How Much Is Your Rent

Description

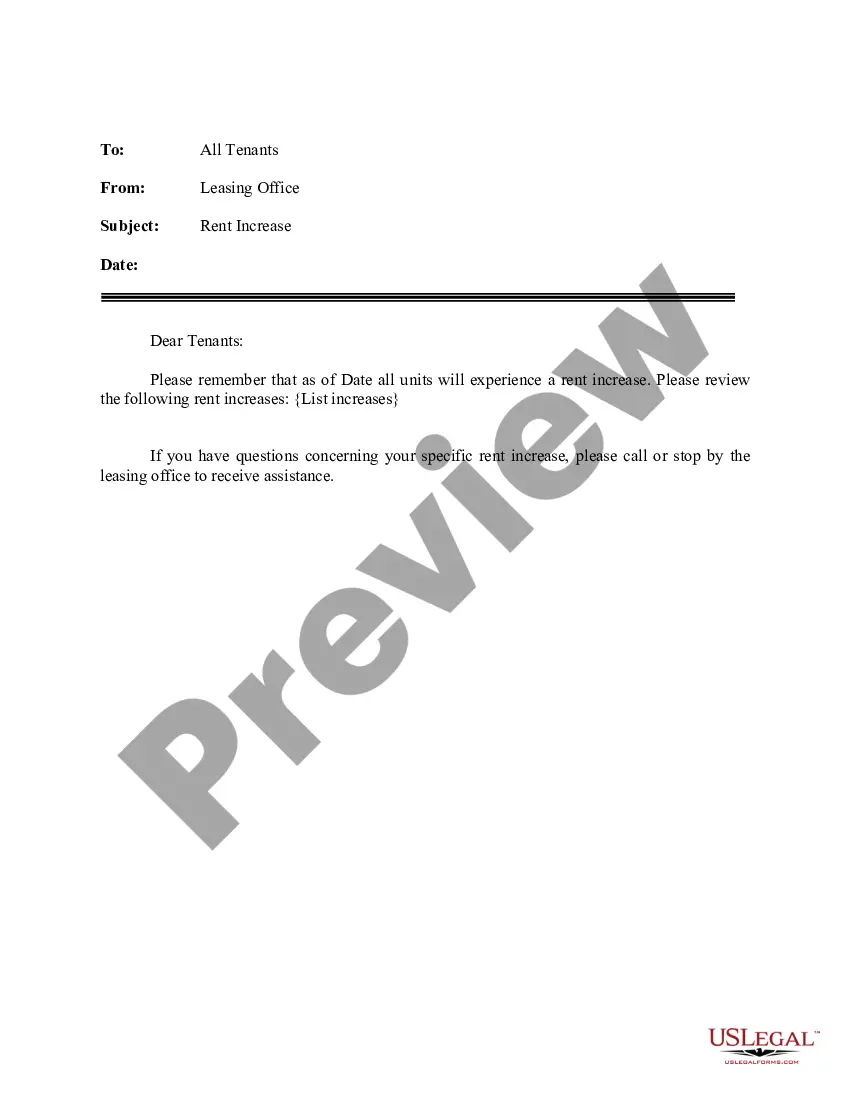

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

- If you're an existing user, visit the US Legal Forms site to log in and initiate the download of your required form. Verify your subscription status to ensure access.

- For new users, begin by browsing the extensive library and reviewing the form descriptions to confirm alignment with your legal requirements.

- If you find the initial template does not meet your criteria, utilize the Search feature to locate an alternative that fits your needs.

- Proceed to purchase the appropriate document by selecting the Buy Now option and choosing your preferred subscription plan, including account registration.

- Finalize your purchase by entering payment information, either through credit card or PayPal.

- Once the transaction is complete, download the document to your device and manage your forms conveniently from the My Forms section.

By leveraging US Legal Forms, individuals and attorneys can effortlessly execute legal documents with an extensive library that is user-friendly and thorough.

Ready to simplify your legal documentation process? Visit US Legal Forms today and empower yourself with the tools you need!

Form popularity

FAQ

To comfortably afford $1500 rent, your monthly income should ideally be around $5000, based on the guideline of spending 30% on housing. This allows you to manage other living expenses without feeling financially strained. Always consider how much is your rent relative to your total income to ensure a balanced budget.

To estimate your rent, start by evaluating your monthly income and the general guidelines—30% of your income should go towards housing. Research the average rental prices in your desired neighborhood, considering factors like amenities and property condition. This helps you gauge how much is your rent in reality.

To comfortably afford $1000 rent, it's generally recommended to allocate no more than 30% of your monthly income for housing costs. This means you should aim to earn at least $3333 a month. However, every individual's financial situation is unique, so consider your other expenses as you assess how much is your rent.

Yes, some states allow you to claim rent as a deduction on your state taxes, but the specifics can vary significantly. It's essential to check your state's tax guidelines to determine how much is your rent affecting your state liabilities. Platforms like US Legal Forms can help you find the relevant state tax forms and guidelines needed for your situation.

The IRS may have access to information about your rental income through third-party reports, such as 1099 forms received from rental platforms. If you don’t report how much is your rent income, the IRS could cross-reference financial records, potentially leading to audits. Therefore, it is essential to proactively report all income to avoid complications.

Recording rent income involves maintaining accurate financial records of all incoming rent payments. Use a simple spreadsheet or accounting software to track how much is your rent income, noting the date received and tenant details. Regularly updating these records helps you stay organized and makes tax reporting easier.

To claim rent income, you will need to fill out the appropriate tax forms, typically Schedule E. This form allows you to report how much is your rent income along with any allowable expenses. Be diligent in maintaining records of all income received and expenses incurred to ensure accurate reporting.

Failure to report rental income can lead to penalties and interest charges from the IRS. If you do not report how much is your rent, the IRS may discover your income through various means, which can trigger an audit. It is crucial to report all rental income accurately and completely to avoid any legal issues.

Generally, you report rental income and expenses on your tax return. If you rent out a property, you can report how much is your rent received on Schedule E. Personal rent is usually not reported as income, but always check local laws and seek advice to ensure you are compliant.

Yes, you can claim certain rent payments on TurboTax. While typically, personal rent is not deductible, if you are a landlord or you rent out property, you can report your rental income and expenses. Additionally, specific states allow you to deduct rent under their tax codes. Always review your state regulations to understand how much is your rent affecting your taxes.