California Hiring Form For Non Profit

Description

How to fill out California Employment Hiring Process Package?

Regardless of whether it's for corporate objectives or personal matters, everyone must confront legal circumstances at some point in their lives.

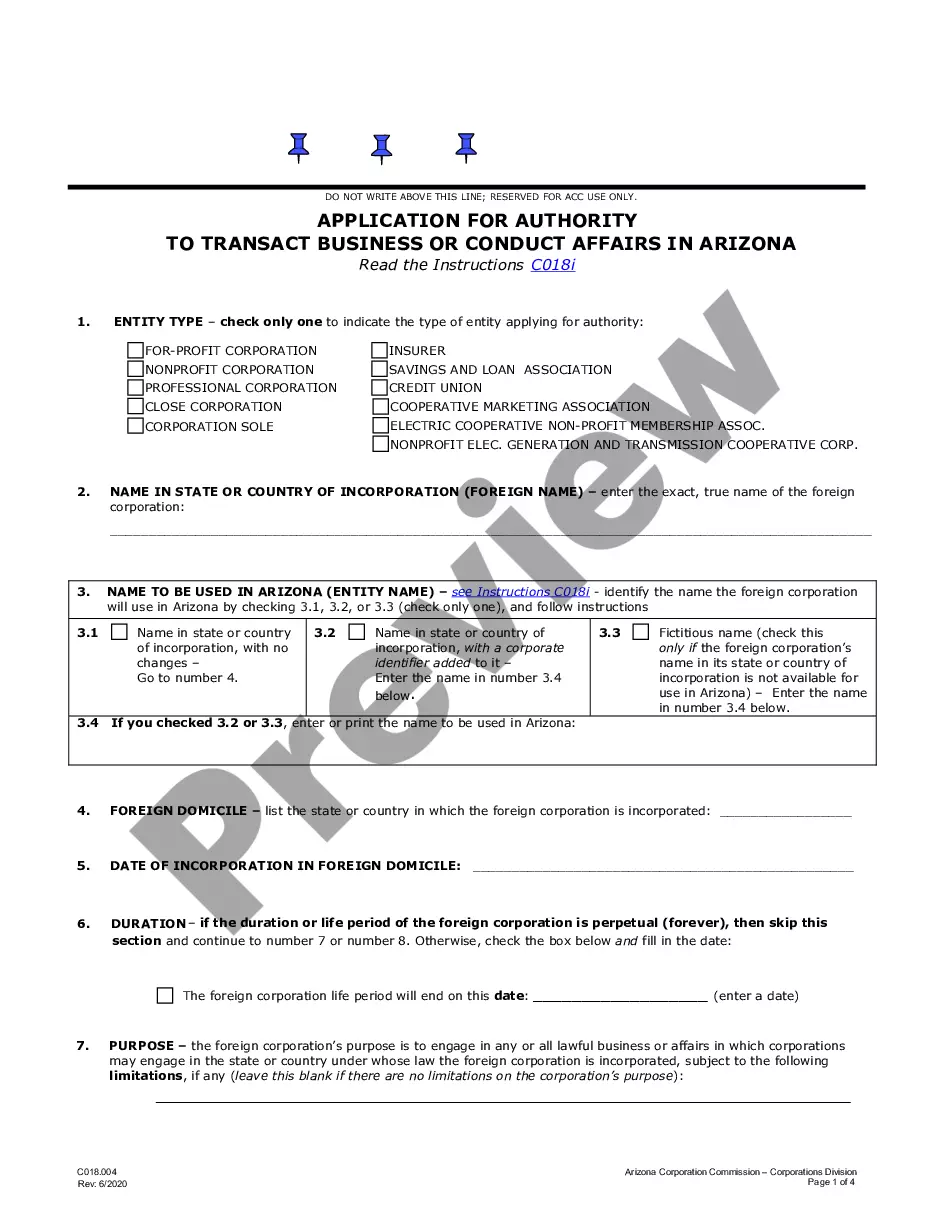

Completing legal paperwork demands meticulous focus, starting with choosing the suitable form template. For example, if you select an incorrect version of a California Hiring Form For Non Profit, it will be rejected upon submission. Thus, it is essential to find a reliable source for legal documents like US Legal Forms.

With an extensive US Legal Forms library available, you won’t have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to locate the appropriate form for any circumstance.

- Acquire the template you require using the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your situation, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the California Hiring Form For Non Profit template you need.

- Download the template once it meets your requirements.

- If you possess a US Legal Forms account, just click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you may obtain the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the document format you prefer and download the California Hiring Form For Non Profit.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

How to Hire an Employee in California Conduct a background check. ... Execute employee offer letter. ... Employee eligibility verification form I-9. ... Execute a confidentiality and invention assignment agreement. ... Grant options or issue stock to employee. ... Provide non-exempt employee with wage theft act protection notice.

File the initial registration form (Form CT-1) with the California Attorney General's Registry of Charitable Trusts. The initial registration must be renewed annually, is required for the majority of nonprofit public benefit corporations, and must be filed within 30 days after receipt of assets.

California Nonprofit Filing Requirements IRS Form 990N. ... CA Franchise Tax Board Form 199N. ... CA Attorney General Form RRF-1. ... CA Secretary of State's Statement of Information.

Both a W-2 and a W-4 tax form. These forms will come in handy for both you and your new hire when it's time to file income taxes with the IRS. A DE 4 California Payroll tax form. Issued by the Employment Development Department, this form helps employees calculate the correct state tax withholding from their paycheck.

Both Federal W-4 Form and California DE 4 Withholding Certificate must be provided to newly hired employees. Generally speaking, most employers in California are required to provide the following documents with new employees upon hire: Time of Hire Pamphlet. Sexual Harassment Pamphlet (DFEH-185P)