Small Estate Affidavit For California

Description

How to fill out California Affidavit Regarding Real Property Of Small Value - $55,425 Or Less?

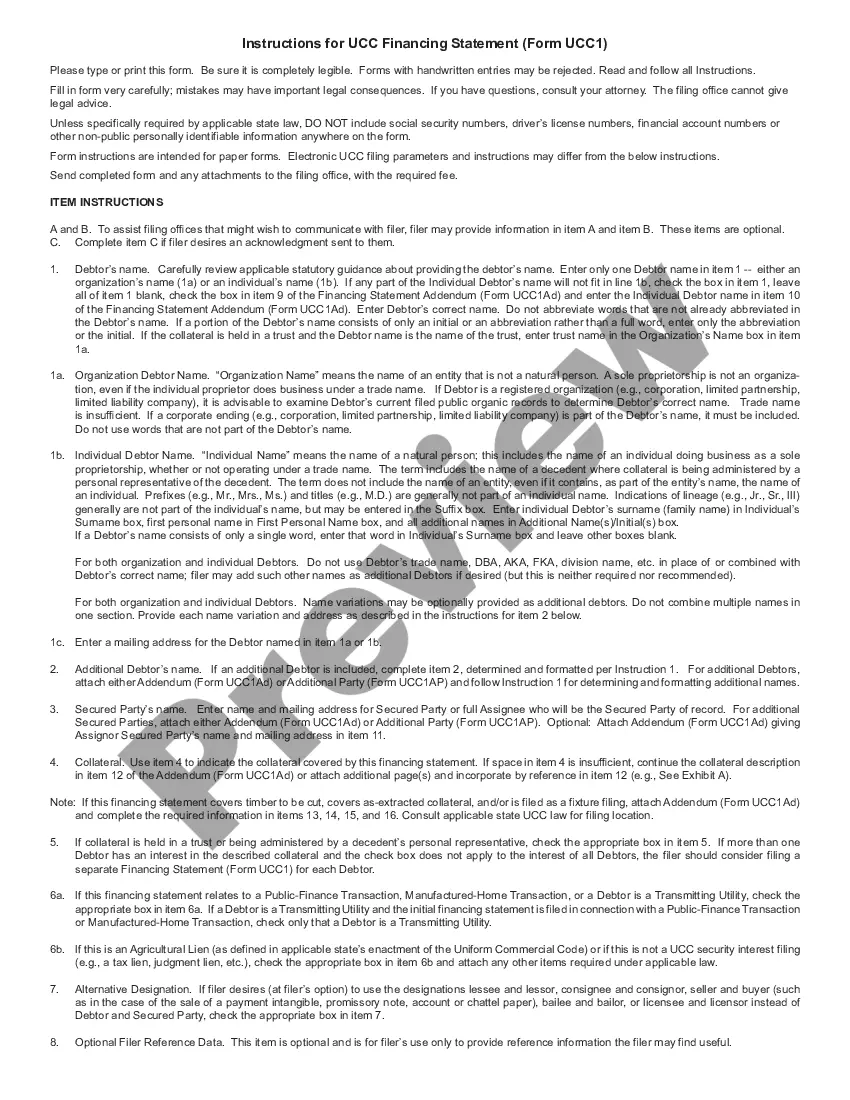

Steering through the red tape of standard documents and templates can be challenging, particularly when one is not familiar with the process. Even selecting the appropriate template for a Small Estate Affidavit For California will demand considerable time, as it must be valid and precise to the last detail. Nevertheless, you will need to invest considerably less time finding a suitable template if it originates from a reliable source.

US Legal Forms is a service that streamlines the process of locating the correct forms online. US Legal Forms is a single destination you require to discover the most recent samples of documents, confirm their usage, and download these samples for completion. It serves as a repository with over 85K forms that are applicable in various professional fields. When searching for a Small Estate Affidavit For California, you need not question its authenticity as all the forms are validated.

Having an account at US Legal Forms will guarantee you possess all the essential samples at your fingertips. Store them in your history or add those to the My documents collection. You can access your saved forms from any device by clicking Log In on the library website. If you do not have an account yet, you can always search for the template you require.

US Legal Forms will save you time and effort determining if the form you observed online suits your requirements. Establish an account and gain unrestricted access to all the templates you necessitate.

- Input the title of the document in the search bar.

- Locate the correct Small Estate Affidavit For California among the findings.

- Review the sample description or view its preview.

- If the template fulfills your requirements, select Buy Now.

- Proceed to choose your subscription plan.

- Utilize your email address and create a password to register an account at US Legal Forms.

- Choose a credit card or PayPal payment method.

- Download the template file on your device in the format you prefer.

Form popularity

FAQ

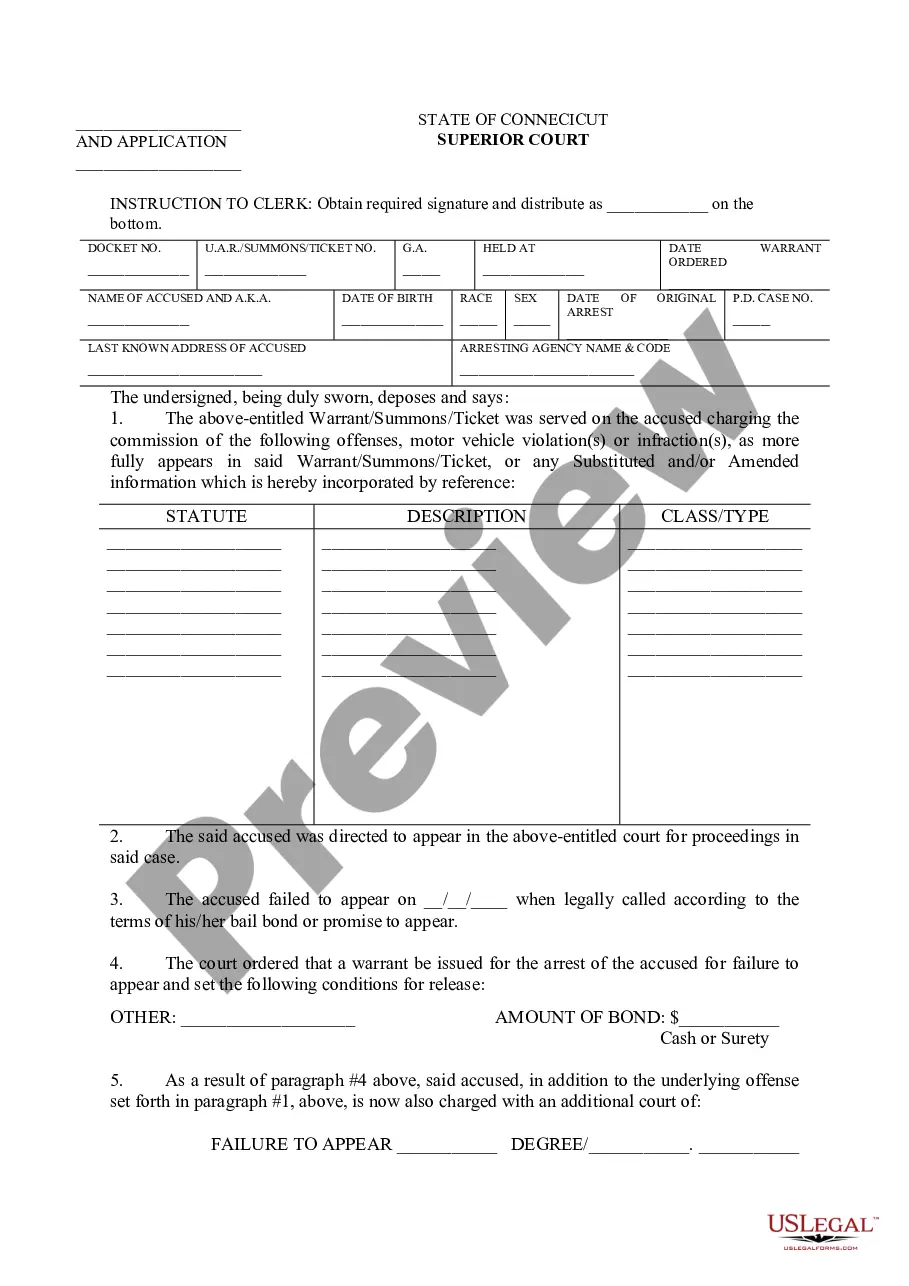

A California small estate affidavit, or Petition to Determine Succession to Real Property, is used by the rightful heirs to an estate of a person who died (the decedent). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.

If the heirs are only looking to transfer the real estate, with no personal possessions, Form DE-310 must be completed and filed. Signing Requirements Must be notarized (Prob. Code § 13104(e)).

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

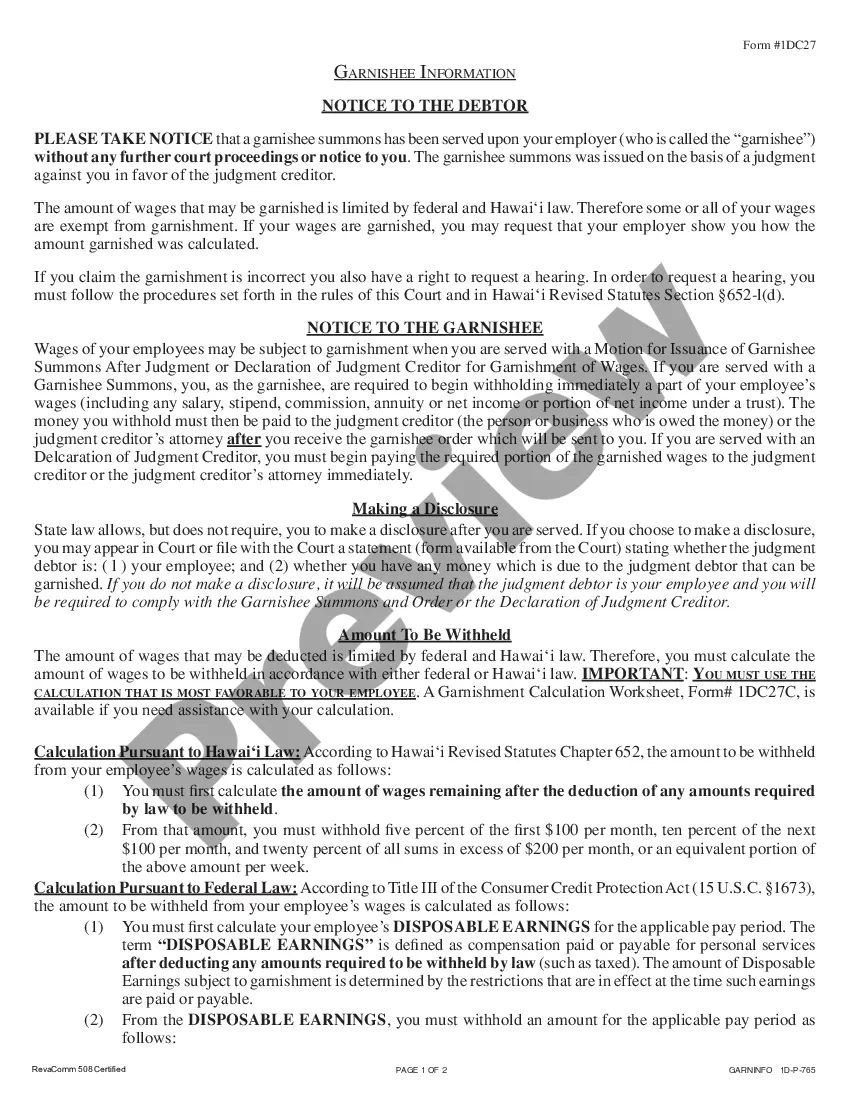

I explained that California law requires filing the original will in the probate court. However, if a will is lost we can file a petition for admittance of a lost will. I assured her I do this all the time. I explained that I would send her an email with the initial probate documents and a FedEx return label.

The terms usually become irrevocable when the creator of the trust dies. A trust may also be set up by a will, which leaves property in trust for a beneficiary. These trusts are called testamentary trusts and are usually irrevocable. Trusts are not filed or registered with the Court.