Ca Death Form Without Nomination

Description

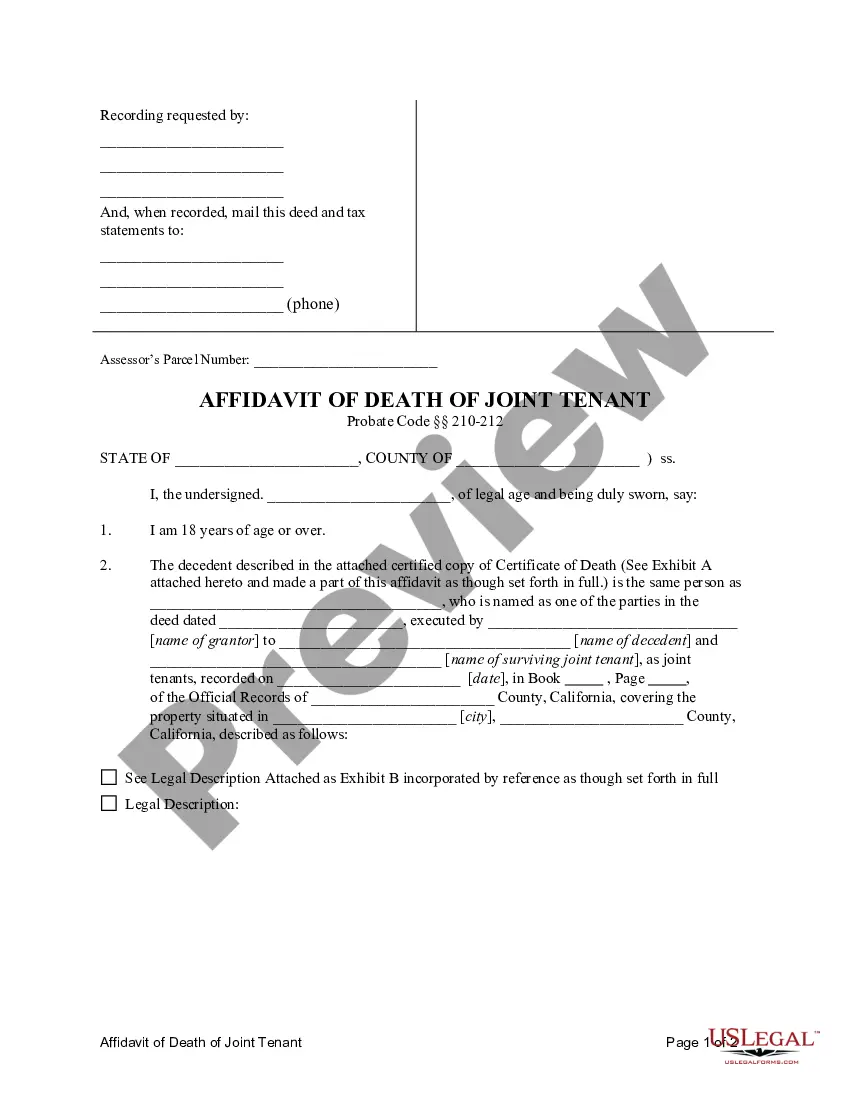

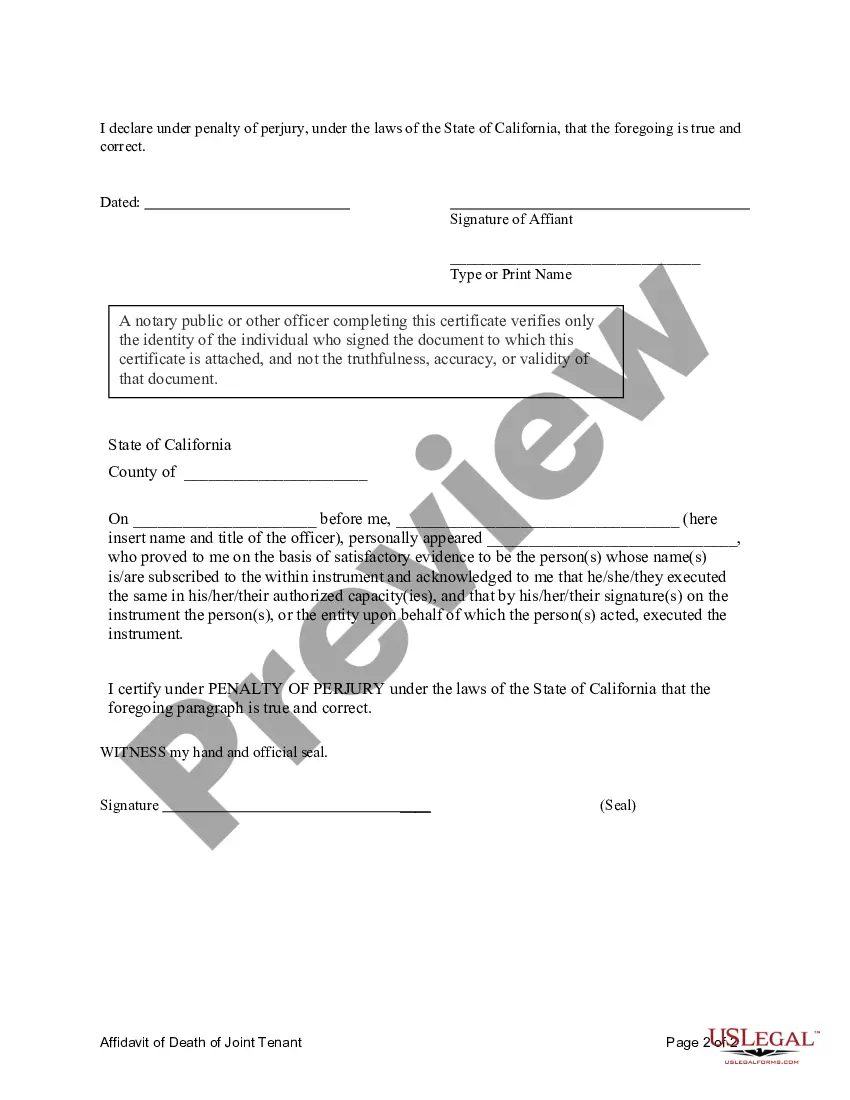

How to fill out California Affidavit Of Death Of Joint Tenant?

It’s well-known that you cannot become a legal specialist instantly, nor can you learn how to swiftly prepare Ca Death Form Without Nomination without having a specialized background.

Producing legal documents is a labor-intensive task that necessitates particular education and expertise.

So why not entrust the development of the Ca Death Form Without Nomination to the professionals.

Preview it (if this option is available) and read the accompanying description to determine whether Ca Death Form Without Nomination is what you need.

Begin your search again if you require a different template.

- With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court documents to templates for in-office correspondence.

- We recognize how vital compliance and adherence to federal and local laws and regulations are.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how you can initiate your journey with our platform and obtain the document you need in just minutes.

- Locate the form you require using the search bar at the top of the page.

Form popularity

FAQ

If your loved one was a resident of California and held a driver's license or vehicle registration, the California DMV should be notified of their passing. This is essential to cancel their driver's license and prevent identity theft, as well as to transfer or cancel vehicle registration.

If the heir will be the new owner, submit the following to a DMV office: The California Certificate of Title. ... Affidavit for Transfer without Probate (REG 5), completed and signed by the heir. An original or certified copy of the death certificate of all deceased owners.

If you die without a valid will, the probate court will distribute your assets in ance with California's intestate succession law. Intestate succession law attempts to distribute property roughly based on next of kin, except with respect to out-of-state real estate.

Fill out the Statement of Facts (REG 256) form (Section G) stating the: Decedent's name. Placard number. Decedent's date of death. Name of the person reporting the death, and their relationship to the decedent. The signature and daytime phone number of the person reporting the death.

If you don't file taxes for a deceased person, the IRS can take legal action by placing a federal lien against the Estate. This essentially means you must pay the federal taxes before closing any other debts or accounts. If not, the IRS can demand the taxes be paid by the legal representative of the deceased.