Rent Will

Description

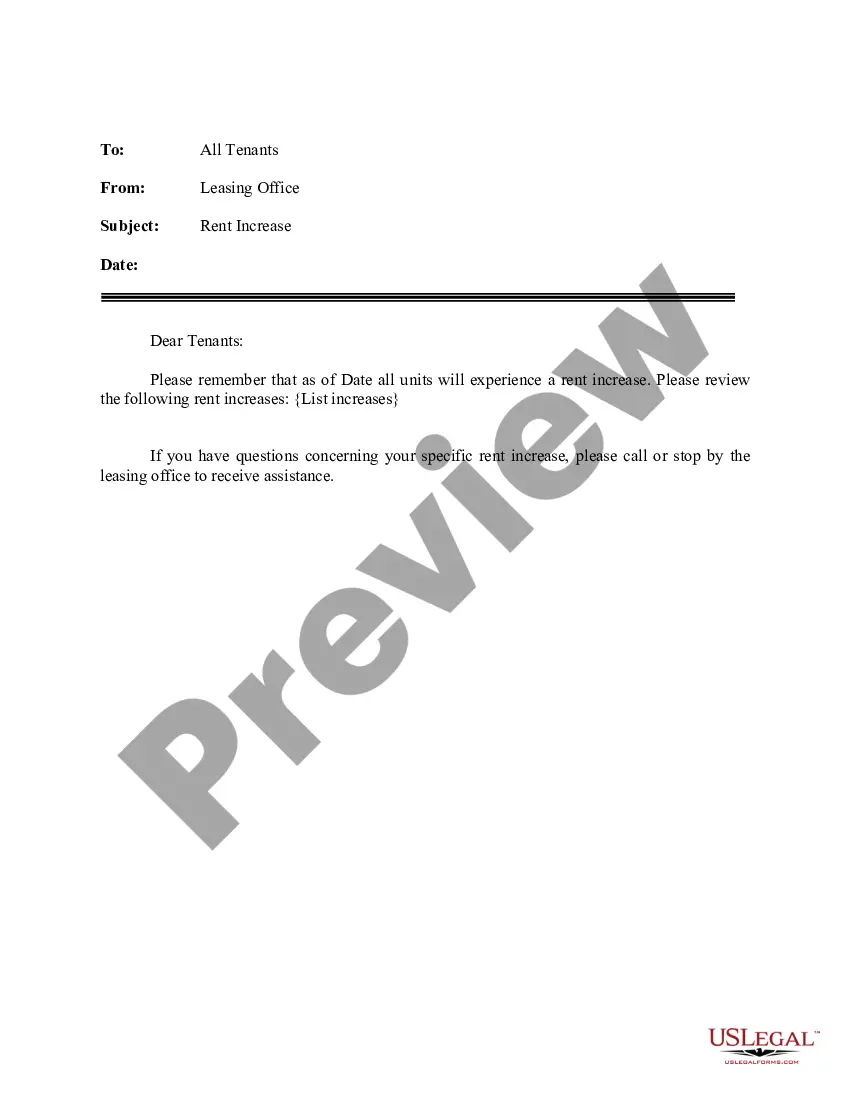

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

- Start by logging into your US Legal Forms account if you're a returning user. Ensure your subscription is active to access your documents.

- For first-time users, explore our extensive online library boasting over 85,000 fillable legal forms. Use the preview mode to find the document that fits your needs and complies with local regulations.

- If you require a different form, utilize the Search tab to find the correct template swiftly.

- Once you’ve selected the appropriate document, click on the Buy Now button and pick your desired subscription plan. Create an account to unlock our full resources.

- Complete your purchase by entering your credit card details or using PayPal for a seamless transaction.

- Immediately download your form to your device and access it anytime via the My Forms section of your profile.

With US Legal Forms, you not only have access to an extensive collection of documents but also receive support from legal experts who can assist you in creating precise, legally binding forms.

Start simplifying your legal processes today with US Legal Forms. Don't miss the opportunity to enhance your legal knowledge and efficiency!

Form popularity

FAQ

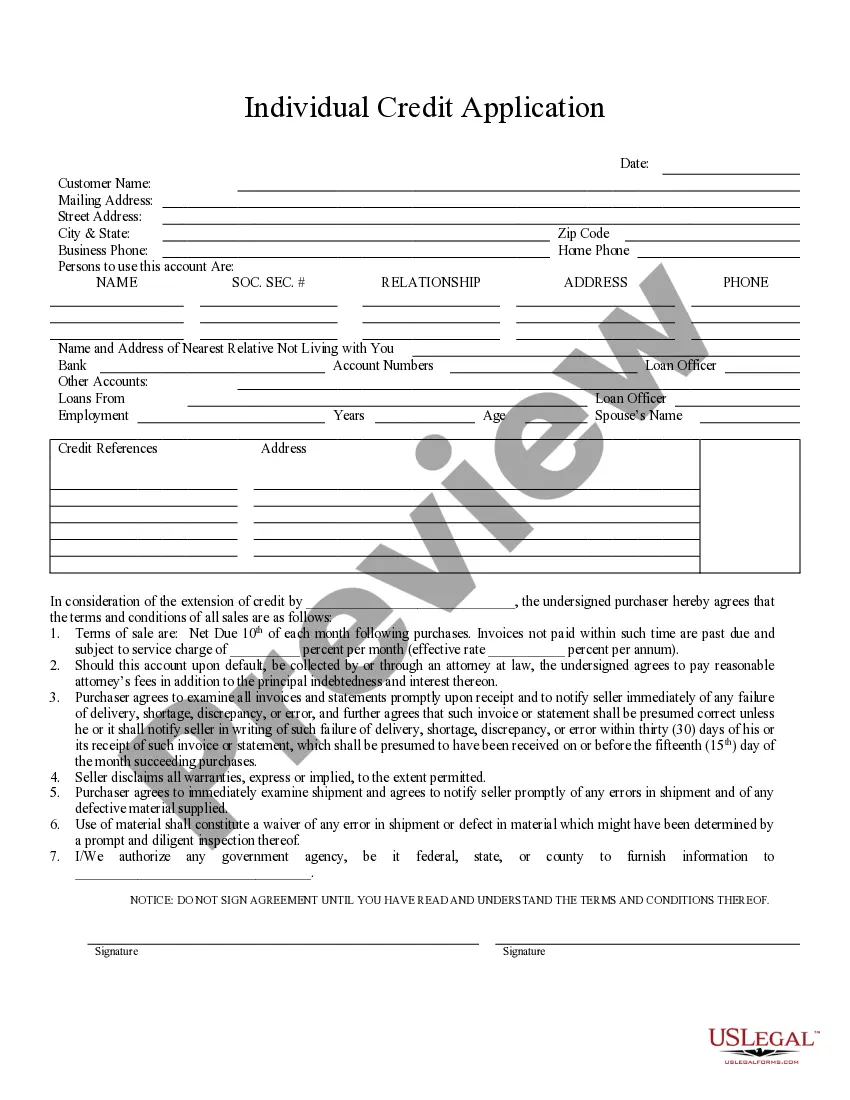

In a proof of rent letter, start with your address and the landlord's contact information. State the purpose of the letter and provide detailed information about the rental agreement, such as the rental amount, payment frequency, and dates. This letter should clearly articulate your commitment to fulfilling rent obligations. If you require assistance, consider using tools from USLegalForms for a professional touch.

Filling out a rent roll form involves listing all your rental units and their corresponding details. Start with the property’s address, and include information such as tenant names, lease start dates, rental amounts, and payment status. This form helps track income from each unit, and organizing it correctly is essential for accurate financial reporting. Utilizing platforms like USLegalForms can streamline the process.

If you lived with your parents and do not have formal rental history, you can list your parents' address as your residence. It is helpful to include a statement mentioning your living situation. Additionally, consider providing a letter from your parents as proof, confirming your time spent living there. This information will help landlords understand your rental background.

Rental income is generally not considered earned income, which includes wages and salaries. Instead, it falls under the category of passive income. Be sure to understand how rental income can impact your overall tax situation, especially if you are considering deductions or credits.

Typically, you do not receive a tax form solely for paying rent, as it is a personal expense. However, if you use a service to manage your rental payments or if your landlord issues receipts, those documents can help you in case of any additional claims. Be sure to keep copies of your payment records for reference.

Reporting rent to the IRS depends on whether you are a tenant or a landlord. Landlords must report rental income using Form 1040 and Schedule E. Tenants, however, do not need to report their rent payments unless claiming a specific credit or deduction available in their state.

In most cases, you do not receive a tax return just for paying rent. However, some states offer credits or deductions for renters that can affect your overall tax situation. Utilizing services like US Legal Forms can help you understand potential benefits based on your rental situation.

As a tenant, you typically do not report rent payments to the IRS, as they are considered personal expenses. However, landlords must report received rent on their tax returns. If you have rental income or deductions associated with renting, ensure you properly file them.

To file income from rental, you would report the earnings on your tax return using IRS Form 1040. You will typically use Schedule E to detail all rental income and related expenses, like maintenance and repairs. Remember, proper documentation of your rental payments will significantly ease this process.

When it comes to paying rent, you generally do not file taxes specifically for it. Rent payments are usually considered personal expenses, and they do not directly affect your tax returns. However, if you are a landlord or have rental income, the scenario changes, and that will require proper reporting.