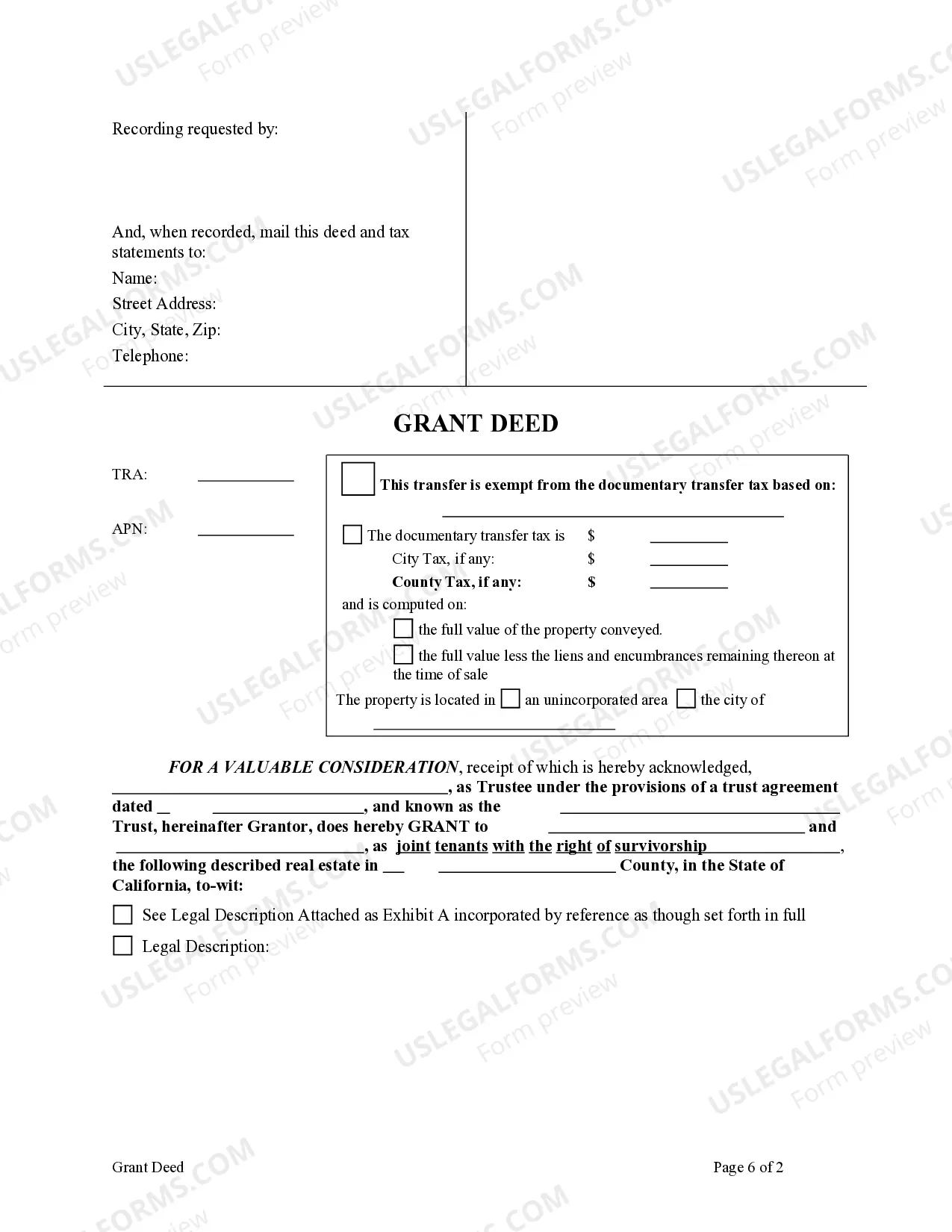

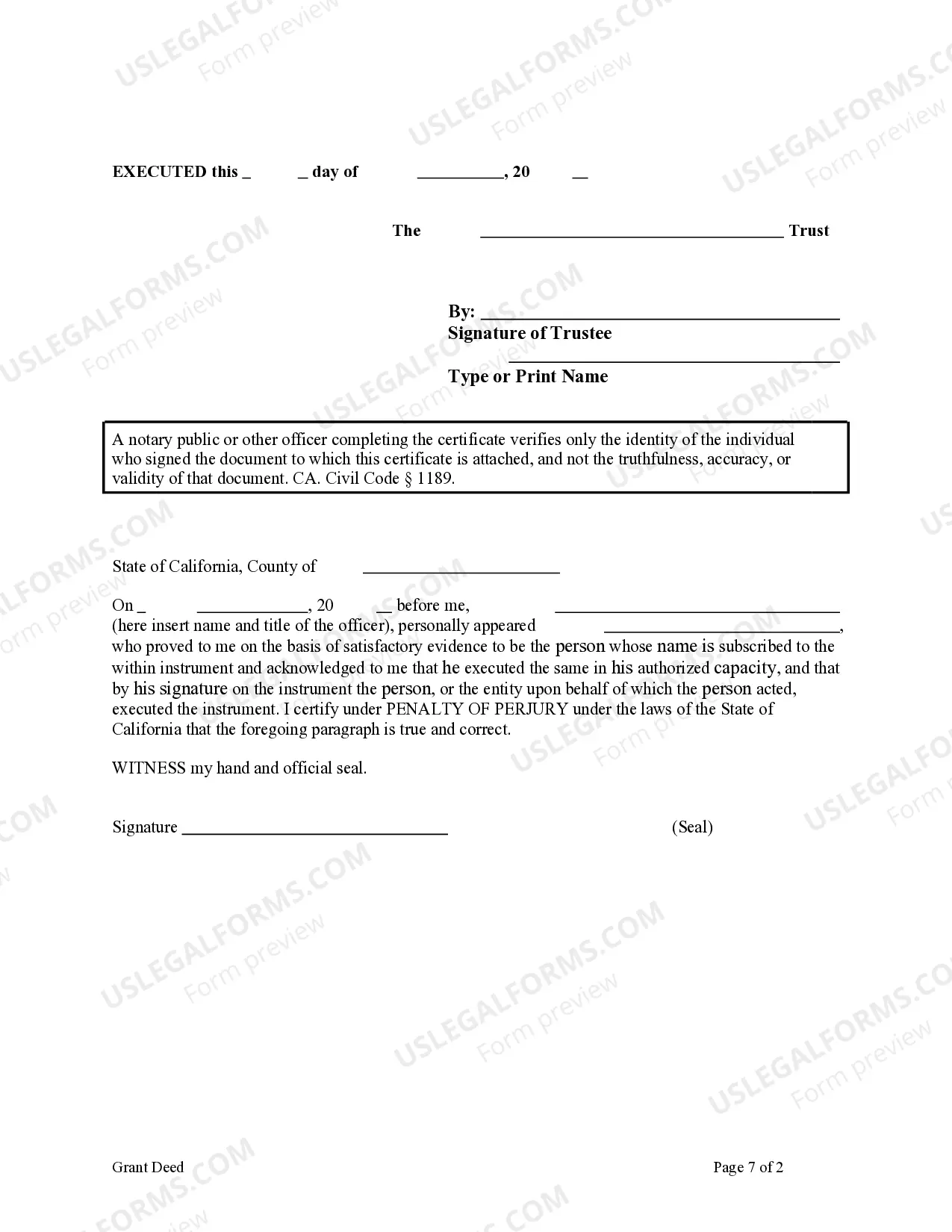

Grant Deed For Living Trust

Description

How to fill out California Grant Deed From Trust To Two Individuals?

- If you're an existing user, log in to your account and download the required form by clicking the Download button. Ensure your subscription is active, or renew it if necessary.

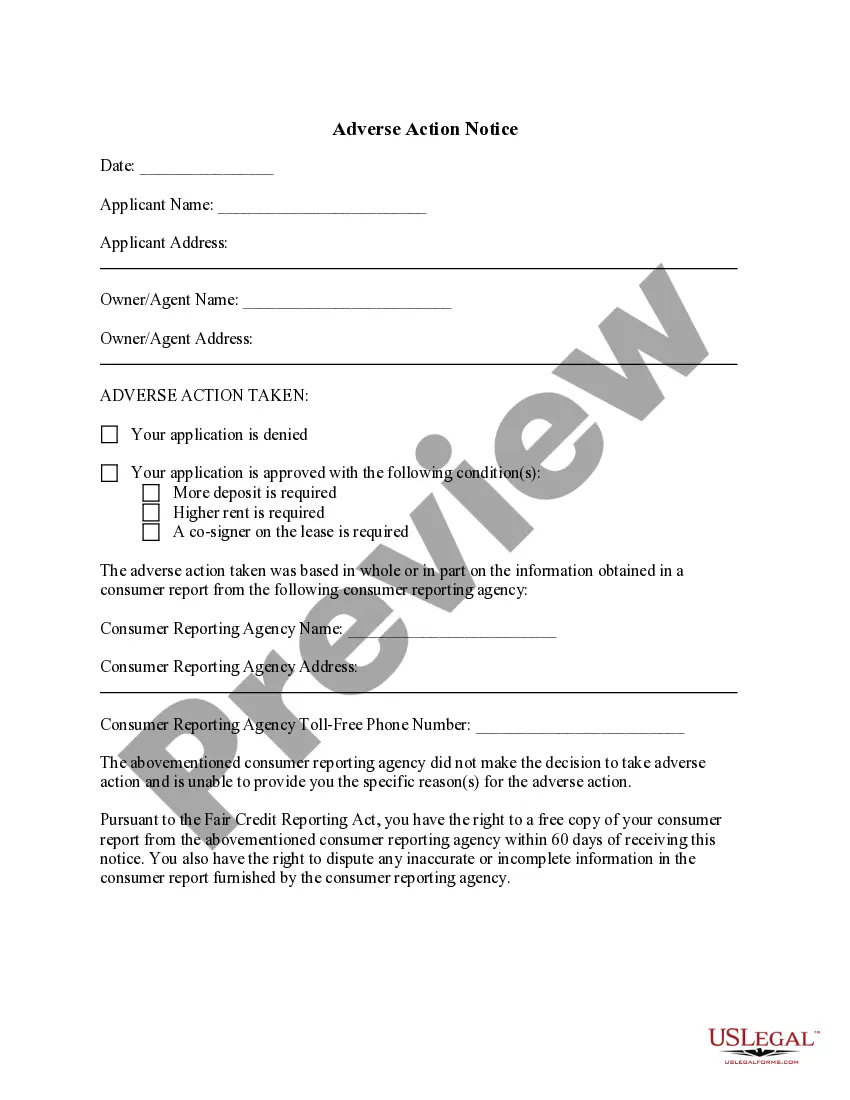

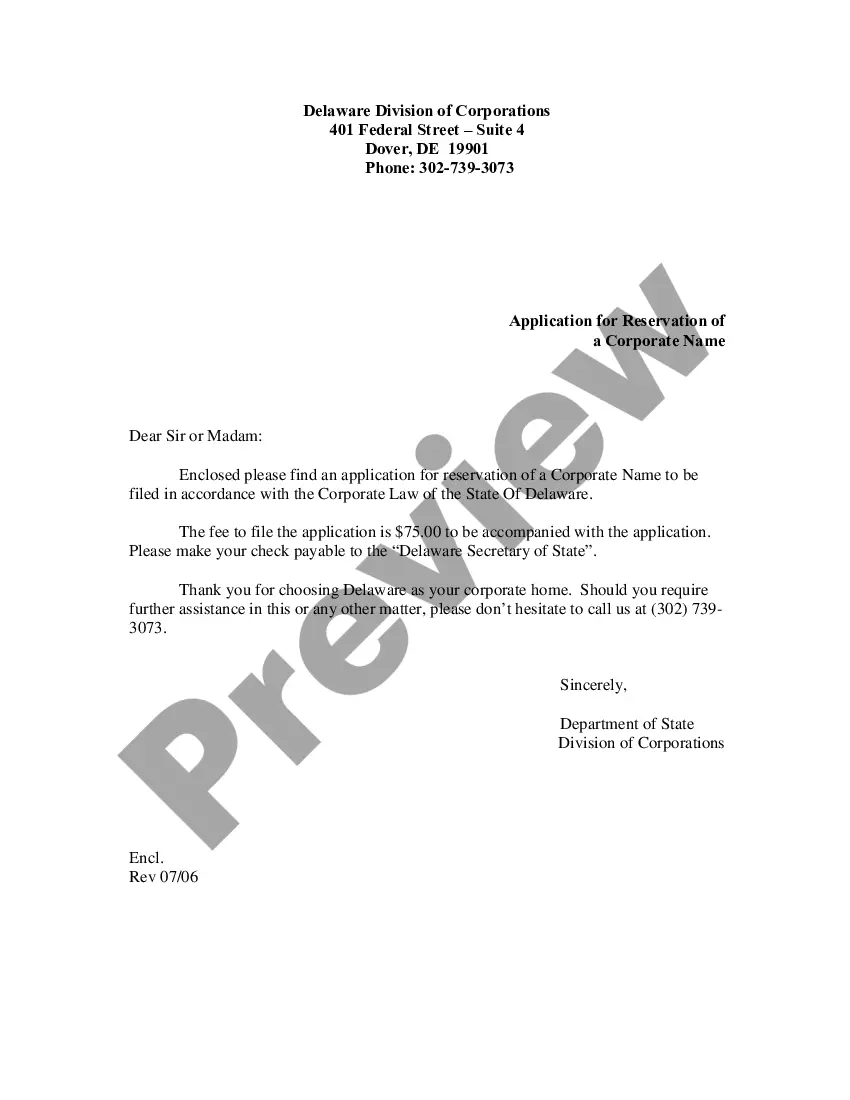

- If this is your first time using US Legal Forms, start by reviewing the Preview mode and form description to select the correct document that meets your jurisdiction requirements.

- Should you need a different template, use the Search tab to find the right one that suits your needs.

- To purchase the document, click on the Buy Now button, select your preferred subscription plan, and create an account to access the extensive resources.

- Complete your purchase by entering your credit card information or utilizing your PayPal account for a seamless transaction.

- After payment, download your form and save it on your device, ensuring you can easily access it from the My Documents menu in your account.

With US Legal Forms, you benefit from a robust collection of forms compared to competitors, along with access to premium experts who can assist you in completing your documents accurately.

Embrace the efficiency and peace of mind that comes with using US Legal Forms. Start today and ensure your legal documents are prepared accurately!

Form popularity

FAQ

The primary downfall of having a trust can be the complexity of administration. Creating a grant deed for living trust requires ongoing management and may involve multiple parties. If not handled properly, it could lead to conflicts or mismanagement of assets. It is essential to have a clear structure and communication among family members.

If your parents want to ensure their assets go to the right beneficiaries without probate hassles, a trust may be beneficial. Utilizing a grant deed for living trust helps streamline the process. However, they should consider their specific circumstances and consult a professional to make an informed decision. A tailored approach is vital for effective estate planning.

One downside to placing assets in a trust is that it could limit access to certain benefits. For instance, some government programs may review trust assets differently. Furthermore, transferring assets may lead to tax consequences. Understanding these implications is essential when executing a grant deed for living trust.

A key disadvantage of a family trust is the potential for high ongoing maintenance costs. While the grant deed for living trust can protect your assets, managing the trust requires time and can involve legal fees. Additionally, if not structured correctly, tax implications can also arise. Families should weigh these factors carefully before proceeding.

One significant mistake parents make is not clearly defining the terms of the trust. They often overlook specifying how the grant deed for living trust will handle assets over time. This can lead to confusion or disputes among heirs. It’s crucial to outline all details explicitly to ensure a smooth transition.

Another name for a grant deed is a warranty deed, which also signifies that the seller guarantees clear title to the property. Both documents provide a level of protection for the buyer by asserting that the seller has the right to sell the property. When addressing a grant deed for living trust, understanding these terms can help ensure that the property is legally and securely transferred.

People put their property in a living trust to simplify the transfer of assets upon their passing and to avoid the probate process. This approach also offers privacy, as the trust does not become a public record like a will does. By utilizing a grant deed for living trust, you secure your property for your heirs without added stress or legal complications, enhancing your estate planning.

A grant deed is a specific type of deed that conveys property ownership while ensuring certain legal protections for the buyer. In contrast, a deed is a general term that refers to any legal document that transfers property ownership. When you consider the grant deed for living trust, you ensure the property is transferred into the trust efficiently, protecting both your interests and those of your beneficiaries.