California Trust Amendment Withholding Tax

Description

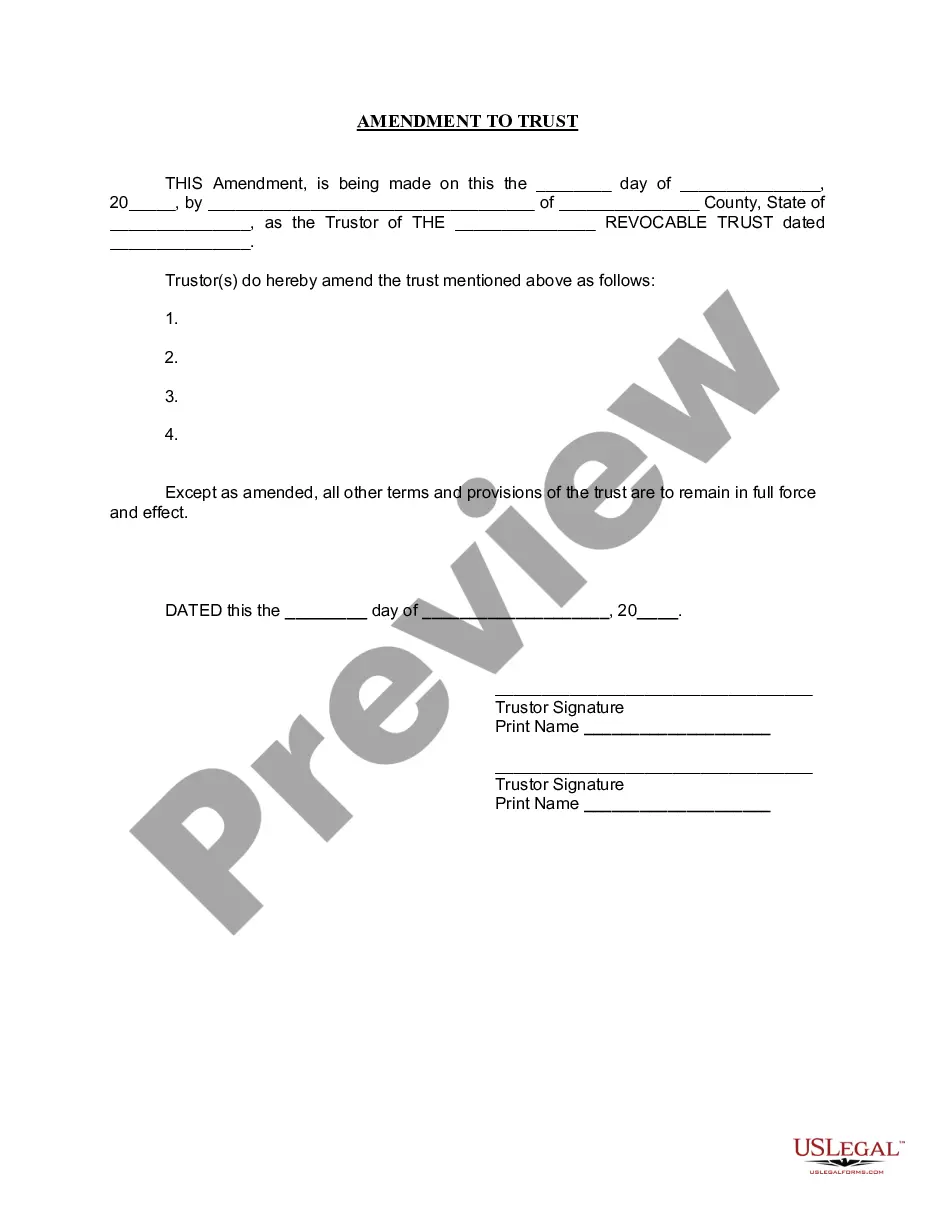

How to fill out California Amendment To Living Trust?

Obtaining legal templates that comply with federal and state laws is crucial, and the internet provides a plethora of choices to select from.

However, what’s the benefit of spending time searching for the appropriate California Trust Amendment Withholding Tax example online when the US Legal Forms digital library already has such documents collected in one location.

US Legal Forms is the largest online legal directory featuring over 85,000 customizable templates created by lawyers for any professional and personal situation.

Evaluate the template using the Preview option or through the text outline to ensure it fits your needs. Search for an alternative sample using the search function at the top of the page if necessary. Click Buy Now once you’ve found the appropriate form and select a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Choose the ideal format for your California Trust Amendment Withholding Tax and download it. All templates you find through US Legal Forms can be reused. To re-download and complete previously saved forms, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal document service!

- They are easy to navigate with all files categorized by state and intended use.

- Our experts keep up with legal changes, ensuring your form is current and compliant when obtaining a California Trust Amendment Withholding Tax from our site.

- Acquiring a California Trust Amendment Withholding Tax is straightforward and quick for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document template you require in the desired format.

- If you are a newcomer to our website, follow the steps outlined below.

Form popularity

FAQ

Amending a trust in California involves creating a written document that clearly states the changes you wish to make. This document should be signed by the trustee and, ideally, notarized to ensure its legality. It’s essential to consider the implications of California trust amendment withholding tax when making amendments, as it may affect tax liabilities. US Legal Forms provides templates and resources that simplify this process.

To adjust California withholding, you must first review your current withholding amounts. You can do this by examining your Form W-4 and making necessary changes to your allowances. If you are dealing with California trust amendment withholding tax, you may need to file a specific form to update your withholding rates accurately. Utilizing platforms like US Legal Forms can guide you through the process effectively.

It is your obligation to file a California tax return, pay any tax due and claim any real estate withholding payment on your California tax return. » The standard withholding is 3.3% of the purchase price of the property, in ance with California Revenue and Taxation Code Section 18662.

Domestic nonresident partners are calculated a withholding tax of 7.0% of distributions, corporations have a 8.84% withholding rate, and nonresident foreign partners calculate a withholding tax of 12.3% of income.

Use Form 592-B to report to the payee the amount of payment or distribution subject to withholding and tax withheld as reported on Form 592, Resident and Nonresident Withholding Statement, Form 592-PTE, or Form 592-F, Foreign Partner or Member Annual Withholding Return. Complete a separate Form 592-B for each payee.

Tax Due Amendment Return: Complete a new Form CA 540 or 540NR and attach a completed Schedule X to the Form.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.