California Deed Ca With Lien

Description

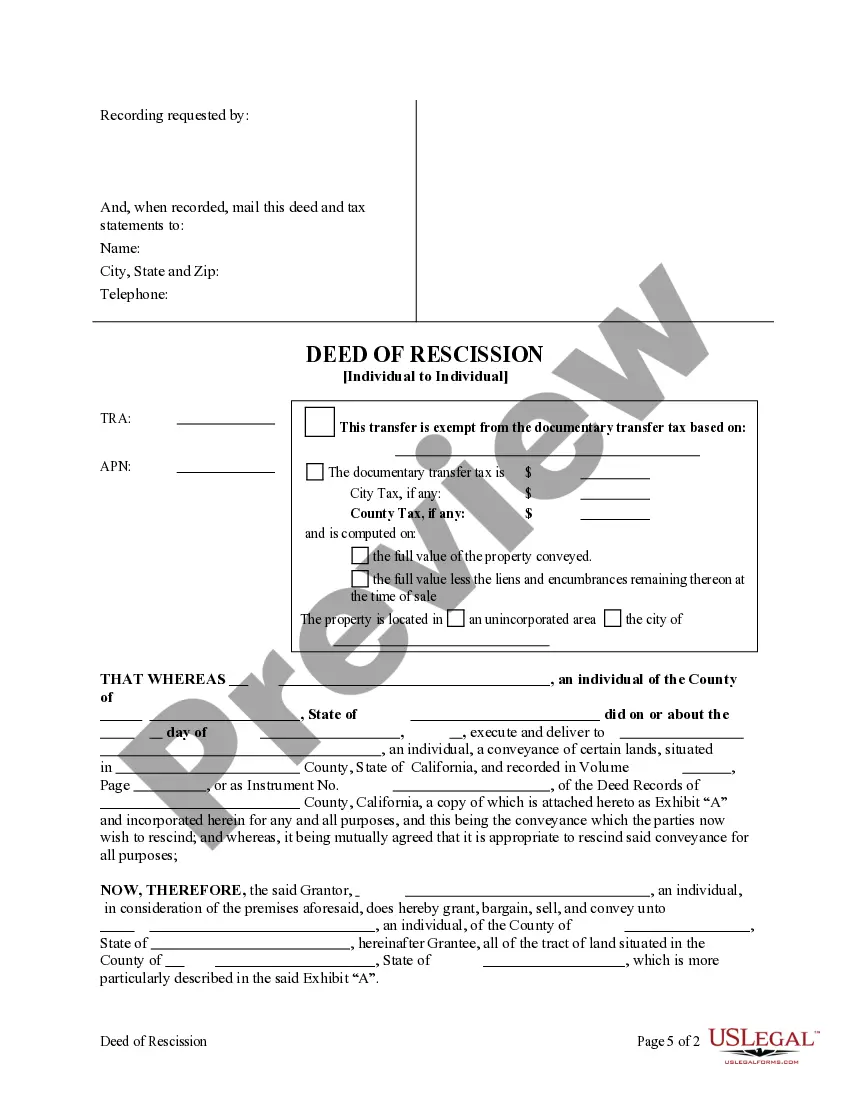

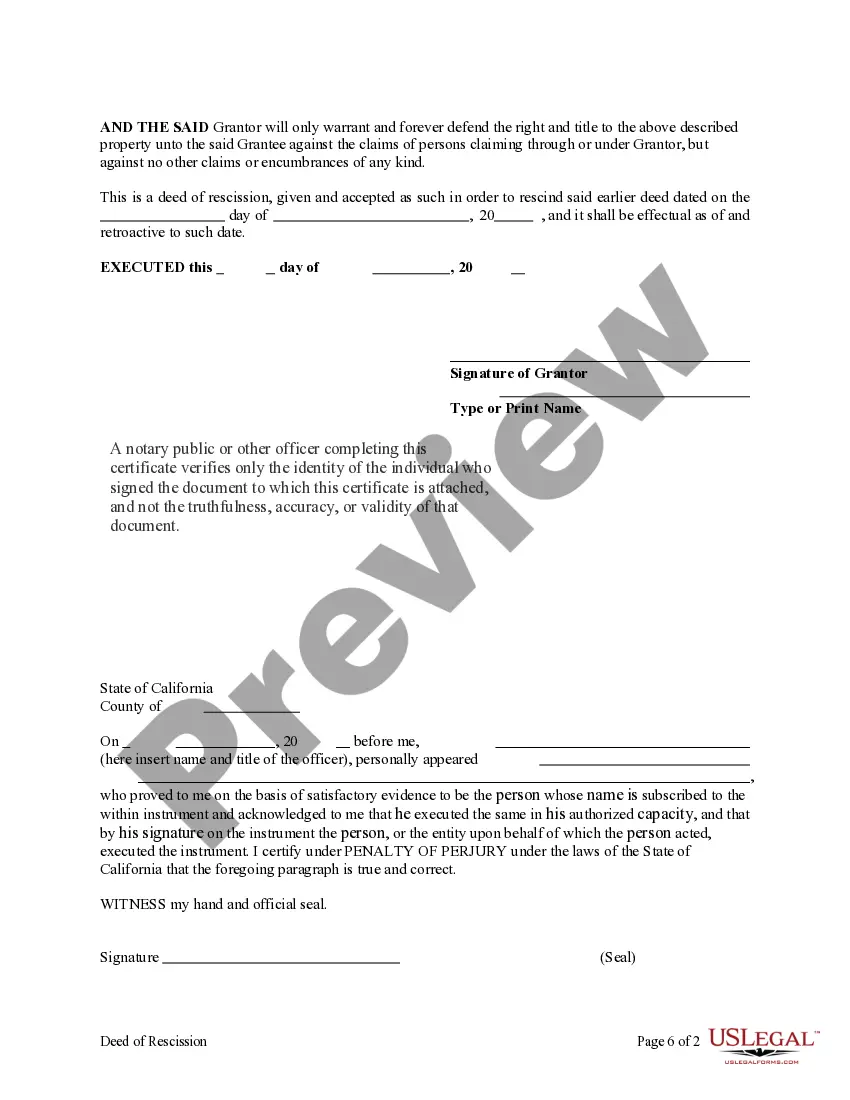

How to fill out California Deed Of Rescission - Individual To Individual?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial expenditures.

If you are looking for a simpler and more affordable method for preparing California Deed Ca With Lien or any other documentation without the hassle, US Legal Forms is always within reach.

Our online library of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

But before jumping right into downloading California Deed Ca With Lien, consider these recommendations: Check the document preview and descriptions to ensure that you are on the correct form you are seeking. Confirm that the template you select meets the regulations of your state and county. Choose the appropriate subscription option to obtain the California Deed Ca With Lien. Download the form. Then, complete, certify, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and transform document completion into a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-specific templates meticulously crafted by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services to efficiently find and download the California Deed Ca With Lien.

- If you are familiar with our services and have previously set up an account with us, simply Log In to your account, select the form, and download it instantly or re-download it anytime from the My documents section.

- Not registered yet? No issue. It takes minimal time to sign up and browse the catalog.

Form popularity

FAQ

Yes, it is possible for a lien to be filed against your property in California without your knowledge. Creditors can file liens based on debts owed, and these filings can happen without notifying the property owner. To safeguard your interests, consider monitoring your property records and understanding California deed ca with lien.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free. The EDGAR database includes several forms that may contain a business's EIN, including the 8-K, 10-K, and 10-Q forms.

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are a.m. - p.m. local time, Monday through Friday.

Unfortunately, looking up your EIN on IRS.gov isn't an option, as there's no EIN lookup tool. Still, that doesn't mean you're entirely out of luck. You can find it on the official IRS notice you received when it was issued, call the IRS directly or locate your EIN on business documents.

If the company is publicly traded and registered with the Securities and Exchange Commission (SEC), you can use the SEC's EDGAR system to look up such a company's EIN for free. You can do an EIN lookup for nonprofit organizations on Guidestar.