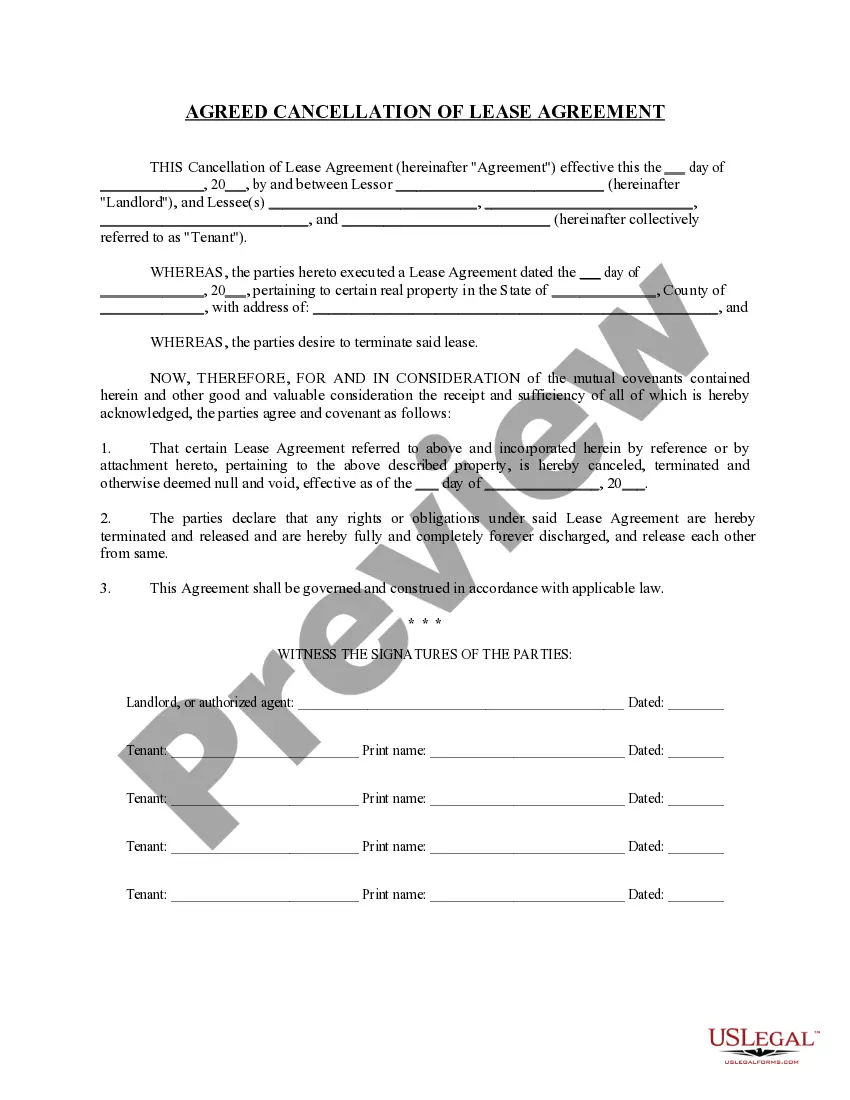

This is a notice provided by the Landlord to Tenant explaining that once the lease term has expired. Tenant has the option of vacating the premises or remaining on the premises provided that they abide by the posted rent increase.

California Tenant Increase Rent Without New Contract

Description

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

Obtaining legal document examples that comply with both federal and local regulations is essential, and the web provides countless alternatives to select from.

However, what is the advantage of spending time hunting for the suitable California Tenant Increase Rent Without New Contract example online when the US Legal Forms digital library already consolidates such templates in a single location.

US Legal Forms is the largest virtual legal repository featuring more than 85,000 editable templates designed by attorneys for various professional and personal situations.

Explore the template using the Preview feature or check the text description to verify it fulfills your requirements.

- They are straightforward to navigate, with all documents sorted by state and intended purpose.

- Our experts stay informed about legislative changes, ensuring that your form is always accurate and compliant when you acquire a California Tenant Increase Rent Without New Contract from our site.

- Acquiring a California Tenant Increase Rent Without New Contract is quick and effortless for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in the desired format.

- If you are a newcomer to our website, follow the steps outlined below.

Form popularity

FAQ

When a one-year lease expires in California, the tenant typically transitions to a month-to-month rental agreement unless the landlord and tenant agree otherwise. The landlord may choose to increase the rent at this time, giving appropriate notice. Understanding these transitions can clarify rights and responsibilities under any California tenant increase rent without new contract scenarios.

These requirements are discussed in detail below. The Settlor must have the Capacity to Create a Trust. ... The Settlor or his Agent Indicates an Intention to Create the Trust. ... The Trust must have a Definite Beneficiary. ... You have to Name a Trustee to Manage the Trust. ... The same Person is not the Sole Trustee and Sole Beneficiary.

A trust is a legal document that protects the assets in your estate. The trust is a legal entity that becomes the legal owner of the property placed into it. You can use it to avoid specific levels of estate taxes and the probate process.

While we recommend that everyone have at least a will (whether or not you also have a trust), trusts aren't strictly necessary for all individuals. Trusts are particularly helpful for individuals who have assets that are potentially going through probate, own property across several states, or have minor children.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.

Creating a living trust in Virginia occurs when you create a written trust document and sign it in the presence of a notary. The trust is not official until you transfer assets into it. A living trust can offer a variety of benefits that may appeal to you. Consider what is best for you.

There is a six-step process for making a living trust in Virginia: Select a type of trust. ... Inventory your assets and property. ... Choose a trustee. ... Put together your trust document. ... Visit a notary public and sign your living trust in front of them. Fund your trust.

To create a living trust in the state of Virginia, you must have a written trust document signed in the presence of a notary. The trust won't be official until you have transferred your assets into it. Living trusts may offer up a variety of benefits that will help you in the long run.