Homestead State California Foreclosure

Description

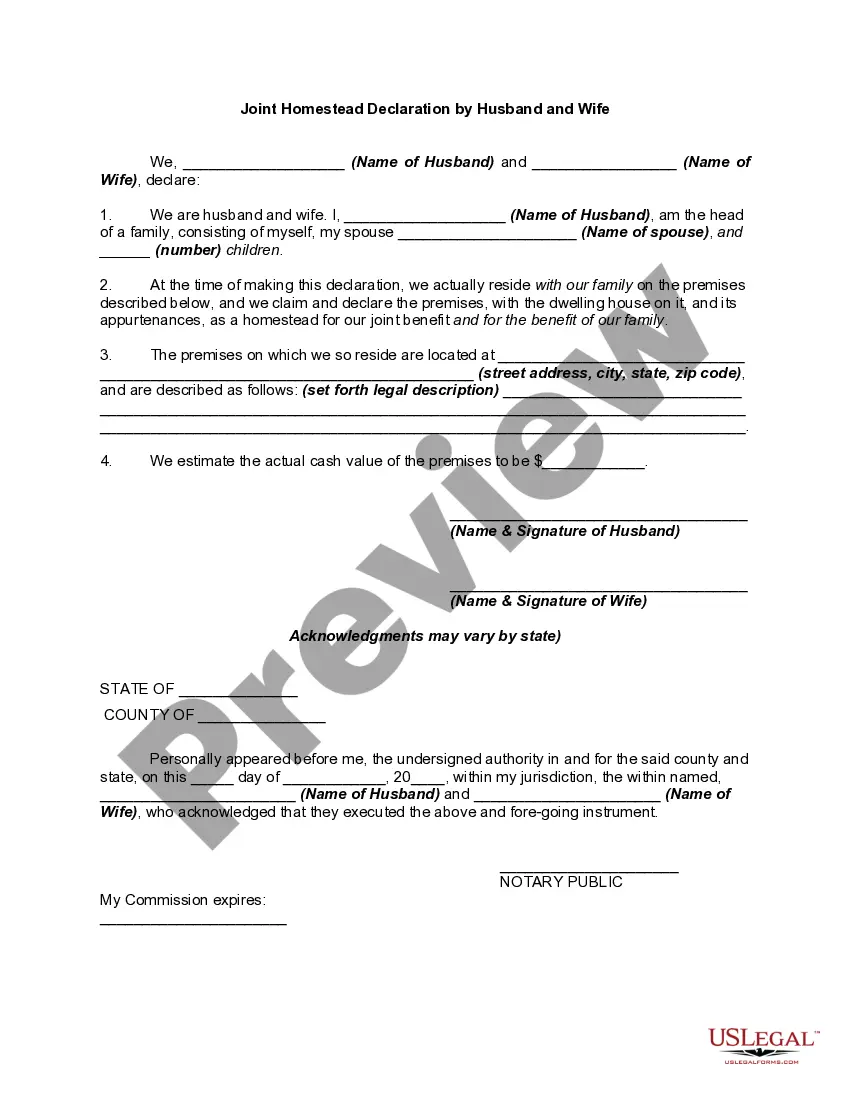

How to fill out California Homestead Declaration For Single Person?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may require extensive research and substantial financial investment.

If you’re looking for a simpler and more cost-effective method of drafting Homestead State California Foreclosure or other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

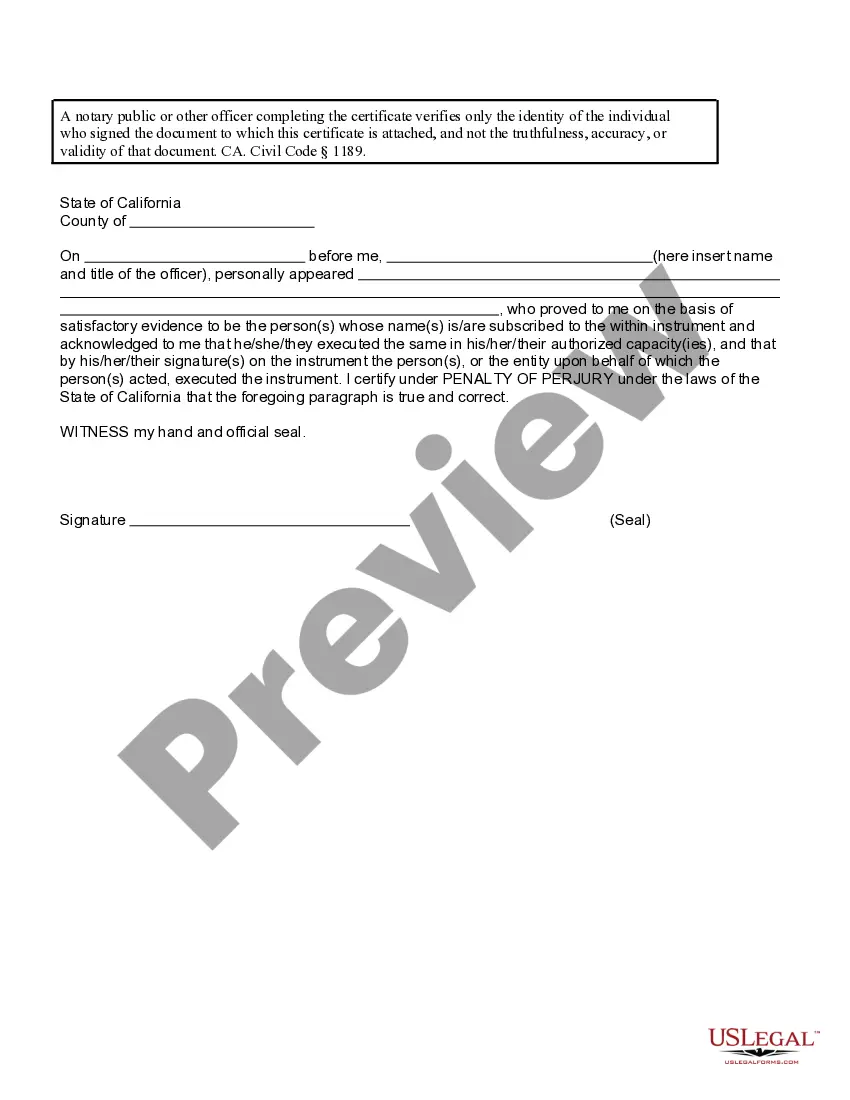

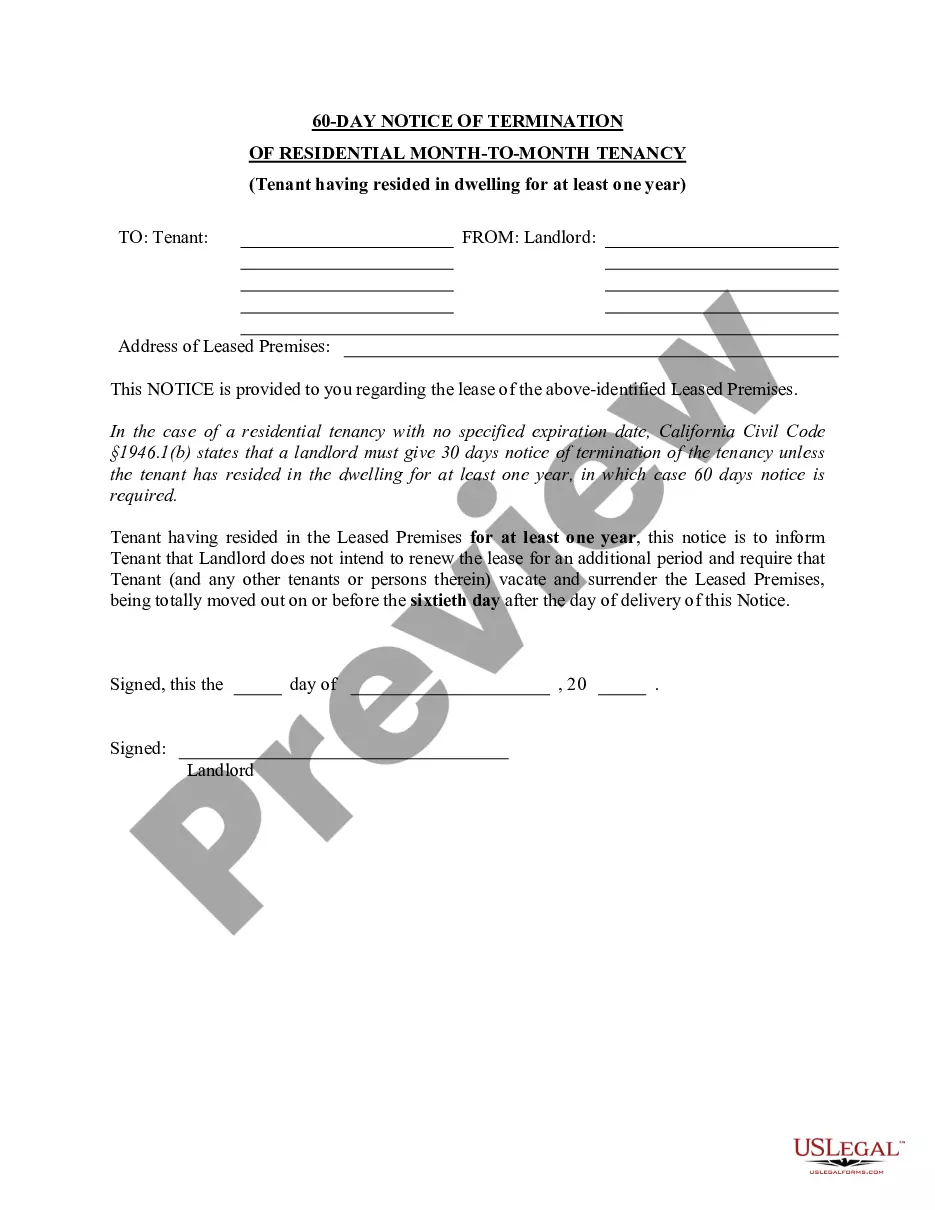

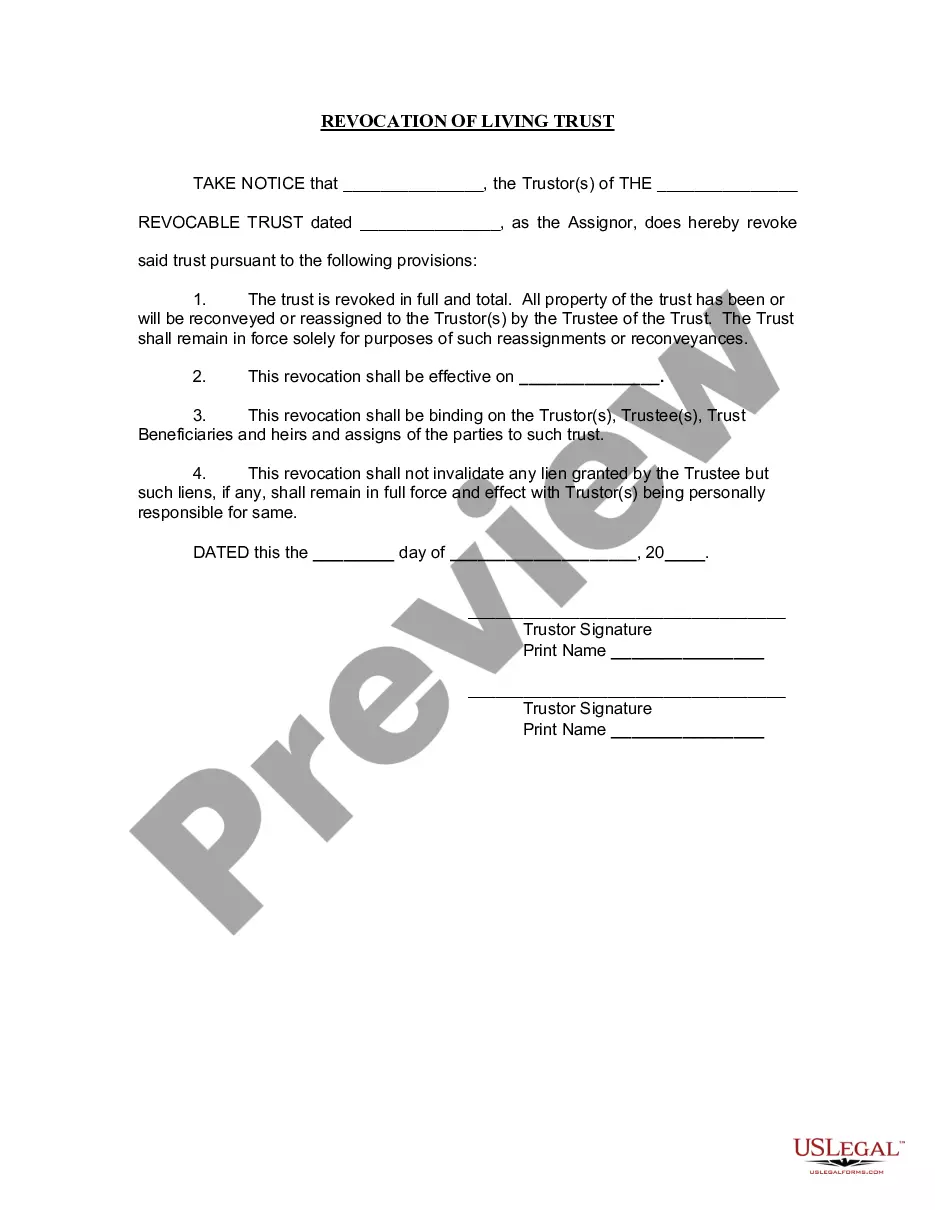

Review the form preview and descriptions to ensure you have the document you seek. Confirm that the template you choose complies with the laws and regulations of your state and county. Select the appropriate subscription plan to acquire the Homestead State California Foreclosure. Download the form, then complete, sign, and print it. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and make form execution a straightforward and efficient process!

- With just a few clicks, you can swiftly access state- and county-specific templates carefully crafted for you by our legal experts.

- Utilize our platform whenever you require a dependable service through which you can quickly locate and download the Homestead State California Foreclosure.

- If you’re already familiar with our offerings and have set up an account, simply Log In, choose the template, and download it or re-download it anytime later in the My documents section.

- Don’t have an account? No issue. Setting it up takes minimal time, allowing you to explore the library.

- However, before diving straight into downloading Homestead State California Foreclosure, heed these suggestions.

Form popularity

FAQ

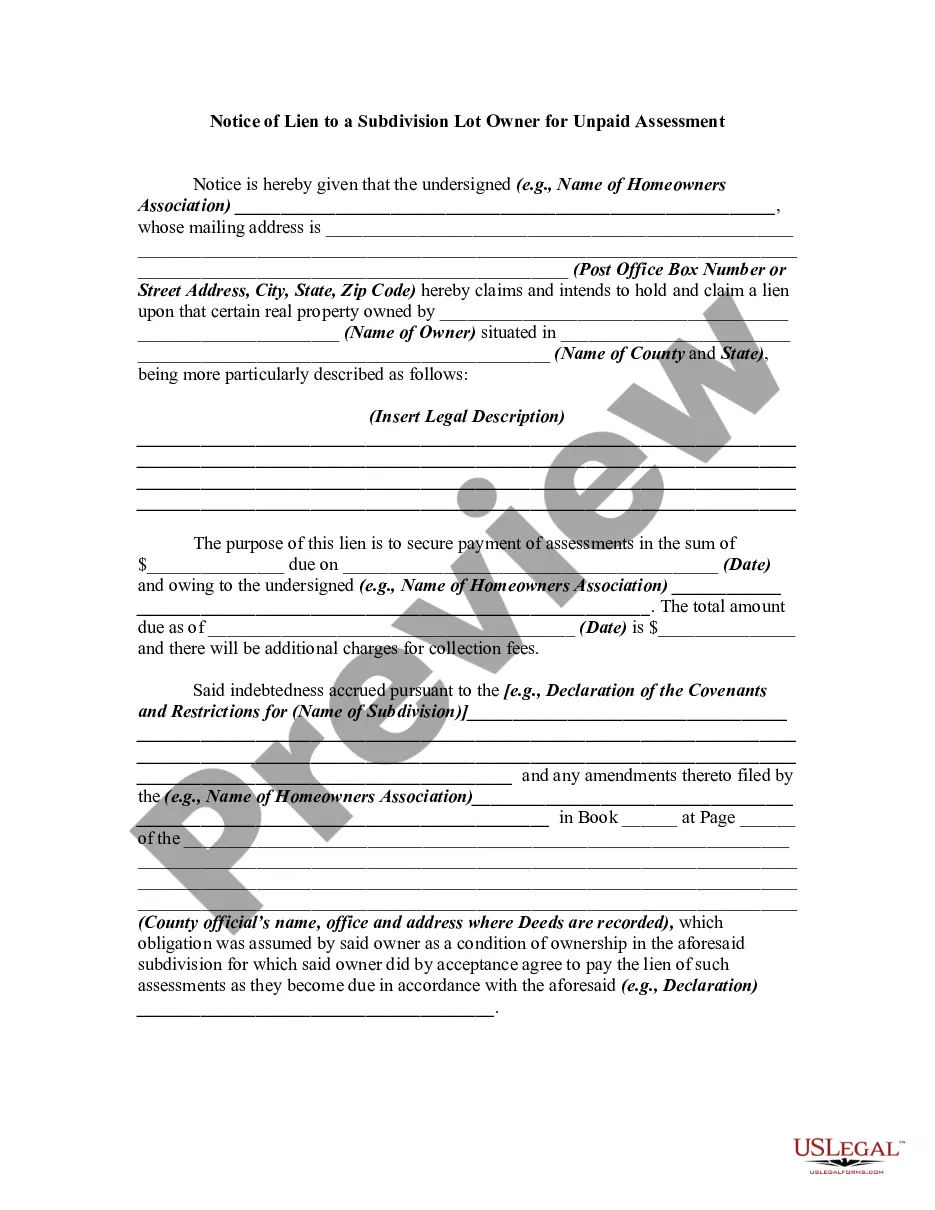

Hear this out loud PauseDeclared Homestead. Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new 2021 law, $300,000?$600,000 of a home's equity cannot be touched by judgment creditors.

California offers an automatic homestead exemption to every homeowner who occupies their home, whether it is a single-family dwelling, mobile home, or even a boat. As of January 1, 2021, the California homestead exemption is a minimum of 300,000 dollars, but can be as high as 600,000 dollars.

Hear this out loud PauseThe North Carolina statutory homestead exemption is provided by NCGS 1C-1601(a)(1), and allows a debtor to exempt up to $35,000 of value in property used as a residence.

Hear this out loud PauseA homestead exemption is automatically applied to your residence but only upon the forced sale of the property. It requires you to continually reside in the property throughout the process, otherwise you lose the exemption, and the burden of proving the exemption should automatically apply is on you.

Hear this out loud PauseBased on the changes to the California Consumer Price Index for the prior fiscal year, the minimum exemption for 2023 is $339,189 and the maximum is $678,378.