California Living Form With Decimals

Description

How to fill out California Revocation Of Living Trust?

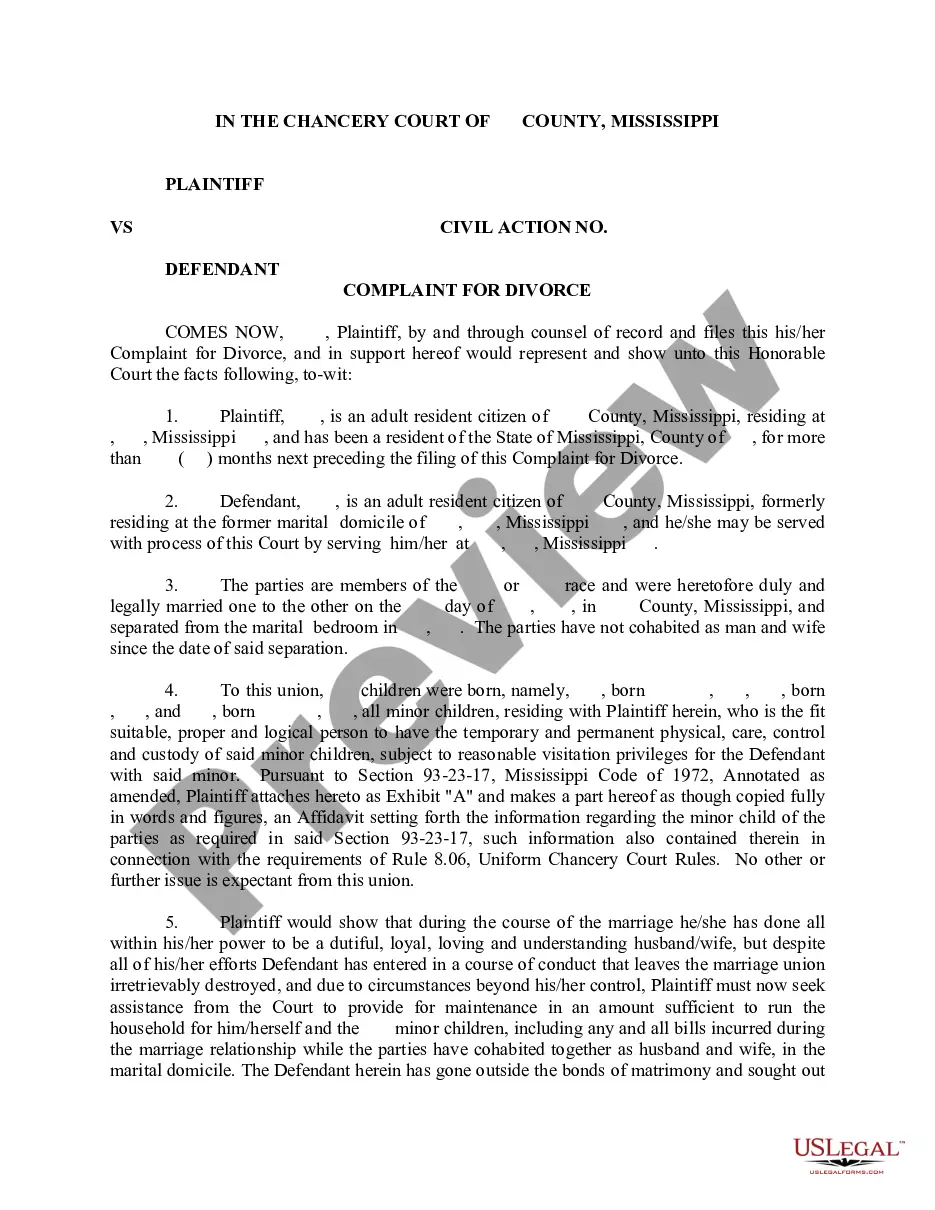

The California Living Form With Decimals displayed on this page is a reusable legal template created by experienced attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has delivered to individuals, businesses, and lawyers more than 85,000 validated, state-specific documents for any commercial and personal situation. It’s the quickest, simplest, and most dependable method to acquire the paperwork you require, as the service ensures the utmost level of data safety and anti-malware defense.

Register for US Legal Forms to have authentic legal templates for all of life's situations readily available.

- Browse for the document you require and examine it.

- Sign up and Log In.

- Obtain the editable template.

- Complete and endorse the paperwork.

- Download your documents again.

Form popularity

FAQ

Which Form To Use. Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2022. If you and your spouse/RDP were California residents during the entire tax year 2022, use Form 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return.

The California Standard Deduction As of the 2022 tax year?the return you file in 2023?the state-level standard deductions are: $5,202 for single taxpayers, as well as married and registered domestic partner (RDP) taxpayers who file separate returns.

Use Form 540-ES, Estimated Tax for Individuals, and the 2023 California Estimated Tax Worksheet, to determine if you owe estimated tax for 2023 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2023 after subtracting the credits you plan to take and tax you expect to have withheld.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Use Form 1040-ES to figure and pay your estimated tax for 2023. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).