California Termination Tenancy Ca Form 568 Instructions

Description

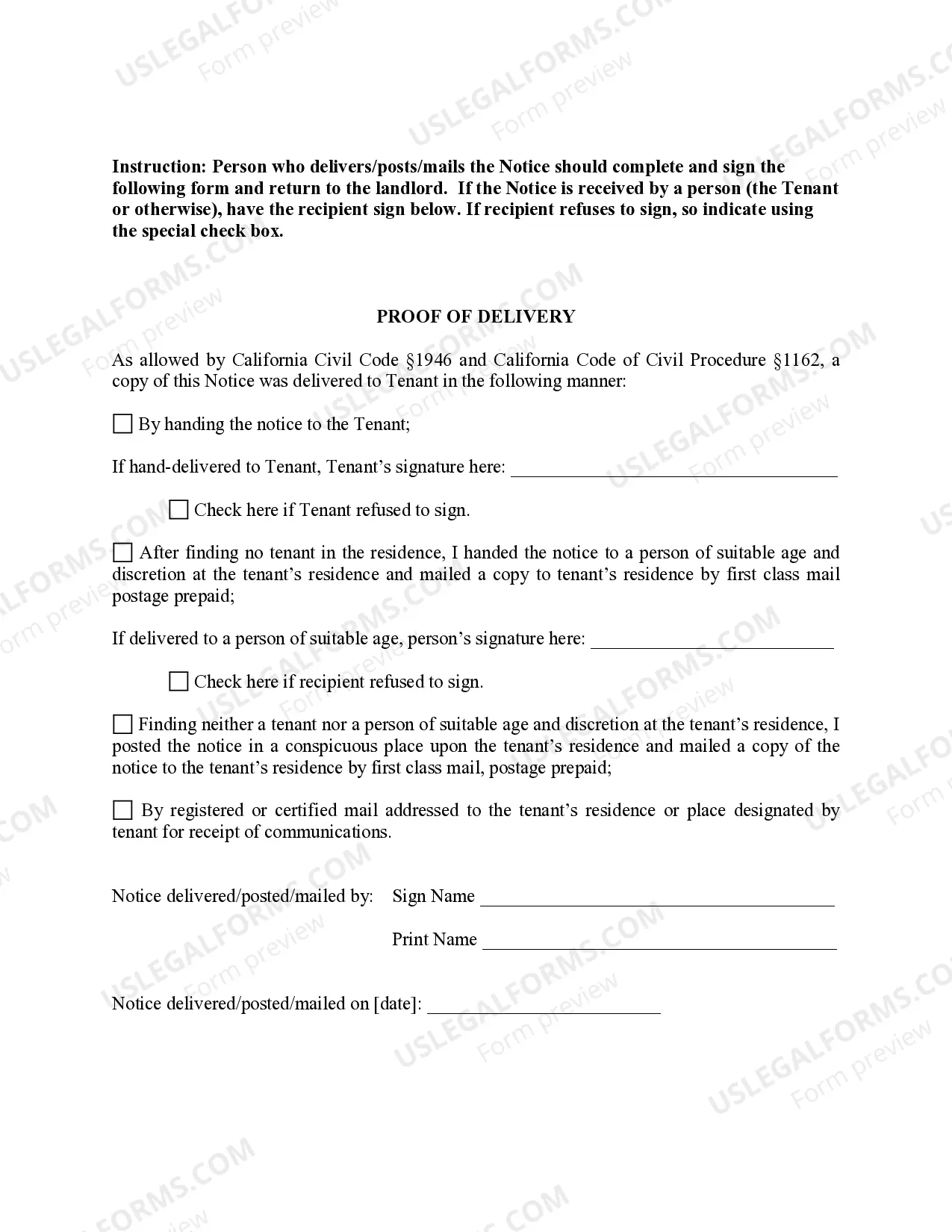

How to fill out California 60 Day Notice Of Termination - Residential Month-to-Month Tenancy?

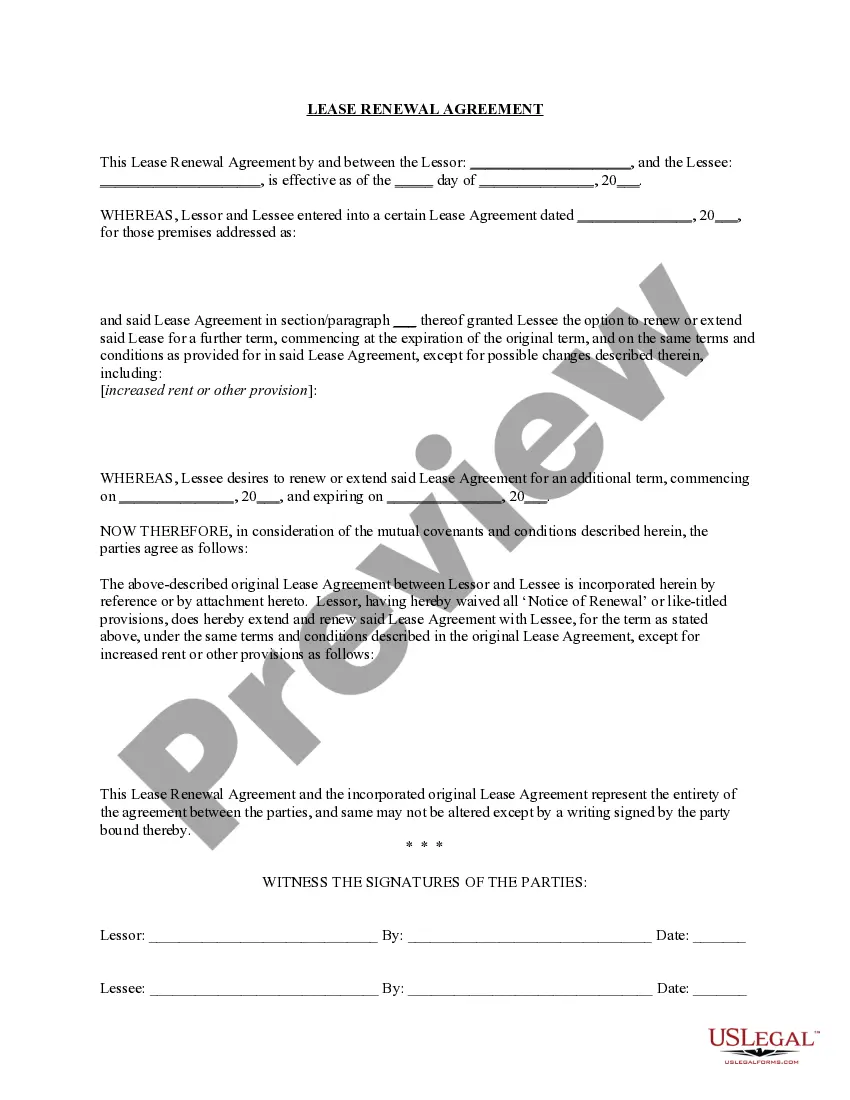

Creating legal documents from the ground up can frequently be intimidating.

Certain situations may require extensive research and substantial financial resources.

If you seek a more uncomplicated and budget-friendly method of preparing California Termination Tenancy Ca Form 568 Instructions or any other papers without unnecessary obstacles, US Legal Forms is always accessible.

Our online library of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal experts.

Ensure the form you select complies with the statutes and regulations of your county and state. Choose the appropriate subscription plan to acquire the California Termination Tenancy Ca Form 568 Instructions. Download the document, then fill it out, sign it, and print it. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and simplify document handling!

- Utilize our site whenever you require dependable and trustworthy services through which you can swiftly locate and download the California Termination Tenancy Ca Form 568 Instructions.

- If you’re already a user of our website and have previously registered an account, simply Log In to your account, select the template and download it immediately or access it again later in the My documents section.

- No account? No problem. Registration takes minimal time and allows navigation through the catalog.

- Before proceeding with downloading California Termination Tenancy Ca Form 568 Instructions, consider these suggestions.

- Examine the document preview and descriptions to ensure you have identified the document you need.

Form popularity

FAQ

To officially terminate an LLC in California, you need to file Form LLC-3, also known as the Certificate of Dissolution. This form formally ends your business's existence in the state. After completing the necessary steps for dissolution, you can also refer to the California termination tenancy CA Form 568 instructions for guidance on resolving any tax obligations. Using USLegalForms can simplify this process, ensuring you have the correct forms and instructions for a smooth termination.

In California, any limited liability company (LLC) that is doing business or organized in the state must file CA Form 568. This includes foreign LLCs that register to operate in California. It’s important to ensure compliance with state regulations, as failing to submit the required documentation can lead to penalties. For those seeking clear guidelines, the California termination tenancy CA Form 568 instructions provide valuable information on filing requirements.

Filing Form 568 in California involves completing the form with accurate financial details, determining your eligibility, and submitting it by the due date. It's crucial to follow all detailed steps outlined in the California termination tenancy ca form 568 instructions to ensure compliance. You can file by mail or e-file if you prefer a convenient online option. For assistance throughout the process, explore the helpful tools available on the uSlegalForms platform.

You need to send California Form 568 to the address indicated on the form, which typically depends on whether you are including a payment. Make sure to double-check the mailing address listed in the most current California termination tenancy ca form 568 instructions to avoid delays. If you are e-filing, the submission process will guide you through electronically sending your form without needing a physical address. Consider consulting uSlegalForms for more guidance.

Yes, CA Form 568 can be e-filed using approved e-filing software that supports California tax forms. This method allows for a quicker, more efficient submission of your financial information. E-filing can also help you receive confirmation of your submission faster than traditional methods. Make sure to follow the California termination tenancy ca form 568 instructions closely to ensure a smooth e-filing process.

CA 568 should be filed on or before the due date of your return for the tax year, which typically falls on March 15 for most partnerships. However, if you require an extension, the filing date may change. Keep track of any new updates each tax year to remain compliant. For comprehensive California termination tenancy ca form 568 instructions, the uSlegalForms platform can provide assistance.

You should file Form 568 in California when you need to report income and deductions from a partnership, limited liability company, or other business entities classified as partnerships. It's important to adhere to the deadlines associated with your tax return to avoid penalties. Ensure that you gather all relevant financial information before filing. For detailed California termination tenancy ca form 568 instructions, consider using the resources available on the uSlegalForms platform.

Yes, you can file CA Form 568 online through California’s official tax website or through authorized e-filing platforms. Online filing often ensures faster processing and can help reduce errors. Utilize the California termination tenancy CA Form 568 instructions during the online submission for guidance. For additional assistance, consider US Legal Forms, which offers resources to streamline your filing experience.

Choosing between CA 565 and CA 568 depends on your business structure. Form CA 565 is primarily used for partnerships, whereas Form CA 568 is for Limited Liability Companies. Always refer to the California termination tenancy CA Form 568 instructions to determine the most appropriate form for your needs. If you have questions about the differences, US Legal Forms can guide you through the process.

Yes, filing Form 568 is necessary if your entity fits into the categories required by California tax law. If you operate a limited liability company or partnership, you need to submit this form. Always review the California termination tenancy CA Form 568 instructions carefully to ensure compliance. If in doubt, seek advice from a tax professional to clarify your obligations.