abilities.

Drafting legal documents is a lengthy process that demands particular education and expertise. So why not entrust the creation of the Security Deposit With A Lease to the specialists.

With US Legal Forms, one of the most extensive libraries for legal documents, you can locate everything from court forms to templates for internal communication. We recognize how vital compliance and adherence to federal and state laws and regulations are.

Create a free account and select a subscription plan to acquire the form.

Click Buy now. Once the payment is finalized, you can download the Security Deposit With A Lease, complete it, print it, and send or mail it to the specified individuals or organizations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s start off with our website and obtain the form you need in just minutes.

- Find the form you require using the search bar at the top of the page.

- View it (if this option is available) and read the accompanying description to determine if Security Deposit With A Lease is what you’re looking for.

- If you need a different template, begin your search again.

Form popularity

FAQ

To claim a security deposit back from a landlord, first, ensure you have documented any necessary repairs or cleaning that may justify deductions. Then, contact your landlord in writing, requesting the return of your deposit, and include a forwarding address for the return. If your landlord fails to respond or refuses to return the deposit, you may consider filing a claim in small claims court. Using resources like US Legal Forms can guide you through this process effectively, ensuring you understand your rights.

In Arkansas, the law regarding security deposits with a lease states that landlords can collect a security deposit, typically not exceeding two months' rent. Landlords must provide a written receipt upon receiving this deposit. Additionally, they are required to return the security deposit within 60 days after the tenant vacates the property, minus any deductions for damages. Understanding these laws can help you navigate your rights and responsibilities.

You typically receive your security deposit back after your lease ends, provided you meet specific conditions. It is important to leave the property in good condition, as landlords often deduct amounts for cleaning or repairs. Check your lease agreement for any specific terms regarding the return of your security deposit with a lease. If you face issues with getting your deposit back, consider using resources like US Legal Forms for guidance on your rights.

In Connecticut, the law regarding a security deposit with a lease stipulates that landlords can collect up to two months' rent as a security deposit for residential leases. This deposit must be returned to the tenant within 30 days after the lease ends, minus any deductions for damages or unpaid rent. It's crucial for both landlords and tenants to document the condition of the property at the start and end of the lease to avoid disputes. If you need assistance navigating these legal requirements, USLegalForms offers resources to help you understand and manage your security deposit obligations.

AMOUNT OF SECURITY DEPOSIT Landlords are not permitted to require more than one and one half times the monthly rental payment as a security deposit. Any additional yearly security deposit increase may not exceed 10% of the current security deposit.

Every tenant in New Jersey has the right to get their security deposit returned whenever they move out of the rental property. In these cases, the security deposit must be returned within 30 days of the tenant leaving the unit.

A security deposit agreement is an agreement between a landlord and a tenant where the tenant deposits a specific amount of money with the landlord at the time the lease is signed. This security deposit is usually an amount between and three months of rent.

Security deposits, on the other hand, are to be considered receivables on the part of the lessee and a payable on the part of the lessor.

Ing to the IRS, a security deposit should not be reported as income if you're planning to return it at the end of the lease. However, there are a few exceptions: When a security deposit is used as the final rent payment, it is considered advance rent and can be reported as income when you receive it.