California Increase Rent Withholding

Description

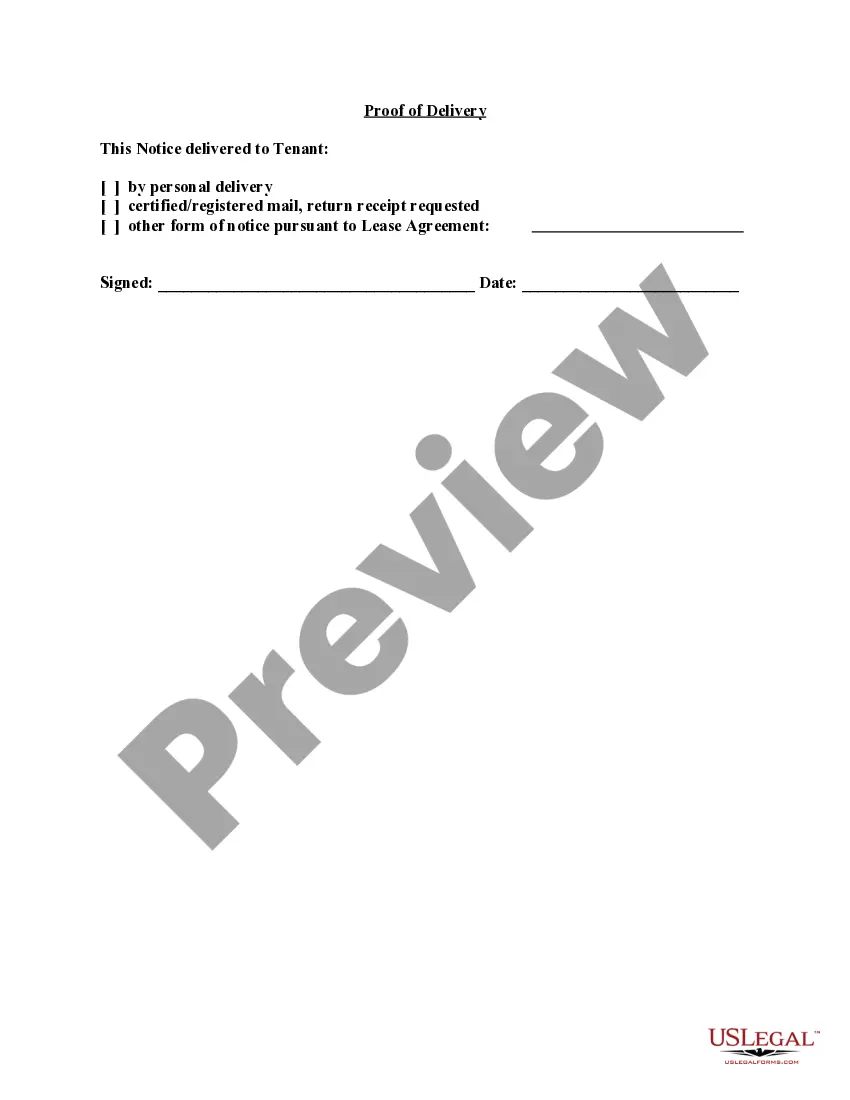

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly acquire the ability to prepare California Increase Rent Withholding without possessing a specialized skill set.

Assembling legal documents is a lengthy endeavor that necessitates particular training and expertise.

Therefore, why not delegate the preparation of the California Increase Rent Withholding to the experts.

You can regain access to your documents from the My documents tab whenever you wish. If you are an existing client, you can easily Log In, and find and download the template from the same tab.

Regardless of your document's intent—whether financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Identify the form you need using the search bar located at the top of the page.

- Preview it (if this feature is available) and review the supporting description to confirm if California Increase Rent Withholding is what you're looking for.

- Initiate your search again if you require a different form.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. Once payment is finalized, you can download the California Increase Rent Withholding, fill it out, print it, and send it to the relevant individuals or organizations.

Form popularity

FAQ

Filling out the DE 4 form in California involves a few straightforward steps. Begin by providing your personal information, like your name and Social Security number, then determine the number of allowances you qualify for based on your financial situation. Follow the instructions for entering additional amounts you wish to withhold. Properly completing this form is essential for managing your taxes while ensuring you stay informed about California increase rent withholding regulations that may affect your budget.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

There are three main situations where a tenant is allowed to lawfully withhold rent in California: If the landlord has failed to repair hazardous conditions in the unit. ... If the landlord has failed to provide essential services. ... If the rental unit is illegal.

In California, when rental property owners increase a tenant's rent more than 10 percent, the owner must provide the tenant with a 60-day advance written notice. For an increase in rent that is greater than 10 percent, owners must provide tenants with at least 60- days' advance notice.

Exemptions. Keep in mind that certain properties are exempt from California rent control law. These types of properties include: Condos and single family-homes not owned by a real estate investment trust (REIT), corporation, or corporation-owned LLC.

During escrow, the remitter would be the REEP as they are the one submitting the payment and Form 593. The remitter is the person who will remit the tax withheld on any disposition from the sale or exchange of CA real estate and file the prescribed forms on the buyer's/transferee's behalf.