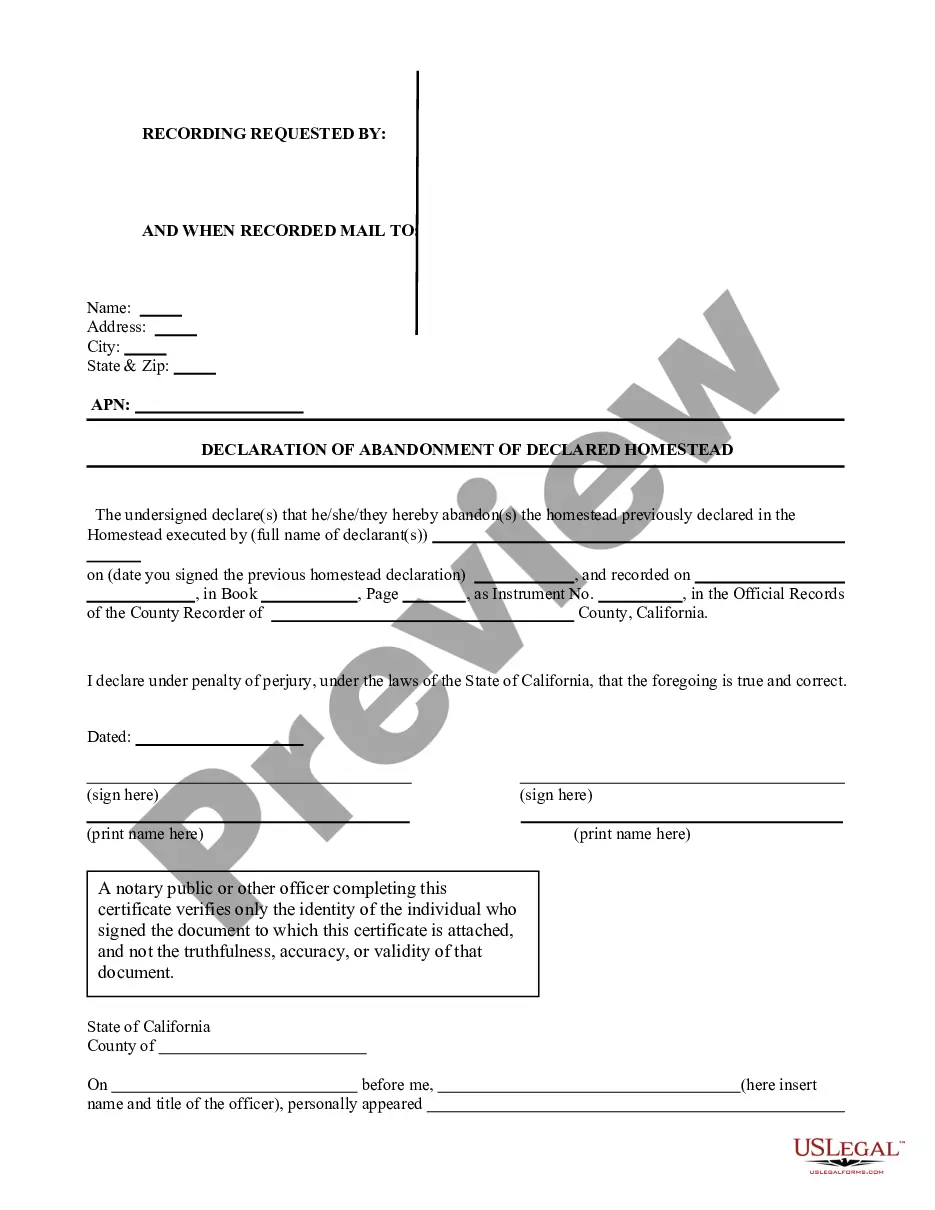

California Homestead Form With 2 Points

Description

How to fill out California Declaration Of Abandonment Of Homestead Declaration?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may require extensive research and significant financial investment.

If you're seeking an easier and more cost-effective method of preparing California Homestead Form With 2 Points or any other documents without the hassle, US Legal Forms is always within reach.

Our online repository of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

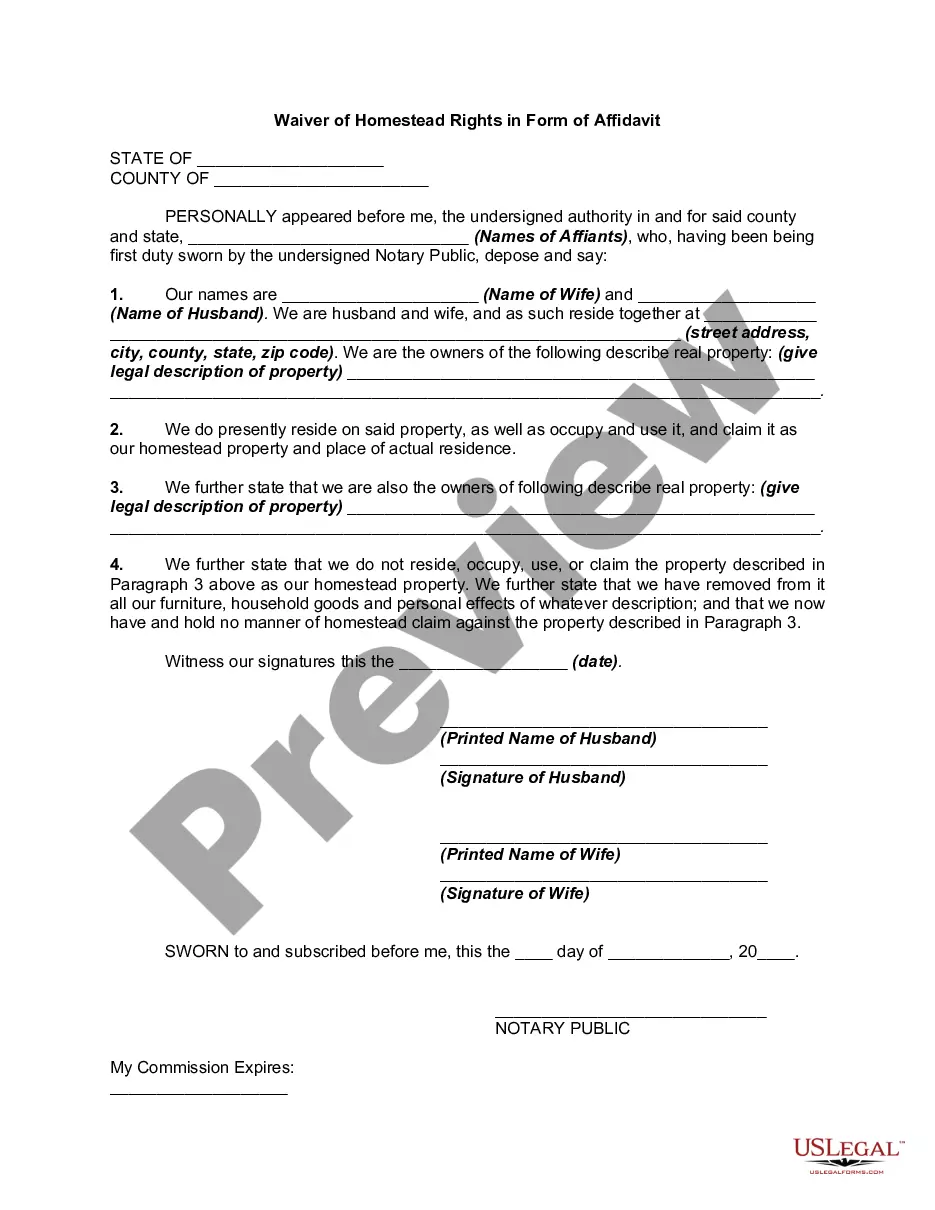

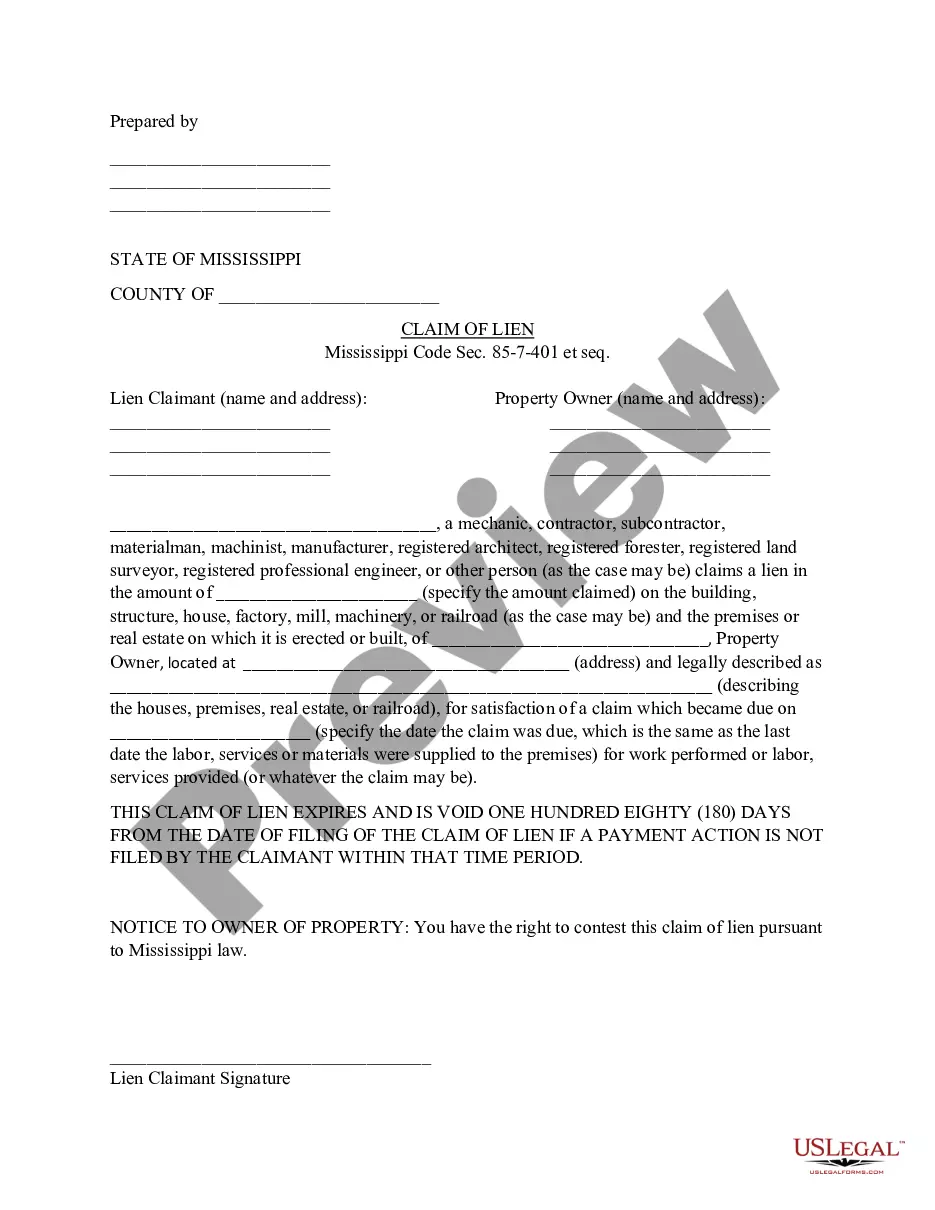

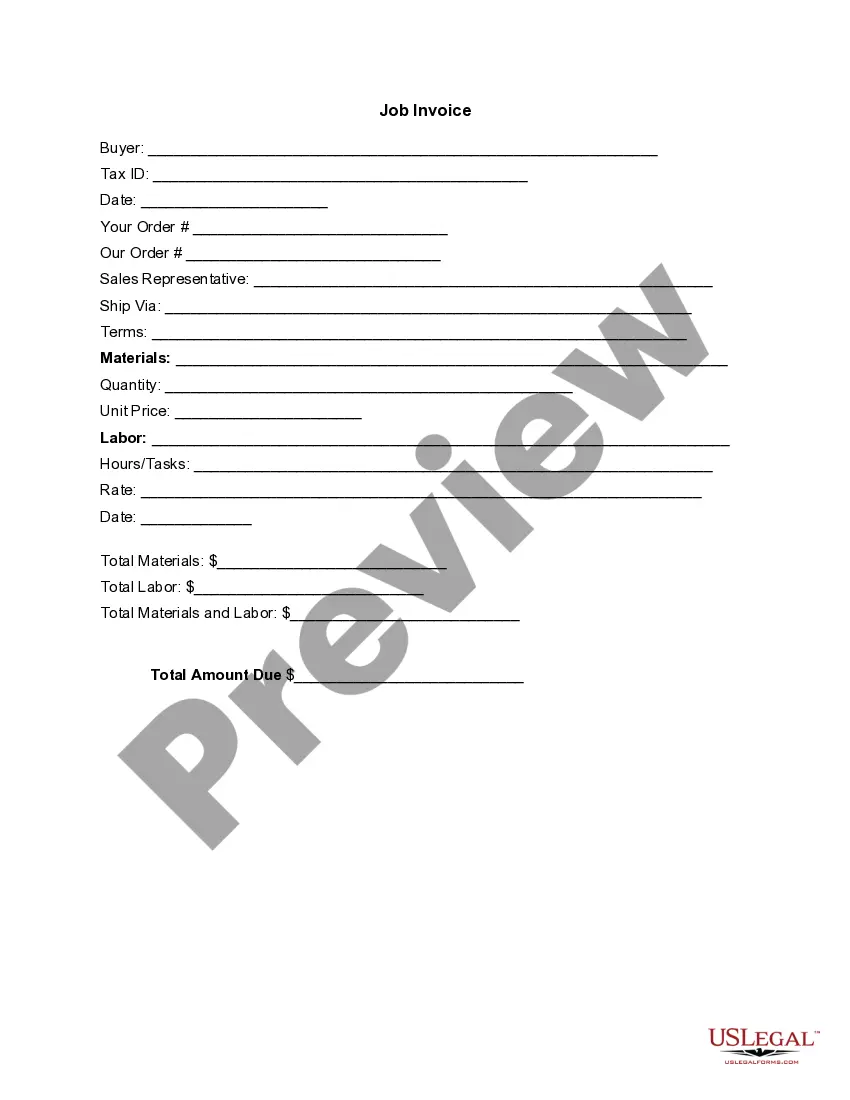

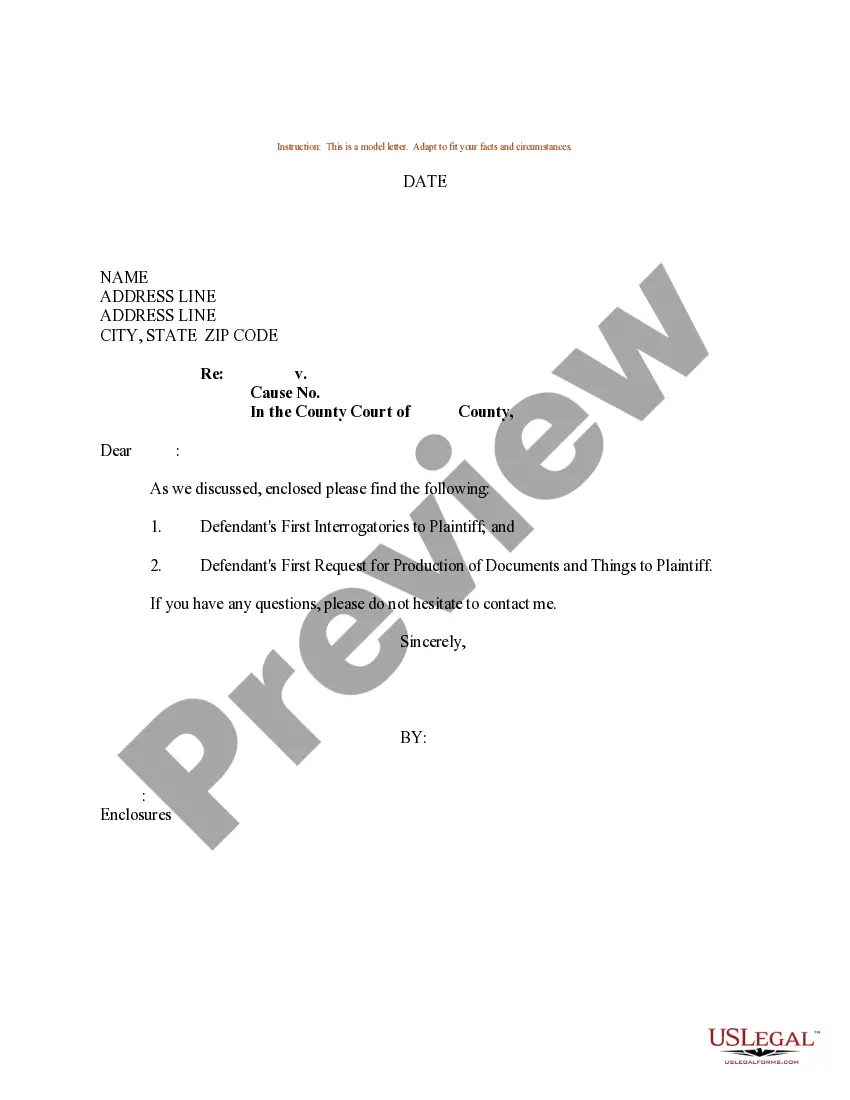

However, before you directly proceed to download the California Homestead Form With 2 Points, make sure to consider the following tips: Review the document preview and descriptions to ensure you have the correct document. Confirm that the template you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the California Homestead Form With 2 Points. Download the file, then complete, sign, and print it out. US Legal Forms maintains an impeccable reputation and boasts over 25 years of experience. Join us today and simplify the process of document completion!

- With just a few clicks, you can quickly acquire state- and county-compliant templates meticulously crafted for you by our legal professionals.

- Utilize our website whenever you require trusted and dependable services to swiftly find and download the California Homestead Form With 2 Points.

- If you're not new to our services and have previously created an account with us, simply Log In to your account, choose the form, and download it or re-download it later in the My documents section.

- Don't have an account? No worries. It takes just a few minutes to register and browse the library.

Form popularity

FAQ

The articles of incorporation may be amended by written consent of all members entitled to vote on such amendment, as provided by section 606. If such unanimous written consent is given, no resolution of the board of directors proposing the amendment is necessary. [PL 1977, c. 525, §13 (NEW).]

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

S Corporation owners need to file a personal tax return using Form 1040 every year. Additionally, they must also file a Form 1120-S: U.S. Income Tax Return for an S Corporation.

Form 1120-S is the annual tax return for businesses that are registered as S corporations. The form is used to report income, gains, losses, credits, deductions, and other information for S corporations.

Step 1: Name Your Maine LLC. It is important that your Maine LLC has a name that attracts customers and follows Maine naming requirements. ... Step 2: Choose a Registered Agent. ... Step 3: File the Maine Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Maine S Corp Tax Designation.

Online: Go to their website under online services and follow the instructions provided on the interactive corporate services page to search and print a certified copy. A list of all filings for the Maine Corporation is provided. If the document is older it may not be available for online printing.

Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

Form 1065 is for partnerships, and Form 1120-S is for S corporations, but both serve the same purpose. The partnership or S-corp must file this form to report each partner or shareholder's share of the entity's income, deductions, and credits.