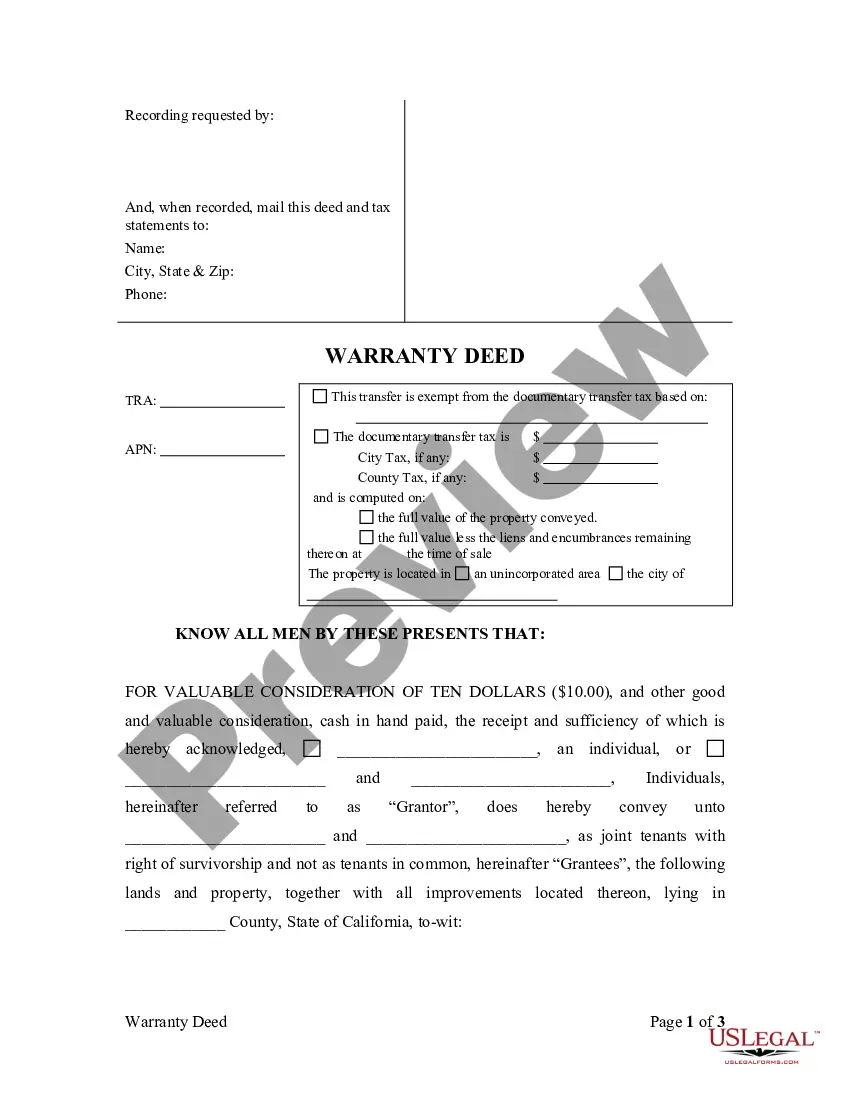

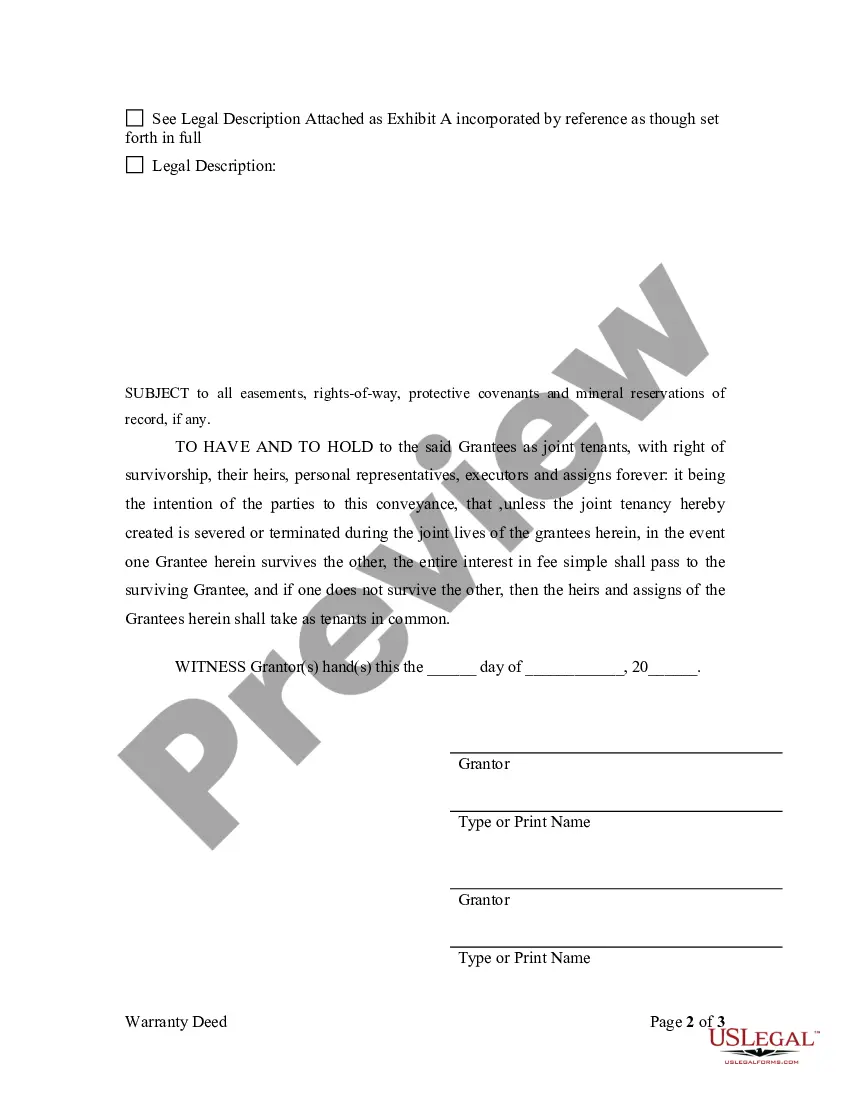

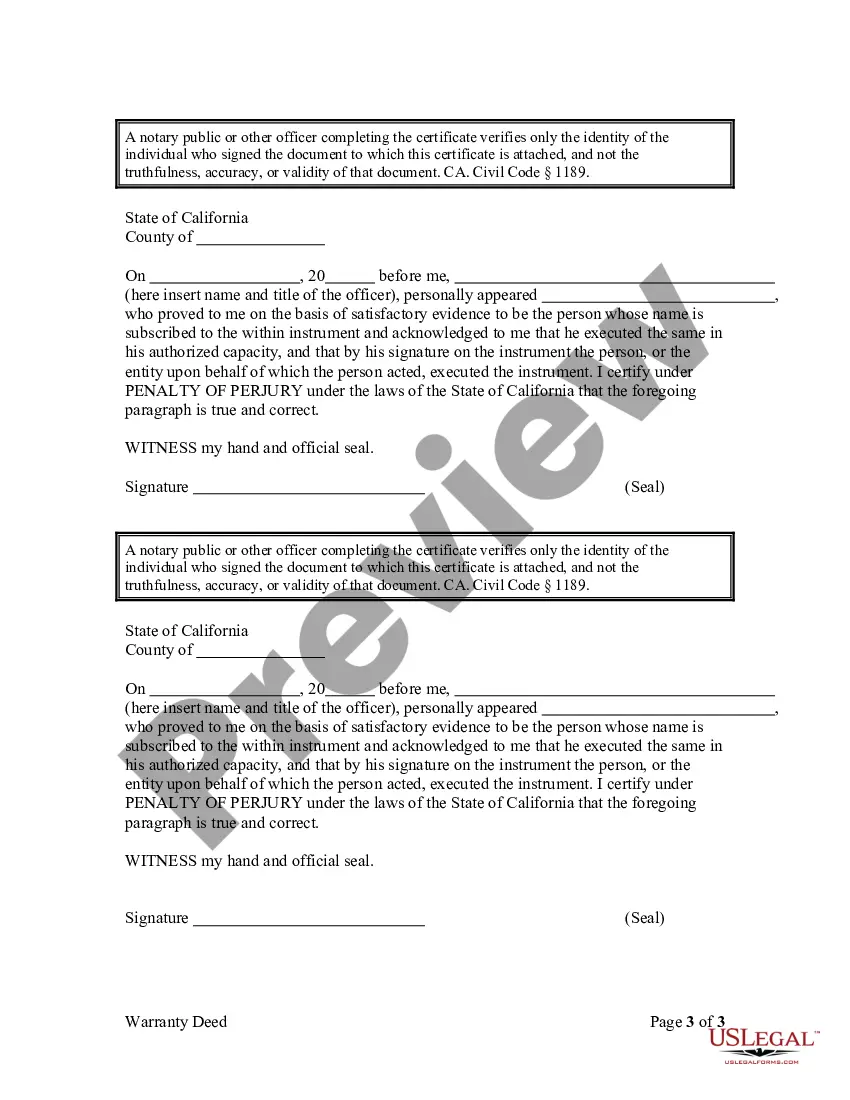

This form is a Warranty Deed where the grantees hold title to the property as a joint tenants.

Assets Joint Tenants With Rights Of Survivorship

Description

Form popularity

FAQ

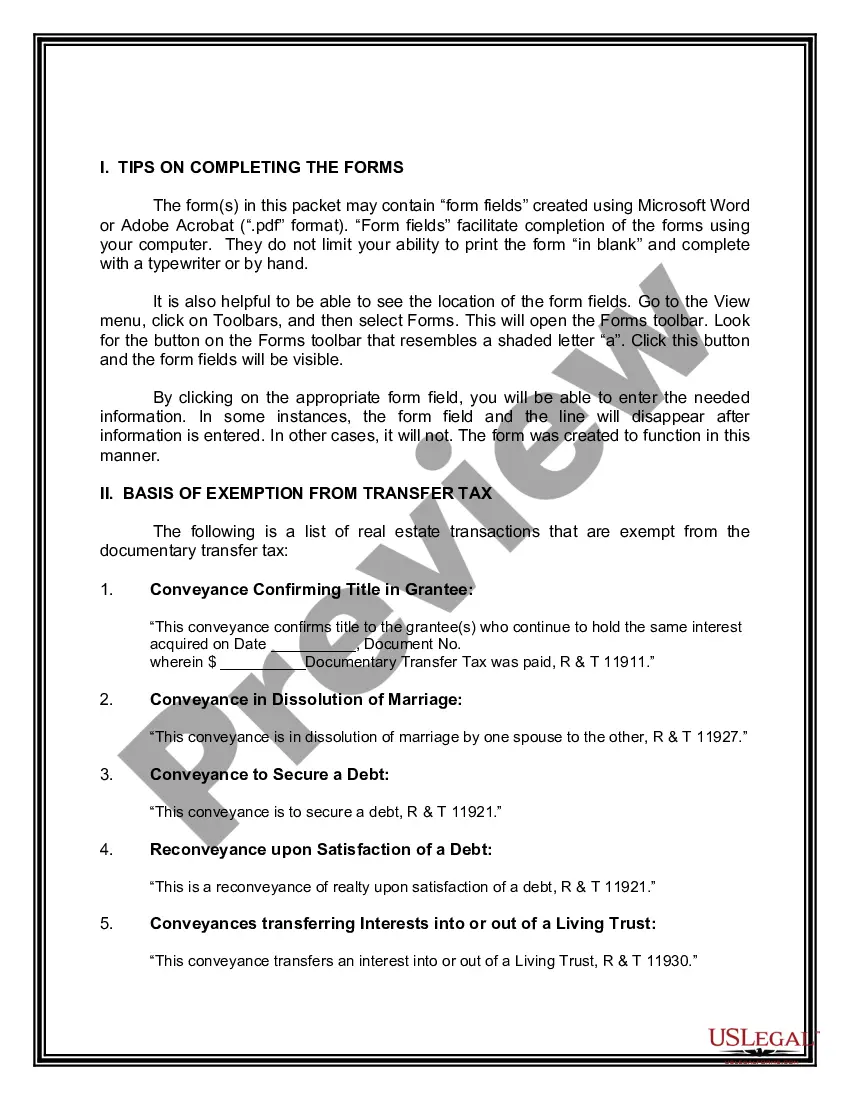

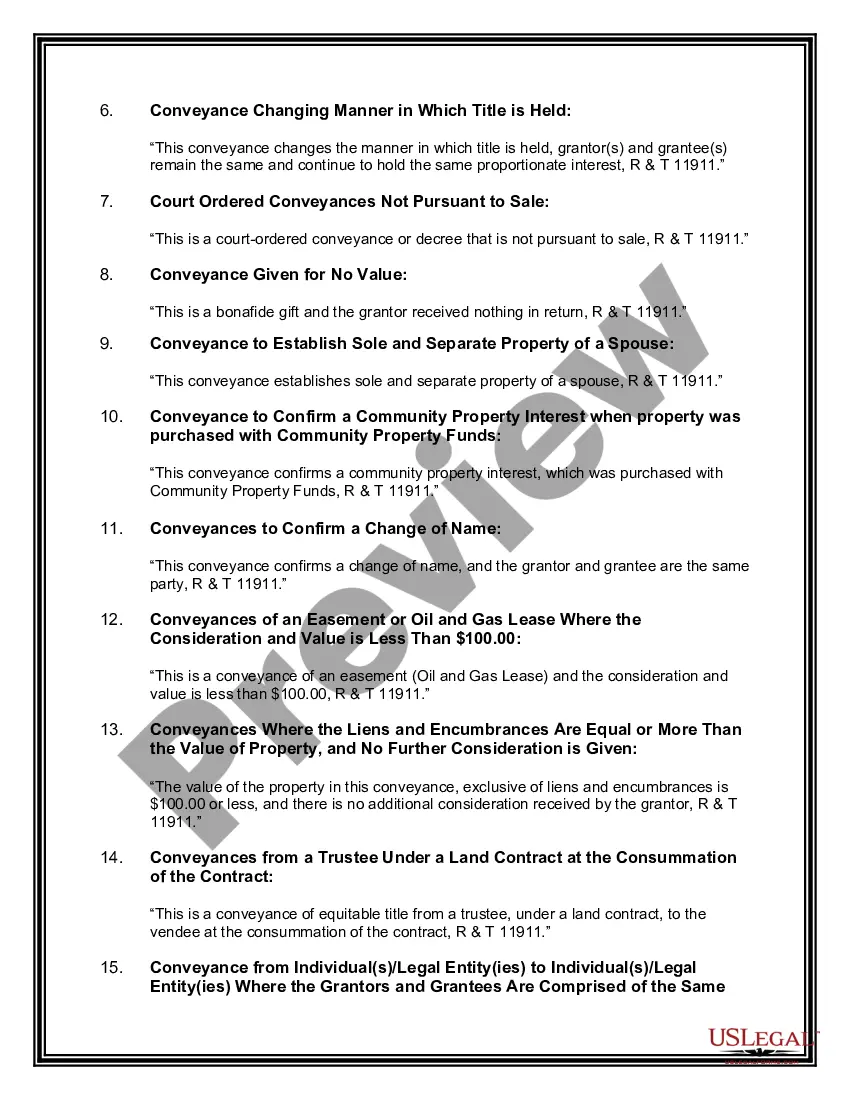

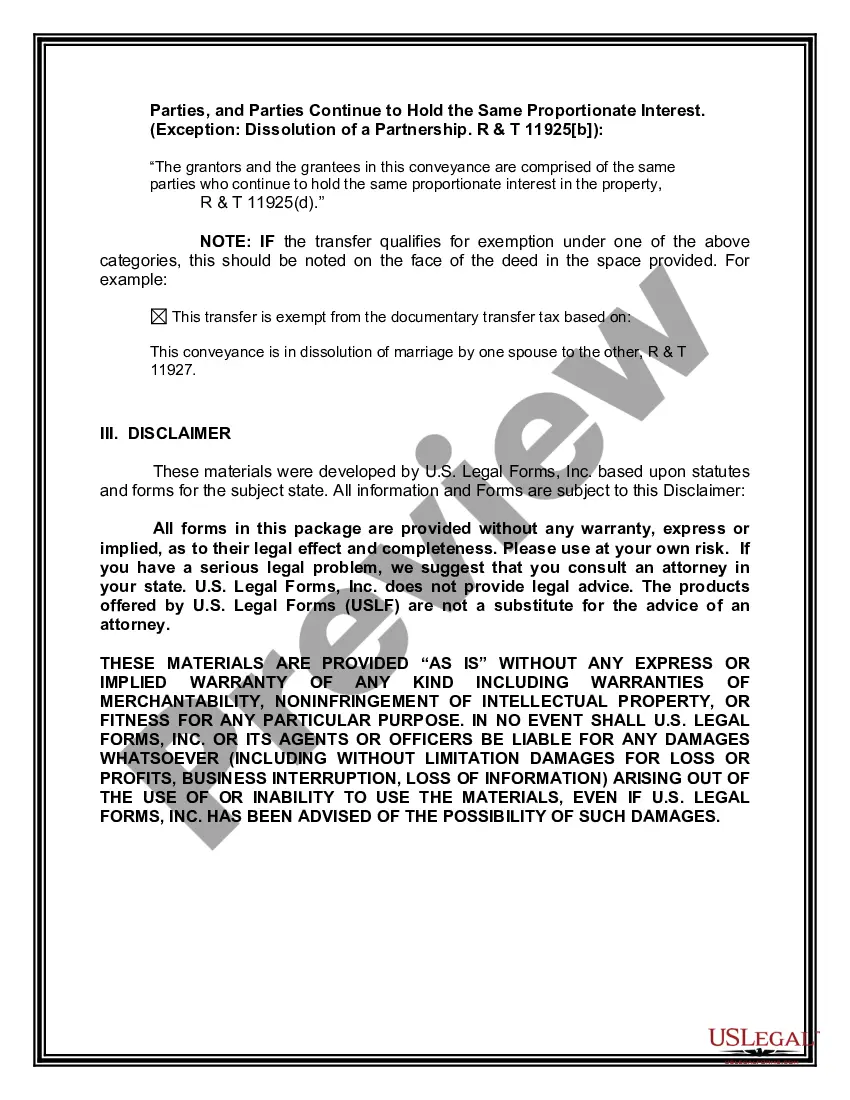

To establish joint tenancy with the right of survivorship, you must draft a deed that clearly states your intention to create this form of ownership. Ensure that all parties involved are named as joint tenants and understand the shared rights and responsibilities. Using platforms like US Legal Forms can help simplify this process by offering templates and legal guidance on setting up assets joint tenants with rights of survivorship properly. Following these steps can provide peace of mind for all involved.

Setting up a joint tenancy requires four key elements: unity of possession, unity of interest, unity of time, and unity of title. All joint tenants must hold equal shares in the property, obtained at the same time, and through the same legal document. These conditions ensure that assets joint tenants with rights of survivorship automatically transfer to the surviving owner upon death. Properly establishing these elements is crucial to avoid future disputes.

Yes, the right of survivorship can be challenged in the UK, depending on specific circumstances. If there is evidence of undue influence or if the joint tenants did not fully understand the implications of their agreement, a challenge may succeed. Moreover, legal disputes regarding assets joint tenants with rights of survivorship can arise during inheritance proceedings. It's essential to seek legal advice to navigate these complexities.

The key difference between joint tenancy and joint tenancy with rights of survivorship lies in the fate of the property when one tenant passes away. In the traditional joint tenancy, ownership shares can be transferred to heirs upon death, whereas joint tenants with rights of survivorship ensures that the surviving tenant automatically receives the deceased tenant's share. This aspect makes joint tenants with rights of survivorship a popular choice for those wishing to simplify the transfer of assets.

While assets held as joint tenants with rights of survivorship offer clear advantages, there are disadvantages to consider as well. One significant drawback is that all tenants have equal rights to the properties, which can lead to conflicts over management and sale decisions. Additionally, the entire value of the joint assets may be included in the surviving tenant's estate for tax purposes, which could impact their financial planning.

When considering assets held by joint tenants with rights of survivorship, it’s important to understand the tax implications they carry. Typically, when one tenant passes away, the surviving tenant does not face income tax on the transfer of ownership. However, estate tax may apply if the total value of the joint assets exceeds the estate tax exemption limit. For personalized guidance, consider exploring resources on USLegalForms as they can provide you with helpful documents.

Yes, the right of survivorship typically overrides a will. When assets are held as joint tenants with rights of survivorship, they pass directly to the surviving owner upon death, regardless of what a will states. This can significantly impact estate planning, so it’s wise to consult with a legal expert to ensure your assets are appropriately managed.

Joint tenants with rights of survivorship refers to a type of ownership where two or more individuals hold equal rights to an asset. When one owner passes away, their share automatically transfers to the surviving owner(s) without going through probate. This arrangement simplifies asset distribution and ensures a smooth transition of ownership, which is beneficial for many families.

Joint tenancy with rights of survivorship and tenants by the entirety serve different purposes. The primary distinction lies in the ownership structure: joint tenancy involves two or more individuals and allows for equal ownership, while tenants by the entirety is exclusively for married couples. With tenants by the entirety, one spouse cannot unilaterally sell or transfer the property without the consent of the other. Understanding these differences helps in deciding the best ownership type for your assets.

While joint tenancy with rights of survivorship offers certain advantages, it also comes with disadvantages. One major issue is that both owners have equal access to the assets, which can lead to conflicts. Additionally, if one tenant incurs debt, creditors may have a claim against the property. Thus, it's crucial to carefully consider how these assets are managed and shared.