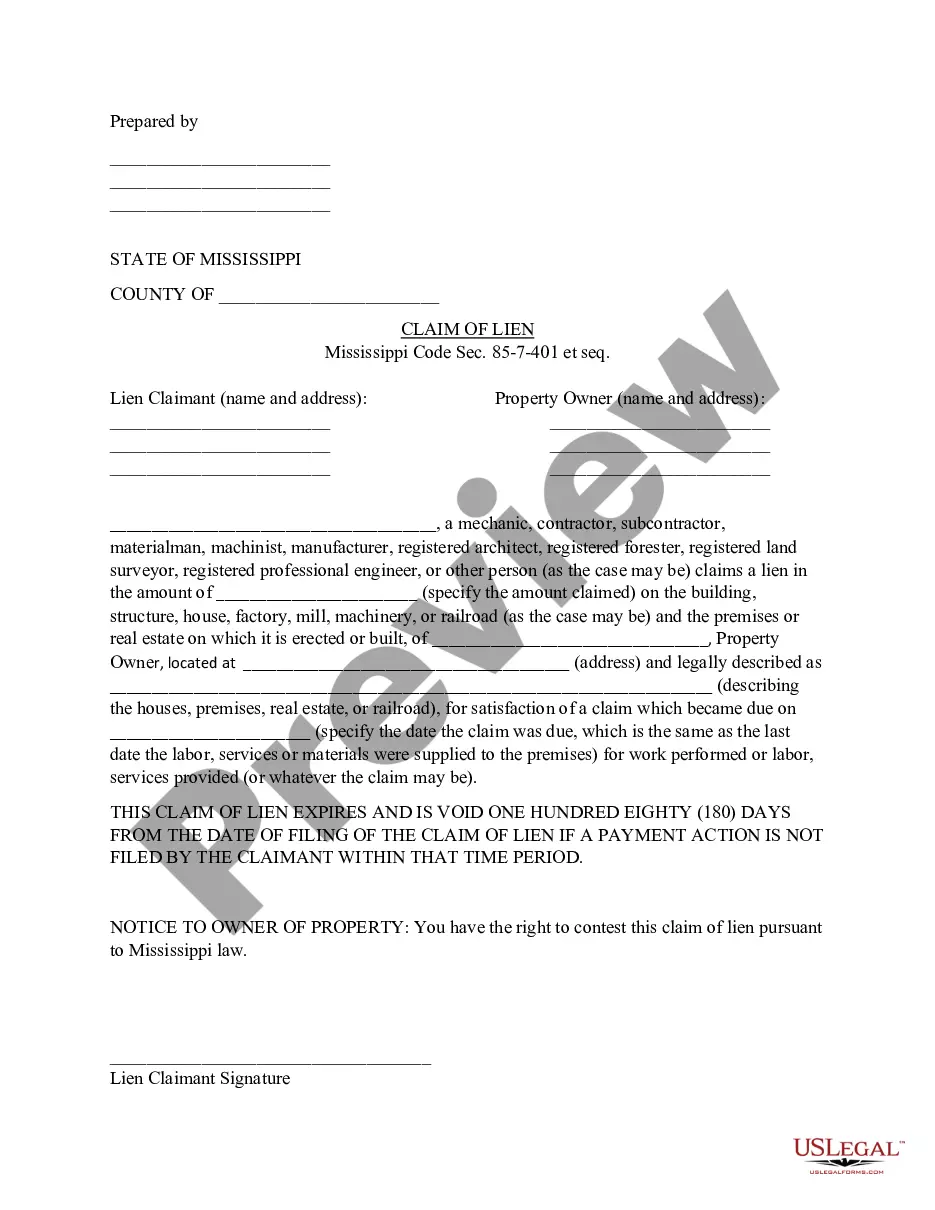

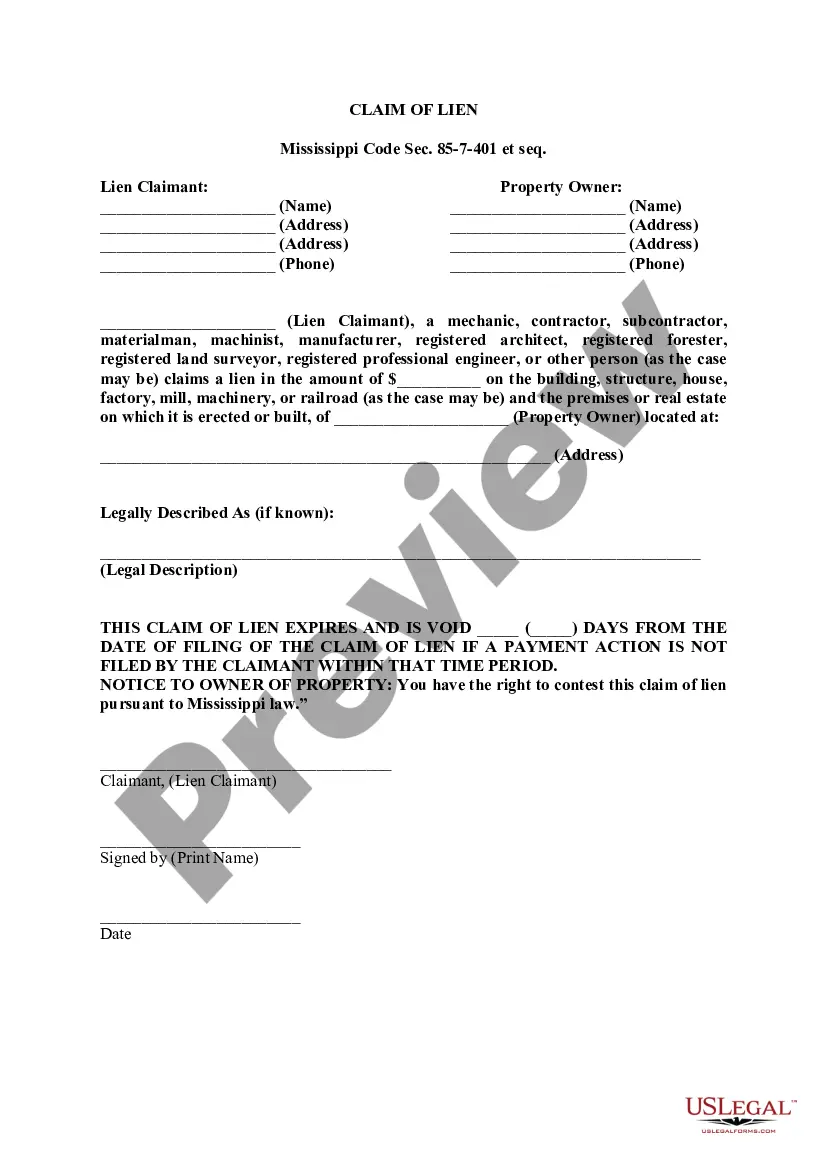

Mississippi Claim of Lien

Description

How to fill out Mississippi Claim Of Lien?

Obtain a printable Mississippi Claim of Lien within several mouse clicks in the most extensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of reasonably priced legal and tax templates for US citizens and residents on-line since 1997.

Customers who have a subscription, need to log in in to their US Legal Forms account, down load the Mississippi Claim of Lien and find it saved in the My Forms tab. Customers who never have a subscription must follow the steps below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If offered, review the form to see more content.

- As soon as you are confident the template suits you, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out through PayPal or bank card.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Claim of Lien, you are able to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Where and how should you file the mechanics lien in Mississippi? The mechanics lien must be filed the chancery court where the project is located. You may have the mechanics lien recorded in the court by sending it via email together with the required lien fees, or you may also walk in and personally file it.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

Prepare the lien document, taking care to include all the necessary information set forth above including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

Formalize a defense for disputing the amount of the lien. Gather supporting documentation for your rebuttal, depending on the type of lien. Contact the agent representing the creditor to dispute the amount of the claim. Negotiate a payment settlement with the creditor if you cannot pay the amount you owe in full.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.