Grant Deed For Trust

Description

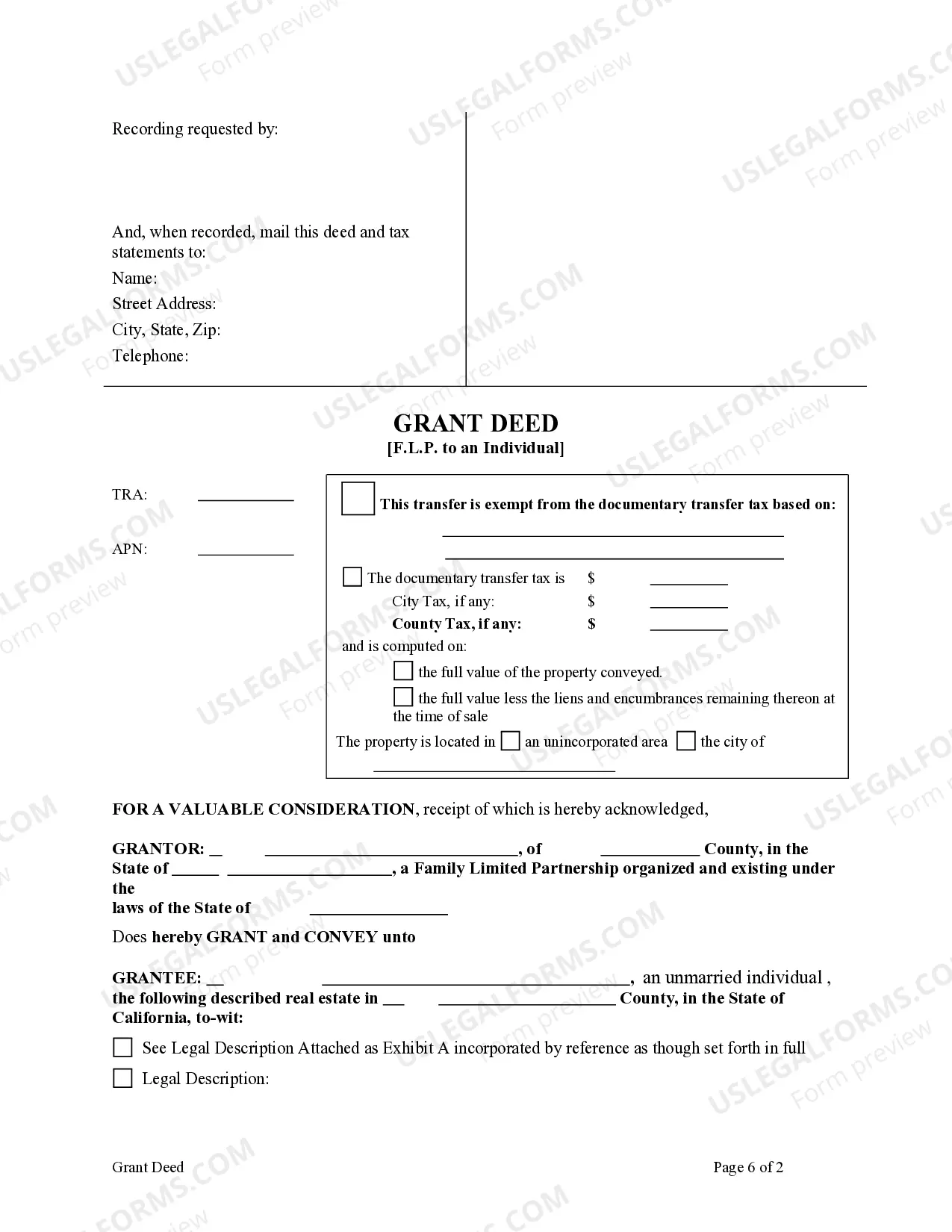

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- If you're a returning user, log in to your account and verify your subscription. Find the grant deed form, then click the Download button to save it on your device.

- For first-time users, start by previewing the grant deed for trust form. Ensure it meets your local jurisdiction requirements by reviewing the description carefully.

- If the current template doesn't fit your needs, leverage the Search tab to find an alternative that aligns with your requirements.

- Once you've selected the correct form, click the Buy Now button to begin the purchase process. Pick a suitable subscription plan, and create an account to access more resources.

- Complete your transaction by entering your credit card or PayPal information to finalize the subscription.

- After purchasing, download the grant deed template to your device. You can access it anytime from the My Forms section of your profile.

With US Legal Forms, you benefit from a comprehensive collection that exceeds competitors in terms of quality and quantity, all while ensuring accuracy in your legal documentation.

Ready to get started with your grant deed for trust? Visit US Legal Forms today and take advantage of our extensive resources!

Form popularity

FAQ

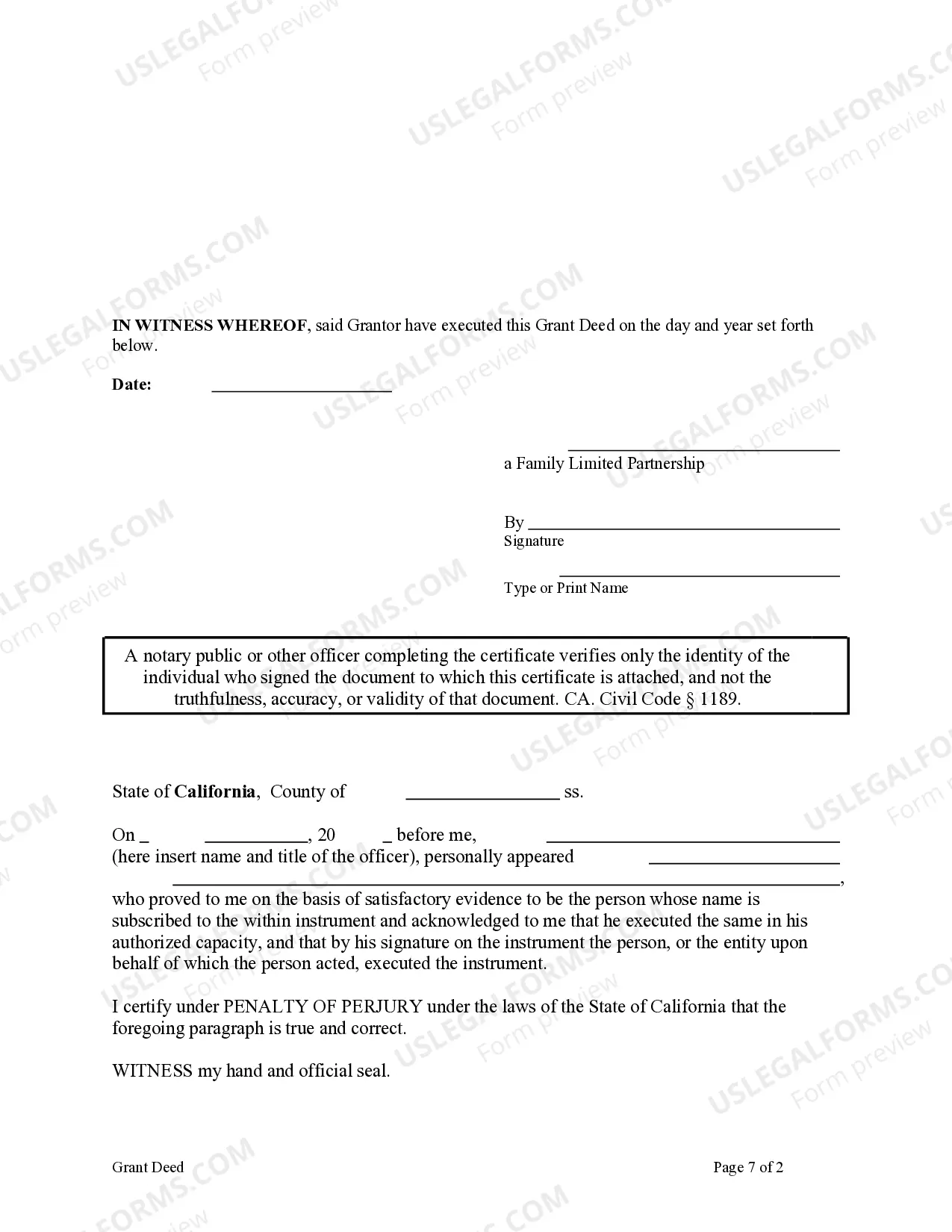

A trustee's grant deed is a specific type of grant deed used when a property is transferred by a trustee, often in the context of a trust. This document indicates that the trustee holds legal title to the property for the benefit of the beneficiaries of the trust. Utilizing a grant deed for trust ensures proper handling of the property in alignment with the trust's terms. This method offers protection and clarity in property management and transfer.

Yes, a grant deed is considered a public record. This means that anyone can access the information contained in the grant deed for trust, such as the names of the parties involved and details about the property. Public access allows for transparency in property transactions, providing security for those involved. You can easily find this information at local county recorder's offices or online databases.

A trustee grant deed involves the trustee transferring property rights on behalf of the trustor to a beneficiary. This type of deed is often used in estate planning and property management to facilitate the smooth transfer of ownership. When considering a grant deed for trust, understanding the trustee’s role can help ensure the transaction aligns with your intentions.

To write a grant deed, start by identifying the parties involved, such as the grantor and the grantee. Include a legal description of the property and any necessary terms. Utilizing a reliable platform like USLegalForms can simplify the process by providing templates tailored for a grant deed for trust.

People often use a deed of trust to secure financing on real estate. It acts as a legal instrument that protects the lender’s interests by placing the property in trust. If you're considering a grant deed for trust setup, a deed of trust simplifies and clarifies the borrower-lender relationship in the transaction.

A notable disadvantage of a deed of trust is the potential risk of losing the property quickly in the event of default. The non-judicial foreclosure process is often faster than traditional methods, which can catch borrowers off guard. Additionally, managing a deed of trust can be complex, so having the right resources can make all the difference. To ensure you understand your rights and obligations, uslegalforms is a valuable tool.

A trust deed is important because it establishes the legal framework for securing loans against real estate. It provides lenders with security and facilitates smooth transactions between buyers and financiers. This documentation minimizes the risk for lenders and allows borrowers to obtain necessary funding. To simplify the creation of these documents, uslegalforms can be a great help.

A deed of trust is commonly used to secure a mortgage on real estate. This legal form creates a lien on the property while the borrower retains ownership. If you’re purchasing a home or refinancing, understanding how a deed of trust works is essential. You can find valuable information and forms on uslegalforms to help you through this process.

One disadvantage of a trust deed is that it can complicate the process of selling property. If the borrower defaults, the lender can initiate a non-judicial foreclosure process, potentially leading to quick dispossession. Additionally, borrowers may face challenges transferring property while the deed of trust remains in effect. To mitigate these issues, utilizing resources from uslegalforms can provide clarity and assistance.

A grant deed is a vital document that serves as proof of ownership in Texas. It ensures that the person named on the deed holds legal title to the property. However, while a grant deed establishes ownership, it's important to confirm that the transfer complies with local regulations. Using uslegalforms can help ensure that your grant deed is complete and valid.