Homestead State California Withholding

Description

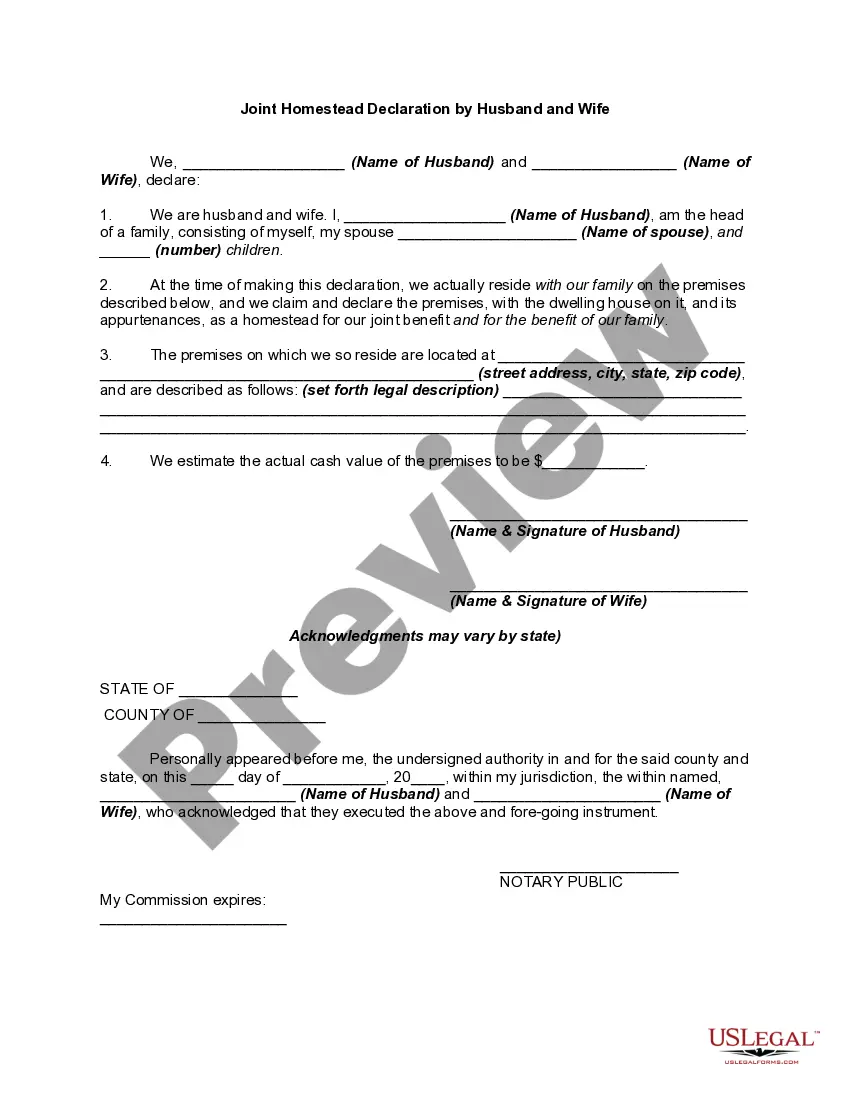

How to fill out California Homestead Declaration For Single Person?

Dealing with legal documents and processes can be a lengthy addition to your whole day.

Homestead State California Withholding and similar forms typically require you to search for them and comprehend how to fill them out accurately.

Thus, if you are managing financial, legal, or personal issues, having a comprehensive and practical online directory of forms readily available will significantly help.

US Legal Forms is the premier online platform for legal templates, offering over 85,000 state-specific documents and a range of tools to help you complete your paperwork effortlessly.

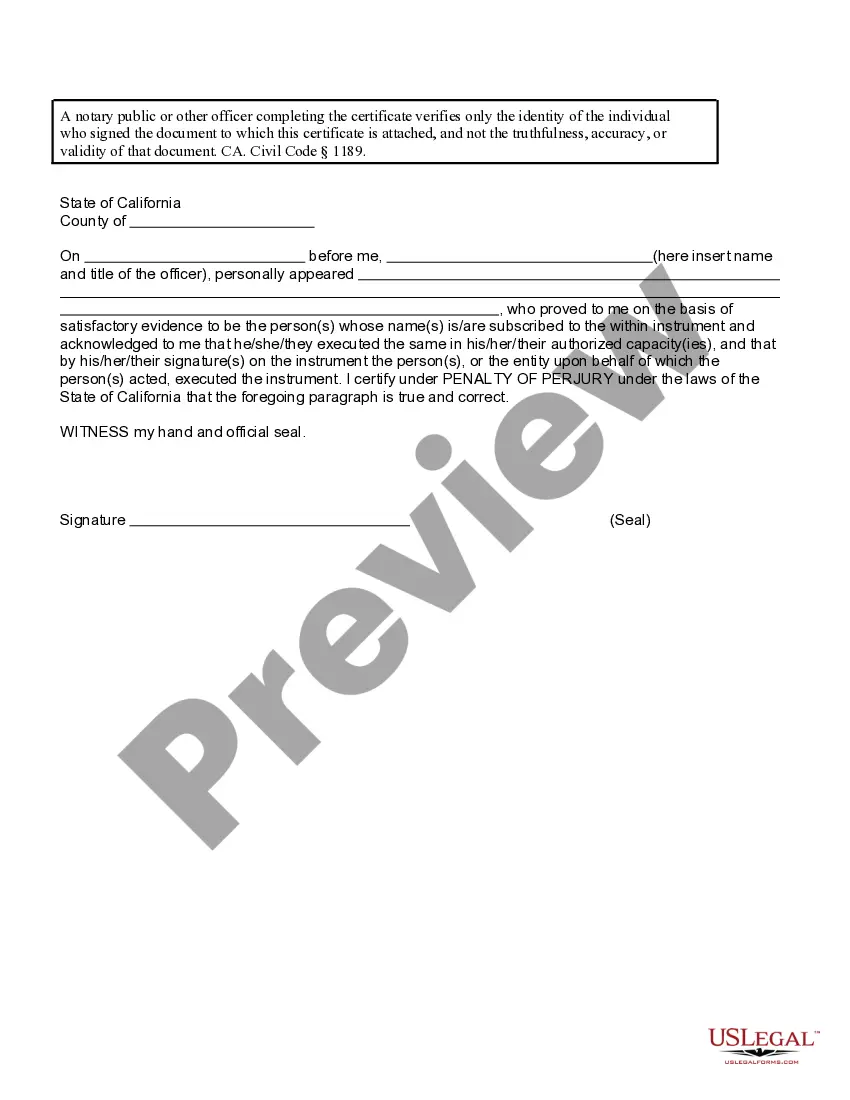

Is this your first time using US Legal Forms? Register and create a free account in a few minutes to access the form directory and Homestead State California Withholding. Then, follow the steps below to complete your form: Ensure you have identified the correct form using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the monthly subscription plan that suits you. Click Download and then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience assisting users in managing their legal documents. Find the form you need today and streamline any process without hassle.

- Browse the collection of relevant documents with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for download.

- Safeguard your document management processes by utilizing a high-quality service that enables you to assemble any form within minutes without extra or hidden fees.

- Simply Log In to your account, find Homestead State California Withholding, and download it immediately from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

Claiming 1 on Your Taxes Claiming 1 reduces the amount of taxes that are withheld, which means you will get more money each paycheck instead of waiting until your tax refund. You could also still get a small refund while having a larger paycheck if you claim 1.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

In order to claim exemption from state income tax withholding, employees must submit a W-4 (PDF Format, 100KB)*. or DE-4 (PDF Format, 147KB)* certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.