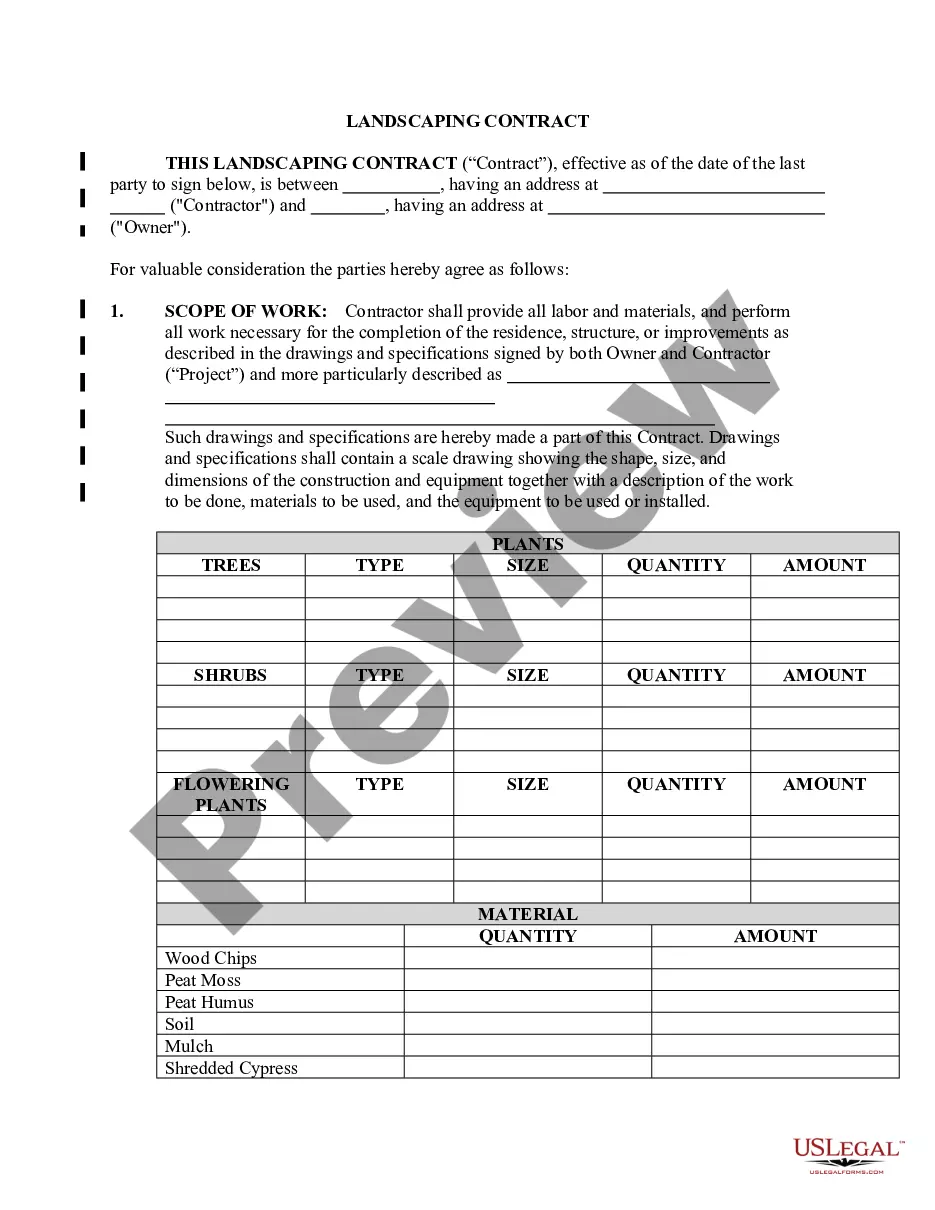

Ca Complaint Form Withholding

Description

How to fill out California Complaint For Dissolution Of Limited Partnership?

It’s clear that you cannot become a legal specialist instantly, nor can you quickly comprehend how to prepare a Ca Complaint Form Withholding without possessing a specific skill set.

Assembling legal documents is a lengthy procedure that necessitates particular training and expertise. Therefore, why not entrust the generation of the Ca Complaint Form Withholding to the experts.

With US Legal Forms, one of the most extensive collections of legal templates, you can find anything from court paperwork to templates for internal communication.

You can regain access to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same tab.

Regardless of the intention behind your forms—be it financial, legal, or personal—our platform has got you covered. Experience US Legal Forms today!

- Recognize the form you require by utilizing the search bar at the top of the webpage.

- View it (if this option is available) and read the accompanying description to determine if Ca Complaint Form Withholding is what you need.

- Initiate your search anew if you require any additional template.

- Sign up for a free account and choose a subscription plan to purchase the form.

- Select Buy now. After the payment is finalized, you can download the Ca Complaint Form Withholding, fill it out, print it, and send it or dispatch it by mail to the necessary individuals or organizations.

Form popularity

FAQ

Form IT-201, Resident Income Tax Return.

NY state income tax: Head of household Tax rateTaxable income bracketTax owed4%$0 to $12,800.4% of taxable income.4.5%$12,801 to $17,650.$512 plus 4.5% of the amount over $12,800.5.25%$17,651 to $20,900.$730 plus 5.25% of the amount over $17,650.5.85%$20,901 to $107,650.$901 plus 5.85% of the amount over $20,900.5 more rows ?

The Process Of Becoming A Resident Of New York Ensure you have a valid driver's license, passport, or other government-issued ID. ... Get a job or be accepted into a school in New York. ... Apply for a New York state ID. ... Register to vote in New York. ... Get a New York state driver's license.

A Nonresident of New York is an individual that was not domiciled nor maintained a permanent place of abode in New York during the tax year. A Part-Year Resident is an individual that meets the definition of resident or nonresident for only part of the year.

Nonresidents who wish to claim a refund on NYS taxes or whose NY adjusted gross income (federal column amount) exceeds $7,500 should file the following forms: IT-203 ?Nonresident and Part-year Resident Income Tax Return?

The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

To request innocent spouse relief for these tax years, you may file Form IT-285 or submit a signed statement with supporting documentation showing why you believe you qualify. Mail your completed Form IT-285 or signed statement with supporting documentation to: NYS TAX DEPARTMENT.

Examples of acceptable proof of residency are: homeowner's or renter's insurance policy. driver's license or automobile registration certificate. bank statement. automobile insurance policy.