California Living Form Withholding

Description

How to fill out California Revocation Of Living Trust?

Acquiring legal templates that comply with federal and local regulations is essential, and the internet provides a plethora of choices to select from.

However, what’s the advantage of squandering time hunting for the appropriate California Living Form Withholding sample online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for any business and personal circumstance.

Review the template using the Preview function or via the text outline to confirm it meets your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts keep abreast of legal updates, so you can always trust your form is current and compliant when acquiring a California Living Form Withholding from our site.

- Obtaining a California Living Form Withholding is fast and simple for both existing and new users.

- If you already have an account with a valid subscription, Log In and download the document sample you require in the correct format.

- If you are a newcomer to our website, follow the steps outlined below.

Form popularity

FAQ

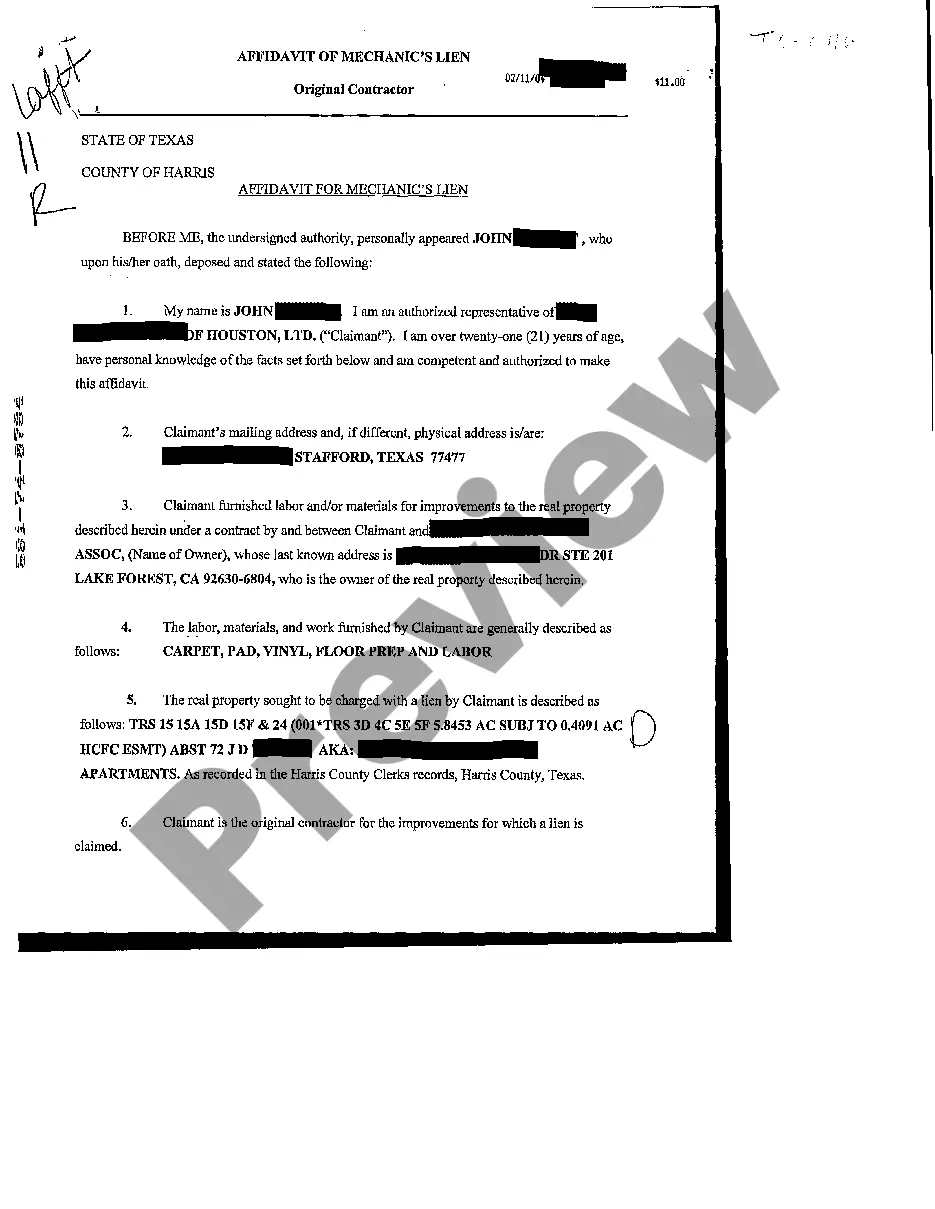

Use Form 592-B to report to the payee the amount of payment or distribution subject to withholding and tax withheld as reported on Form 592, Resident and Nonresident Withholding Statement, Form 592-PTE, or Form 592-F, Foreign Partner or Member Annual Withholding Return. Complete a separate Form 592-B for each payee.

» The standard withholding is 3.3% of the purchase price of the property, in ance with California Revenue and Taxation Code Section 18662. Form 593-C will be provided with your escrow instructions. The seller should carefully fill out the form to see if any exemptions apply.

Who Certifies this Form. Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.