Lease With Guarantee

Description

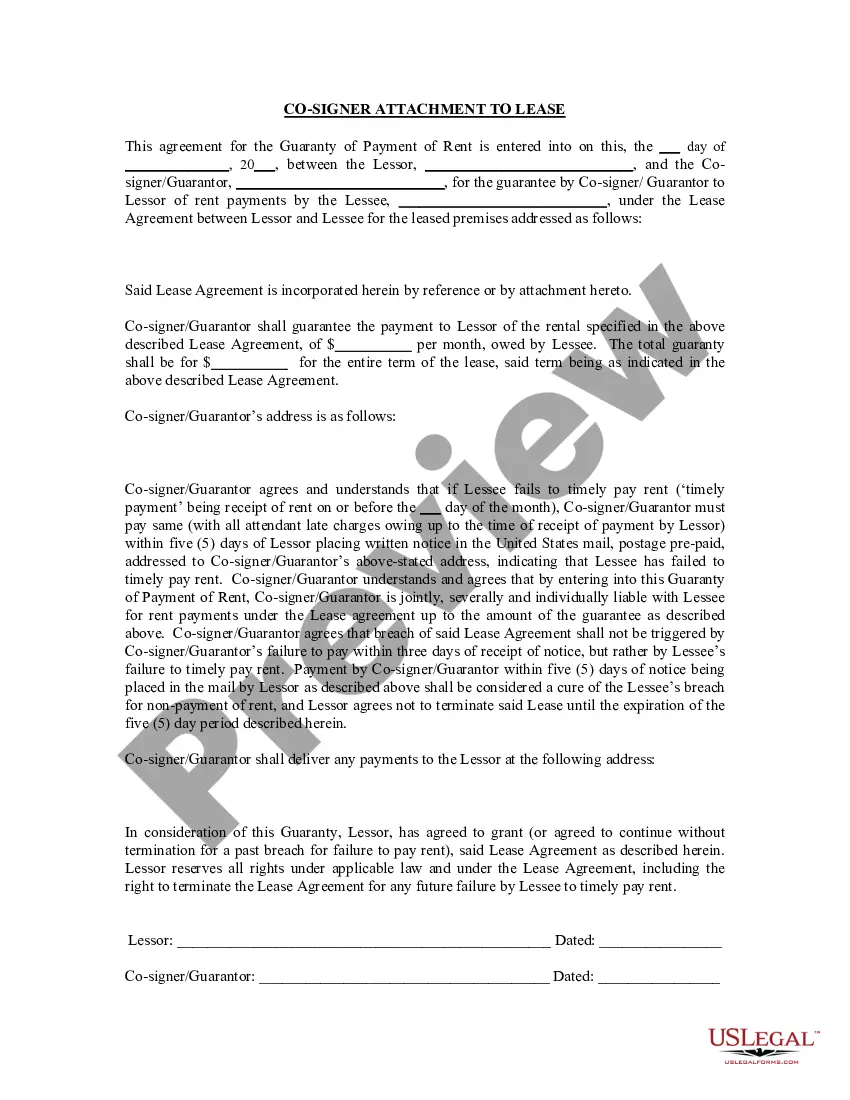

How to fill out California Guaranty Attachment To Lease For Guarantor Or Cosigner?

Legal administration can be perplexing, even for the most seasoned experts.

When you are looking for a Lease With Guarantee and lack the time to seek out the suitable and current version, the tasks may become challenging.

US Legal Forms caters to all requirements you might have, ranging from personal to business documents, all in one location.

Utilize advanced tools to complete and manage your Lease With Guarantee.

Here are the steps to follow after obtaining the form you desire: Confirm this is the correct document by previewing it and checking its details. Ensure that the template is recognized in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Select the file format you want, then Download, complete, eSign, print, and send your documents. Benefit from the US Legal Forms online library, backed by 25 years of expertise and reliability. Streamline your everyday document management into a straightforward and user-friendly process today.

- Gain access to a repository of articles, tutorials, and handbooks related to your situation and requirements.

- Save time and energy searching for the documents you need, and use US Legal Forms’ enhanced search and Preview feature to find Lease With Guarantee and download it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to review the documents you have previously saved and manage your folders as desired.

- If it's your first time with US Legal Forms, create an account for unrestricted access to all platform benefits.

- A comprehensive online form repository could be a significant advantage for anyone who wishes to manage these scenarios efficiently.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you have the ability to access state- or county-specific legal and business documents.

Form popularity

FAQ

To guarantee a lease, you must sign a guarantee agreement that outlines your commitment to cover the tenant's obligations under the lease with guarantee. This process typically involves providing proof of income and possibly a credit check to ensure your suitability as a guarantor. Once the agreement is in place, it becomes a legally binding contract. US Legal Forms offers resources to help you navigate this process smoothly.

Yes, guarantees are legally enforceable contracts that bind the guarantor to the obligations outlined in the lease with guarantee. This means that if the tenant fails to meet their obligations, the landlord can seek payment or compliance from the guarantor. It's important for both parties to understand the terms of the guarantee to avoid disputes later. At US Legal Forms, you can find templates to create legally sound agreements.

A guarantor typically needs to demonstrate a stable income that is at least three times the monthly rent of the property under the lease with guarantee. This income requirement ensures that they can cover the rent payments in case the tenant defaults. Additionally, having a solid credit history can further strengthen their position as a reliable guarantor. Using US Legal Forms can help you understand your obligations and prepare necessary documentation.

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

A lease guaranty is a contract between an individual or entity (guarantor) that is typically related to the tenant. The guarantor promises to pay the landlord any and all payments due under the lease in the event the tenant defaults under its lease obligations and otherwise cure the tenant's defaults.

A person who guarantees the repayment of a borrower's debt if the borrower cannot make loan repayments is known as a guarantor. Guarantors put up their property as security for the loans. A co-applicant works alongside a borrower during the loan underwriting and approval process.

(a) For good and valuable consideration, the receipt and sufficiency, of which is hereby acknowledged by Lease Guarantor, the Lease Guarantor hereby personally and unconditionally guarantys to Lessor the payment of all Base Rent and any and all other sums due hereunder, including, but not limited to, all damages, fees, ...

How to get out of a personal guarantee on a commercial lease Subleasing the space to another tenant. ... Assigning the lease to another party. ... Use a break clause. ... Renegotiate the lease contract. ... Have a personal guarantee insurance. ... Breaking the lease.