Deed Without Warranty Vs Quitclaim Deed

Description

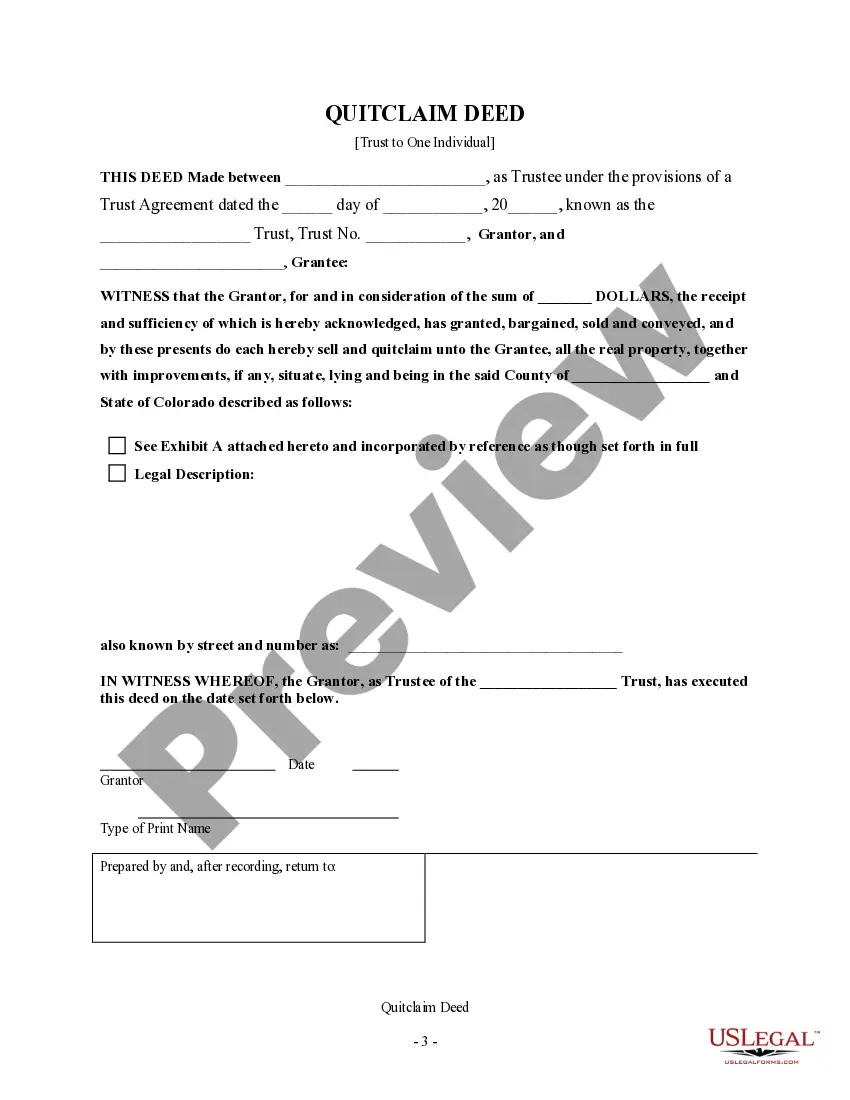

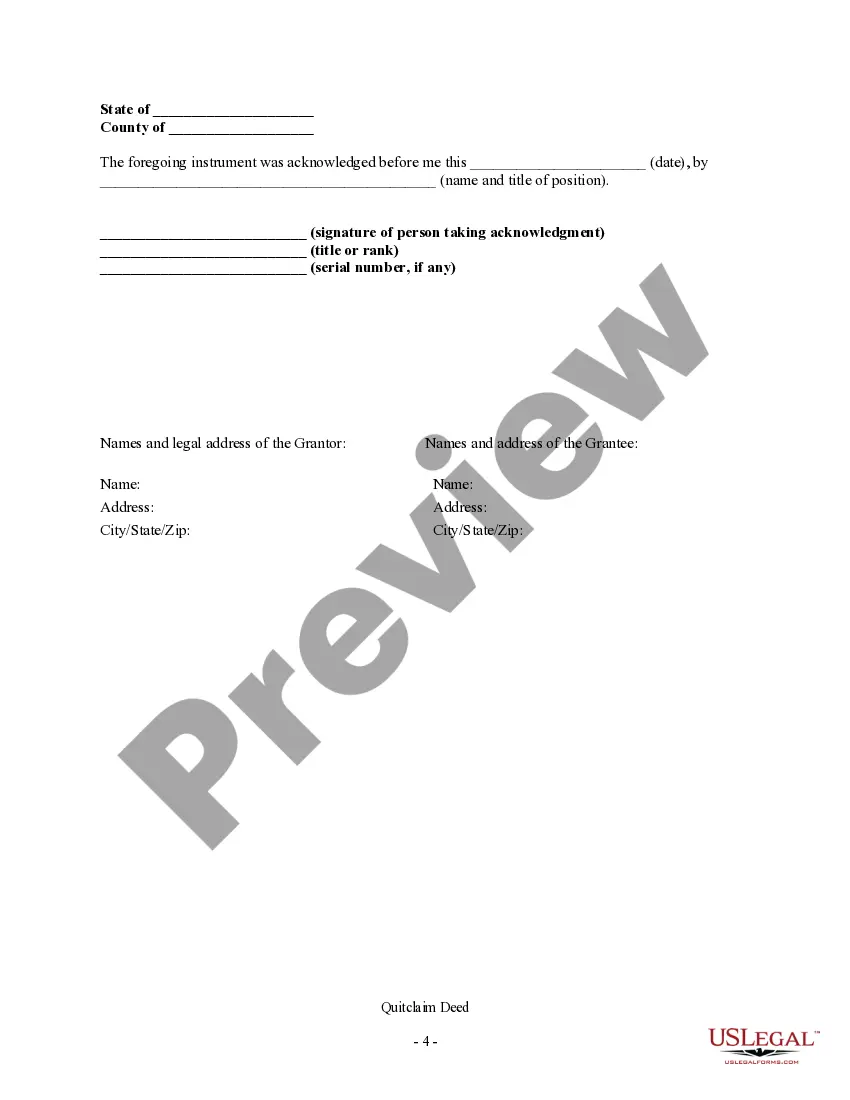

How to fill out Colorado Quitclaim Deed - Trust To An Individual?

Red tape demands accuracy and precision. If you don’t engage in filling out documents like Deed Without Warranty versus Quitclaim Deed on a regular basis, it might lead to some misunderstandings.

Choosing the appropriate template from the outset will guarantee that your paperwork submission proceeds smoothly and avoid the hassle of resubmitting a document or repeating the entire task from the ground up.

You can always find the correct template for your paperwork at US Legal Forms.

Search for the template using the search bar. Ensure the Deed Without Warranty versus Quitclaim Deed you’ve discovered is relevant for your state or region. Preview or read the description that includes details on the sample's application. If it suits your needs, click the Buy Now button. Select a suitable option from the offered subscription plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal. Save the document in your preferred file format. Locating the right and updated templates for your paperwork takes just minutes with an account at US Legal Forms. Sidestep bureaucratic issues and enhance your document processing efficiency.

- US Legal Forms is the largest online collection of forms that provides over 85 thousand templates across various areas.

- You can discover the latest and most pertinent version of the Deed Without Warranty versus Quitclaim Deed by simply searching on the site.

- Find, organize, and save templates in your account or refer to the description to ensure you have the right one ready.

- With an account at US Legal Forms, you can efficiently acquire, store in one place, and navigate the templates you have saved for easy access.

- When on the site, click the Log In button to authenticate.

- Then, visit the My documents page, where your document history is maintained.

- Review the form descriptions and save the ones you need at any time.

- If you are not a registered user, finding the needed template will require a few more steps.

Form popularity

FAQ

Many individuals have used quitclaim deeds to transfer property ownership without the warranties that come with a warranty deed. A quitclaim deed offers a simple way to convey a property, often in family or informal transactions. It's crucial to understand the deed without warranty vs quitclaim deed distinction since the latter carries no guarantees about the property's title. If you are considering a quitclaim deed, you can explore resources on the US Legal Forms platform, which provides guides and templates to help you through the process.

In Texas, whether a deed without warranty is better than a quitclaim deed can depend on your specific situation. A deed without warranty may provide broader protection against title defects compared to a quitclaim deed by transferring the property with certain covenants. However, the trade-off may involve more complexity and additional costs. Ultimately, understanding the nuances of a deed without warranty vs quitclaim deed can guide you in making informed decisions.

Many people use a quitclaim deed because it offers a quick and easy way to transfer ownership. This is particularly useful in situations like family transfers or when clearing up titles after a divorce. While it lacks warranties, the parties involved often trust each other, which makes this option practical. It serves as a straightforward method for transferring property rights when certainty about the title is less critical.

False. A quitclaim deed does not provide the most protection for the buyer. Unlike other forms of deeds, it offers no warranties about the title of the property. This means the buyer accepts the property 'as is,' assuming any risks associated with potential title issues. When considering safety, understanding the differences between a deed without warranty vs quitclaim deed is essential.

In Texas, a quitclaim deed transfers whatever interest the grantor has without guaranteeing the title, while a deed without warranty offers a similar provision with slight differences. A deed without warranty typically implies that the seller does not warrant against encumbrances. Understanding these distinctions is crucial for anyone considering property transfers. Evaluating the Deed without warranty vs quitclaim deed can help you determine which choice best suits your needs.

Homebuyers typically benefit the most from a warranty deed. This type of deed provides assurance that the seller holds clear title and will defend that title against any claims. Such protection is invaluable as it builds trust and minimizes risks in property transactions. In the discussion of Deed without warranty vs quitclaim deed, buyers should note that warranty deeds are ideal when security is the primary concern.

The best deed to transfer property depends on the needs of the parties involved. A warranty deed offers strong protection for the buyer because it guarantees a clear title, while a quitclaim deed or a deed without warranty may be suitable for informal transactions. For those transferring property among family or friends, a quitclaim deed is often sufficient. However, if you seek clarity, understanding the differences in terms of 'Deed without warranty vs quitclaim deed' can steer you in the right direction.

One of the key disadvantages of a warranty deed is that it provides a stronger guarantee to the buyer. While this might sound beneficial, it places greater liability on the seller. If a title issue arises after the sale, the seller may face legal consequences. Considering the Deed without warranty vs quitclaim deed, the latter options may provide a more flexible solution for those seeking less risk.

The most powerful deed is often regarded as the general warranty deed. It not only conveys ownership but also implies a level of safety and security for the buyer. When weighing deed without warranty vs quitclaim deed, the general warranty deed is the clear leader due to its extensive protections and assurances to the new owner.

The weakest form of deed is the quitclaim deed. This type of deed transfers whatever interest the grantor has in the property without any guarantees or warranties. In the context of deed without warranty vs quitclaim deed, the quitclaim deed provides minimal protection and leaves the buyer vulnerable to potential claims or disputes.