California Payment Property With Lien

Description

How to fill out California Notice Of Default In Payment Of Rent As Warning Prior To Demand To Pay Or Terminate For Residential Property?

Creating legal documents from the ground up can occasionally feel overwhelming. Some situations may require numerous hours of investigation and substantial financial resources.

If you’re looking for a simpler and more cost-effective approach to drafting California Payment Property With Lien or any other paperwork without unnecessary complexities, US Legal Forms is always at your service.

Our online database of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously prepared by our legal professionals.

Utilize our platform whenever you need dependable services through which you can promptly locate and download the California Payment Property With Lien. If you’re already acquainted with our website and have created an account in the past, simply Log In to your account, find the template, and download it or re-download it at any time later in the My documents section.

US Legal Forms enjoys a strong reputation and over 25 years of expertise. Join us today and transform form completion into an effortless and streamlined process!

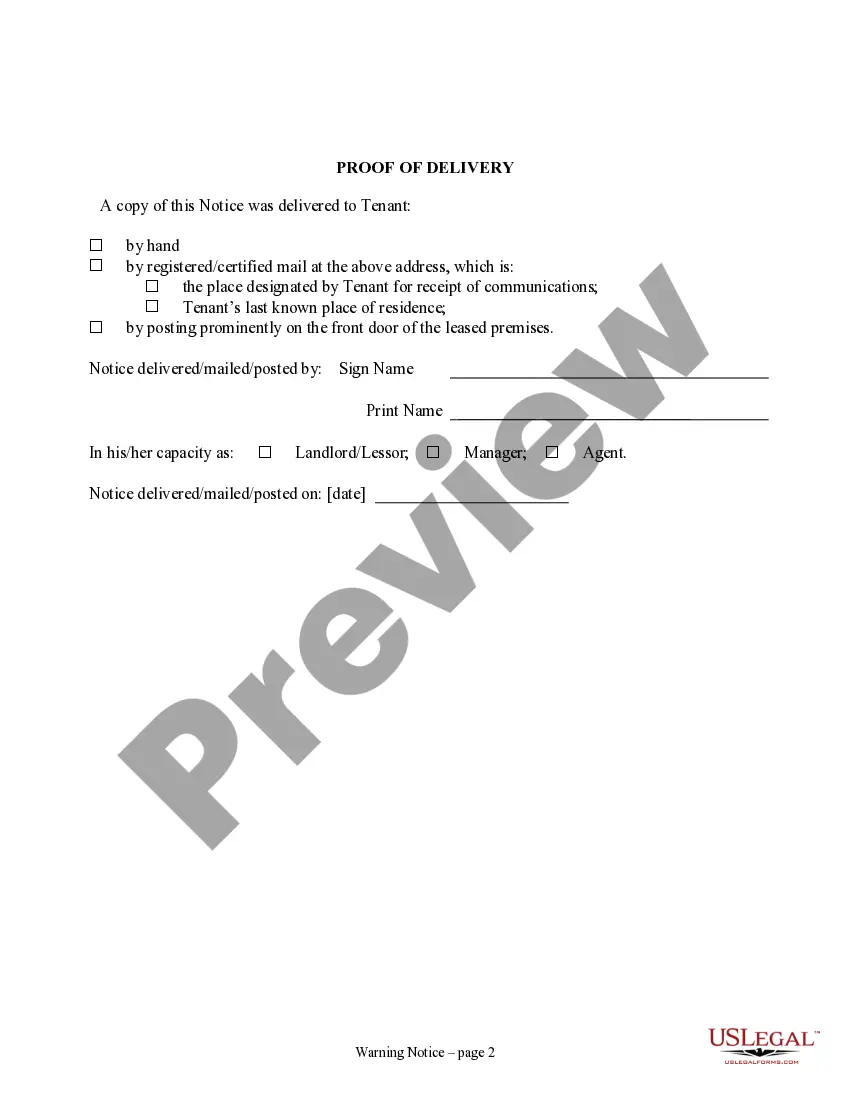

- Check the form preview and descriptions to ensure you have identified the document you are looking for.

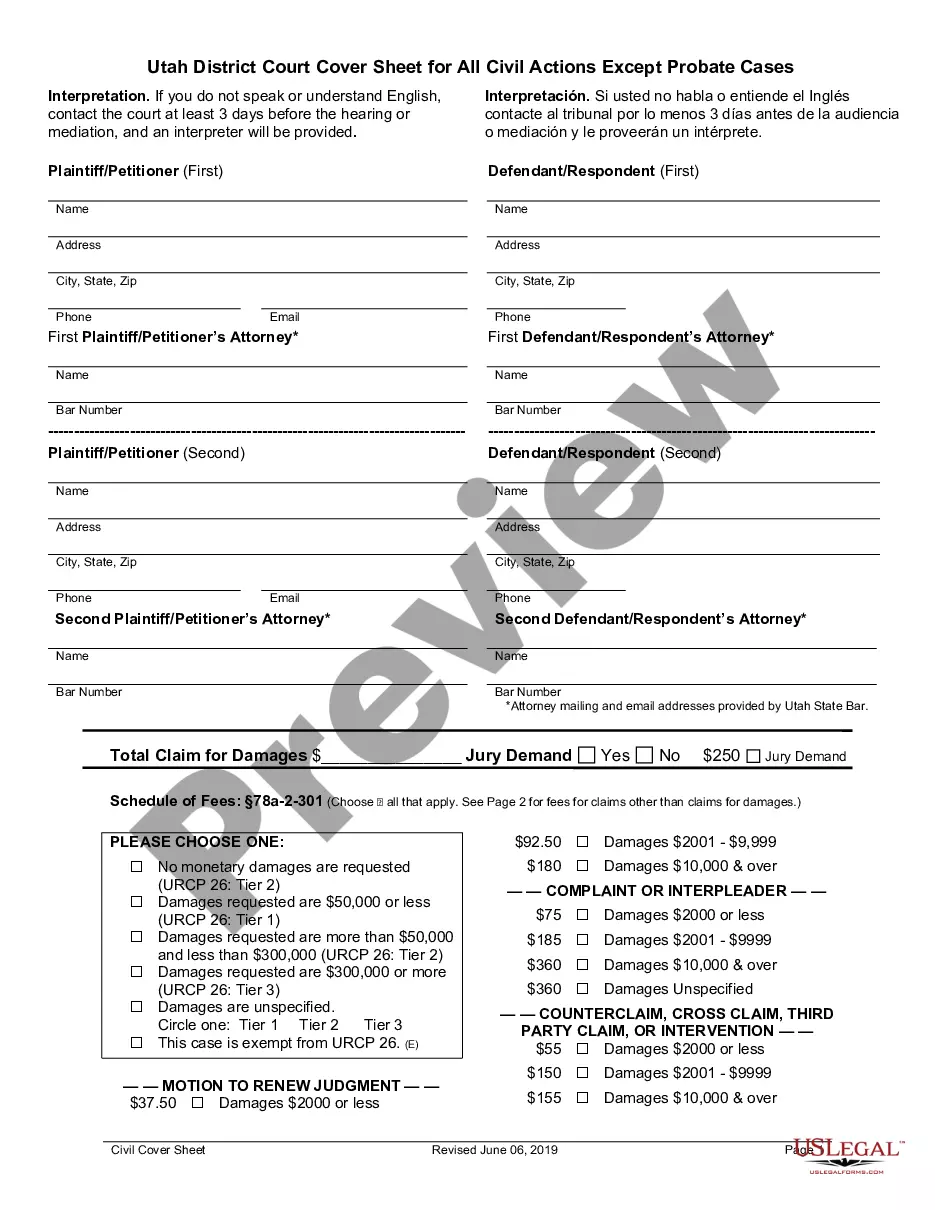

- Confirm that the template you choose aligns with the prerequisites of your state and county.

- Select the most appropriate subscription plan to acquire the California Payment Property With Lien.

- Download the form. Then fill it out, authenticate, and print it.

Form popularity

FAQ

Paying property tax in California does not automatically grant ownership of the property. It is a legal obligation for all property owners, but ownership is determined by the deed recorded with the county. Nevertheless, consistent payment of property taxes can strengthen your claim to the property and can help you avoid tax liens. For guidance on managing your California payment property with lien, USLegalForms offers valuable resources to understand your rights and responsibilities.

In California, it is possible for someone to place a lien on your property without your immediate knowledge. Typically, lienholders must file a claim with the county recorder, which becomes public record. However, you may not be notified unless you actively monitor your property’s status. To protect your interests, consider using USLegalForms to stay informed about any potential liens on your California payment property with lien.

To buy property with liens in California, start by researching the property’s status. You can check public records to identify any existing liens. Once you find a property with a lien, you can negotiate with the lienholder, potentially settling the debt or assuming the lien. Utilizing platforms like USLegalForms can help you navigate the legal documents and procedures involved in purchasing California payment property with lien.

Information to include on a California Mechanics Lien Form The lien claim amount. ... Name of the property owner. ... Description of the work or materials you provided. ... Your hiring party's information. ... Property description. ... Identify yourself (name & address) ... Include the warning statement. ... Sign & verify your California lien claim.

Place a lien on property. To do this, fill out an EJ-001 Abstract of Judgment form and take it to the clerk's office. After the clerk stamps it, record it at the County Recorder's Office in the county where the property is located.

The party who signed the original lien and, in most cases, notarized must sign the release and, in most cases, it must be notarized. If the person or agency that filed the lien is not available or is no longer in business, you may wish to contact an attorney to seek resolution of the matter.

How to put a lien on someone's property Fill out Abstract of Judgment. Abstract of Judgment ? Civil and Small Claims (form EJ-001) ... Get Abstract certified and pay fee. Bring the Abstract of Judgment to the small claims court clerk. ... Make a copy. ... Record the Abstract.

Yes, it's possible to sell your house if it has a lien on it, but the process involves highly specific and often-complicated steps. The key concern is obtaining title insurance, which can be affected by the type of lien that's in place.