Agree Pay Wages For Taxes

Description

How to fill out California On Duty Meal Period Agreement?

Working with legal documents and procedures might be a time-consuming addition to your entire day. Agree Pay Wages For Taxes and forms like it often require you to search for them and understand how to complete them correctly. Consequently, if you are taking care of economic, legal, or personal matters, using a extensive and hassle-free online catalogue of forms when you need it will greatly assist.

US Legal Forms is the number one online platform of legal templates, offering more than 85,000 state-specific forms and numerous resources to help you complete your documents quickly. Explore the catalogue of relevant papers available with just a single click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Safeguard your document management operations with a high quality services that lets you make any form within minutes without having extra or hidden cost. Just log in to your account, find Agree Pay Wages For Taxes and download it immediately from the My Forms tab. You may also gain access to previously downloaded forms.

Could it be the first time utilizing US Legal Forms? Sign up and set up a free account in a few minutes and you will gain access to the form catalogue and Agree Pay Wages For Taxes. Then, follow the steps below to complete your form:

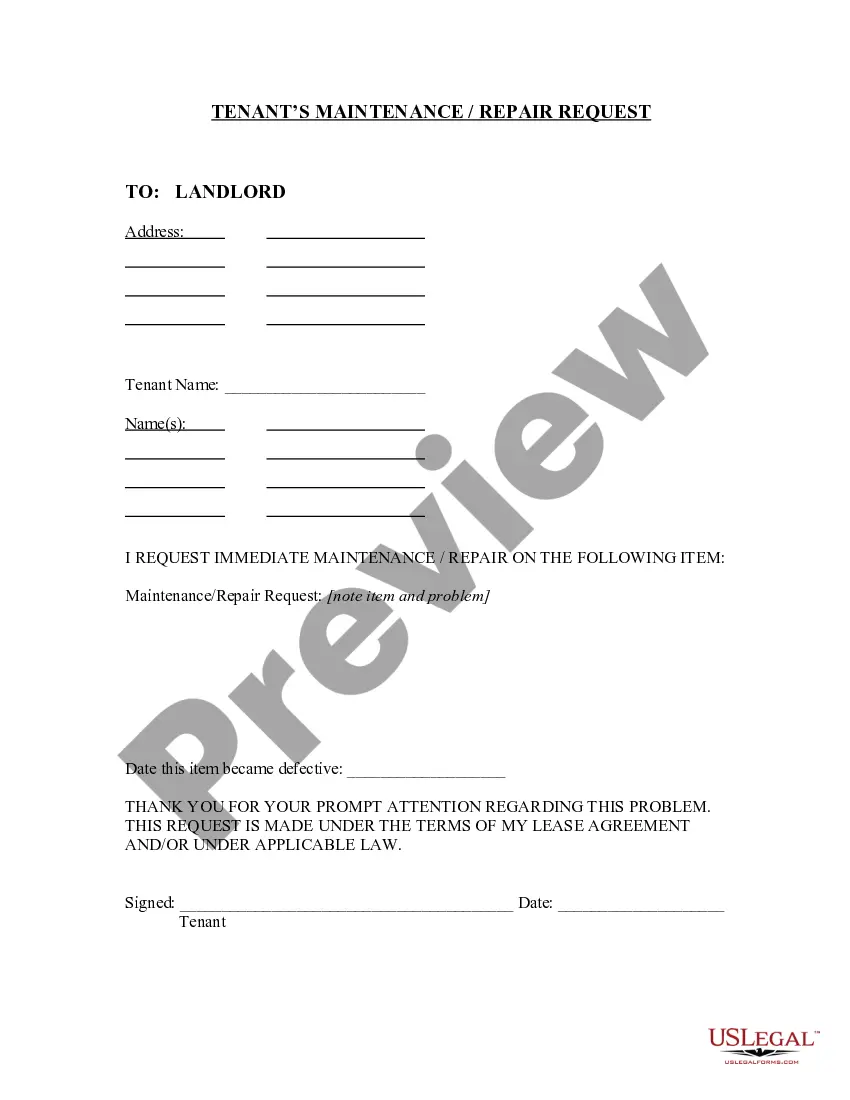

- Be sure you have discovered the right form using the Preview feature and reading the form information.

- Select Buy Now once ready, and choose the monthly subscription plan that meets your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience helping consumers manage their legal documents. Get the form you need right now and enhance any process without having to break a sweat.

Form popularity

FAQ

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

It just depends on your situation. If you are single, have one job, and have no dependents, claiming 1 may be a good option. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

How to fill out Form W-2 Box A: Employee's Social Security number. ... Box B: Employer Identification Number (EIN) ... Box C: Employer's name, address, and ZIP code. ... Box D: ... Boxes E and F: Employee's name, address, and ZIP code. ... Box 1: Wages, tips, other compensation. ... Box 2: Federal income tax withheld. ... Box 3: Social Security wages.