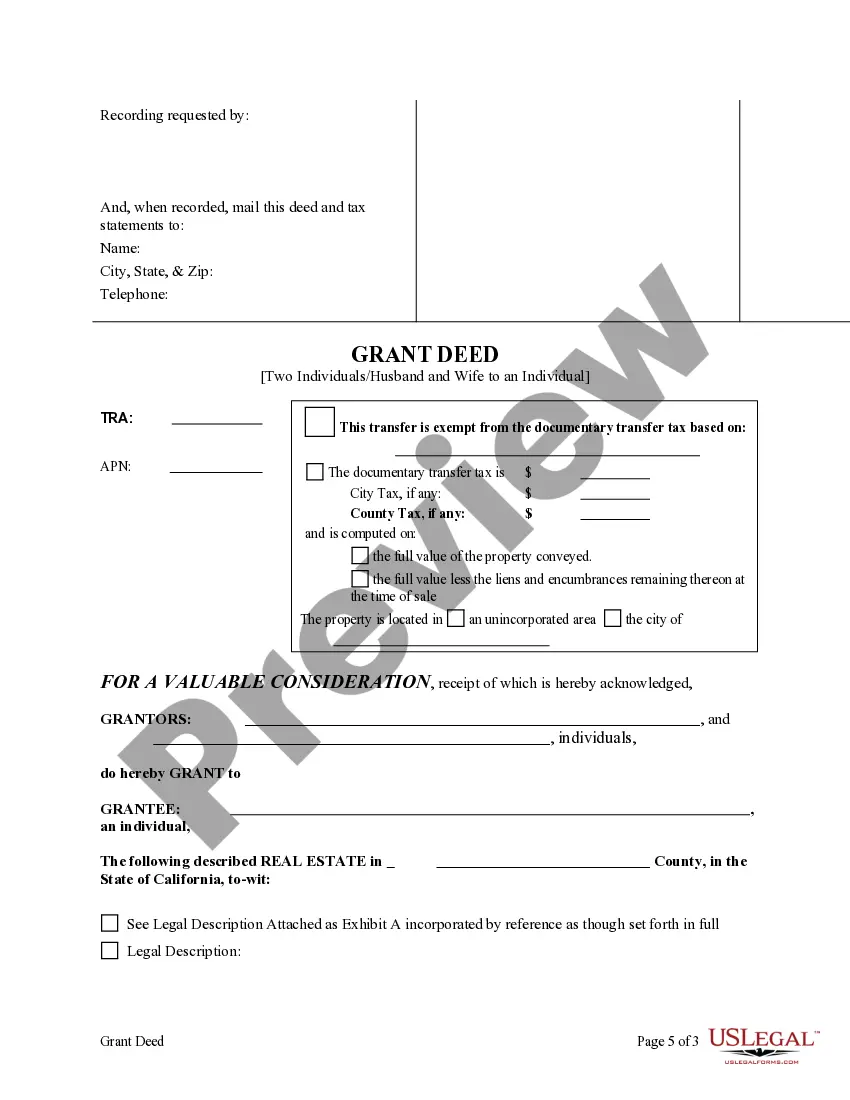

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantee is required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Estate Lady Bird For Sale

Description

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To An Individual?

- Log in to your US Legal Forms account if you are a returning user, or create an account if it’s your first time.

- Check the Preview mode of the estate lady bird form to ensure it's suitable for your jurisdiction and needs.

- If necessary, use the Search tab to find additional templates that meet your requirements.

- Select the Buy Now button on the desired document and choose your preferred subscription plan.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download your form directly to your device, and access it anytime from the My Forms menu in your account.

In conclusion, US Legal Forms offers an extensive collection of legal templates, making it the best resource for acquiring necessary documents like the estate lady bird. With an easy-to-navigate library and expert assistance, crafting legally sound documents has never been simpler.

Start your journey with US Legal Forms today to ensure your estate planning needs are met efficiently!

Form popularity

FAQ

Yes, a lady bird deed generally takes precedence over a will concerning the transfer of property. If the lady bird deed exists, the property transfers automatically upon your death, bypassing any instructions in your will. Thus, it streamlines the transfer process, making the estate lady bird for sale an efficient choice for many property owners.

Whether a trust is better than a lady bird deed depends on your specific situation and goals. A trust can provide more comprehensive asset protection and may shield your property from probate. However, for simple estate transfers and avoiding Medicaid claims, a lady bird deed often suffices. Evaluating your needs in estate lady bird for sale can help you make the right decision.

Currently, several states including Florida, Michigan, and Texas permit the use of lady bird deeds. If you're considering estate planning options, understanding which states recognize this deed is crucial. Not all states offer the same legal protections or advantages, so checking local laws is essential for your planning. Platforms like uslegalforms can guide you in navigating these state-specific regulations.

A common problem with lady bird deeds is that they may not be recognized in every state, leading to confusion or complications. Furthermore, improper execution can render the deed invalid, which could create issues for your heirs. It is important to ensure correct drafting and execution, which is where platforms like uslegalforms can help simplify the process of estate lady bird for sale.

One downside of a lady bird deed involves potential property tax implications. If the value of the home rises significantly, your heirs could face a higher tax burden when they inherit the property. Additionally, a lady bird deed does not prevent challenges from creditors after your death. Exploring the estate lady bird for sale can help clarify these concerns.

No, having a lady bird deed offers some protection against Medicaid's claim on your house. When you have a lady bird deed, you retain complete control over the property during your lifetime. Therefore, even if you apply for Medicaid, the house is not counted as an asset. This feature makes the estate lady bird for sale an appealing option for many.

Yes, a lady bird deed typically overrides any conflicting provisions in a will concerning the property it covers. This means that if a will states differently, the lady bird deed will take precedence upon the owner's death. Understanding how an estate lady bird for sale interacts with your will can help you avoid disputes and ensure your intentions are clear.

The lady bird deed itself does not directly avoid inheritance tax; beneficiaries may still be responsible for any owed taxes on the estate. However, the deed does facilitate a quicker transition of ownership, which can be beneficial in managing the estate. For clarity on this issue, resources on the estate lady bird for sale, like those at USLegalForms, can offer valuable insights.

One potential downside of a lady bird deed is that it may not provide the same level of control over the property during the owner's lifetime, as it transfers certain rights to the beneficiary. Additionally, should the property increase significantly in value, capital gains tax could affect the beneficiary upon transfer. Understanding these implications can help you make more informed decisions about the estate lady bird for sale in your planning.

A lady bird deed may not directly avoid inheritance tax, as tax laws vary by state. However, since the transfer occurs outside of probate, it can simplify estate management and potentially reduce overall taxation. For specific guidance, consult resources like USLegalForms, which provide information on estate planning strategies, including those related to an estate lady bird for sale.