Employee Tracking Form For W2

Instant download

Description

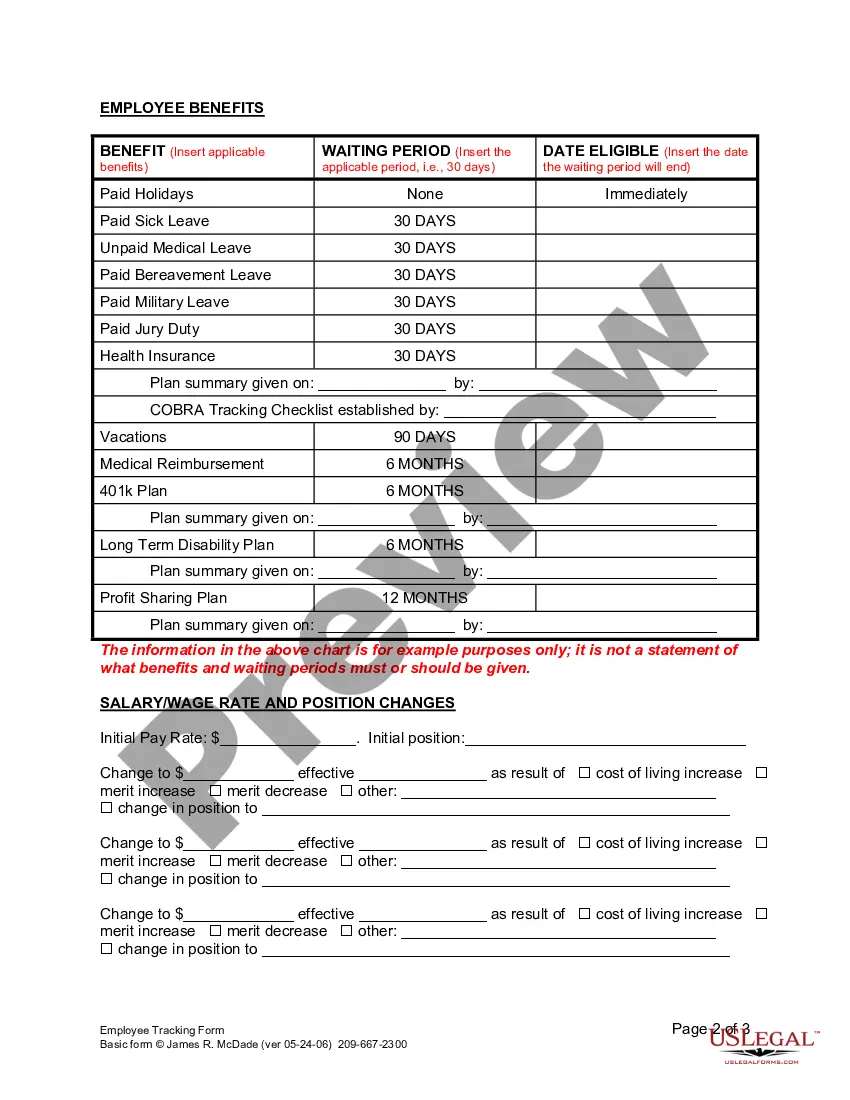

The Employee Tracking Form for W2 is an essential tool for employers to systematically document the onboarding process of new employees. This form helps track completion of initial orientation and eligibility for benefits, ensuring compliance with employment laws. Key features include sections for pre-offer exams and background checks, post-offer pre-employment exams, a detailed checklist for initial orientation items, benefits information, and documentation of salary changes and termination procedures. It is designed to collect essential employee information while facilitating the company's hiring and onboarding processes. The form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants in human resources and compliance roles, as it streamlines record-keeping and legal adherence in hiring practices. To fill out the form, users should provide accurate details in each section and ensure necessary items are marked as completed. Additionally, maintaining clear records of employee benefits and any changes during employment is crucial for legal and financial audits. This form supports businesses in managing employee records efficiently while protecting both the employer's and employee's rights.

Free preview