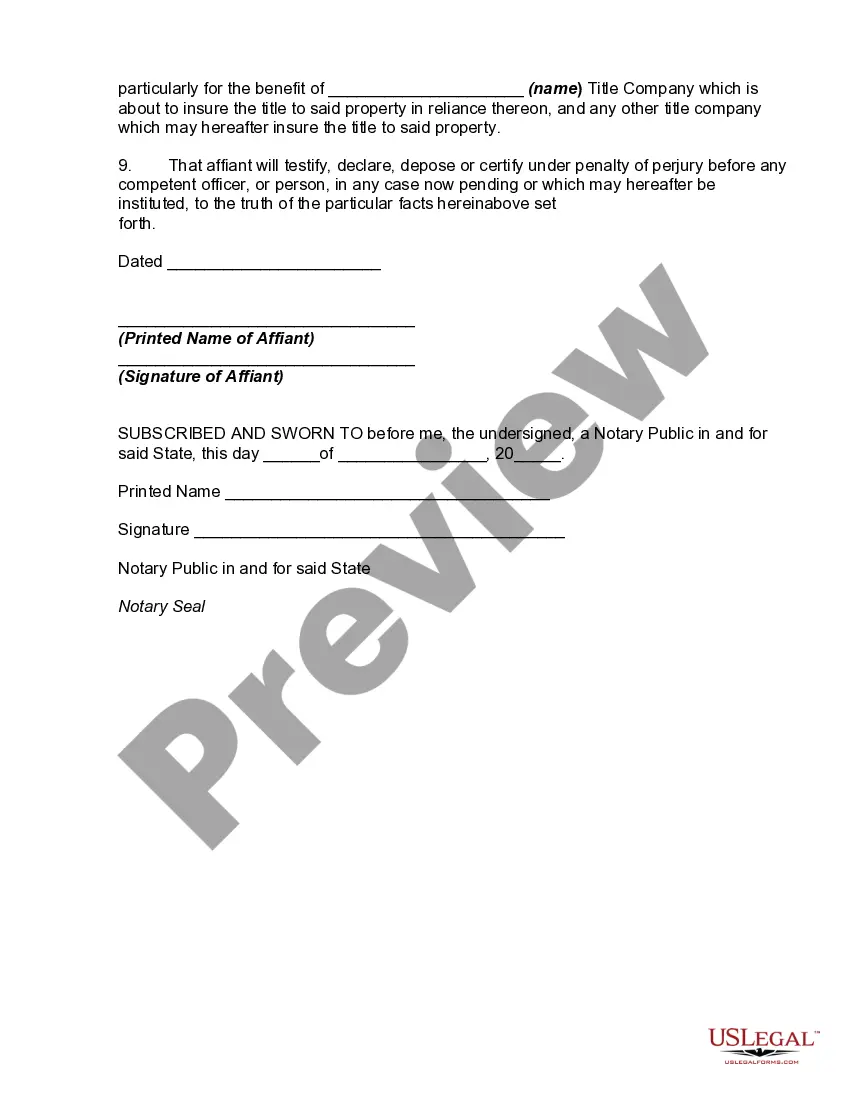

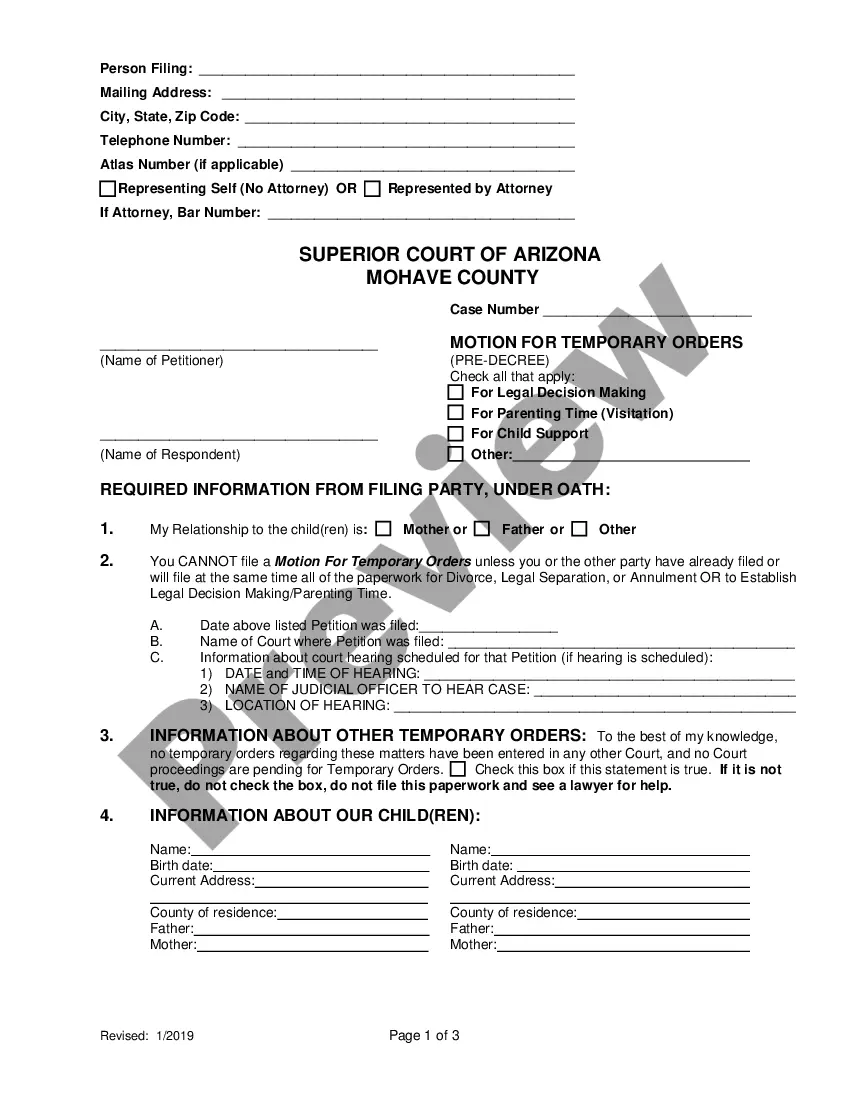

Estoppel By Deed

Description

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

Utilizing legal templates that comply with federal and state laws is crucial, and the internet provides numerous choices to select from.

However, what’s the purpose of squandering time searching for the accurately composed Estoppel By Deed example online when the US Legal Forms online library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for all kinds of business and personal situations.

Review the template using the Preview function or through the text outline to confirm it satisfies your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring your documents are consistently current and compliant when obtaining an Estoppel By Deed from our platform.

- Acquiring an Estoppel By Deed is quick and straightforward for both existing and new members.

- If you possess an account with an active subscription, Log In and retrieve the document sample you need in the desired format.

- If you are a newcomer to our site, follow the instructions below.

Form popularity

FAQ

Minnesota's Social Security subtraction Taxpayers may subtract a portion of their taxable benefits, up to a maximum established in law. In tax year 2023 the maximum subtraction is $5,840 for married taxpayers filing joint returns and $4,560 for single taxpayers.

The aircraft must be located in a different state when the bill of sale is filed with the Federal Aviation Administration and title (and funds) changes hands from seller to buyer. Ensuring delivery outside of California also ensures that California sales tax is not assessable on the purchase of the aircraft.

This means you may pay a percentage of your overall charges for air transportation, currently set at 7.5% of the cost (6.25% if only shipping cargo ? no passengers). There is also a segment fee of $4.20 per passenger for domestic travel and a headcount tax for each passenger traveling internationally as well.

An aircraft owned by a nonresident of Florida is exempt from use tax if the aircraft enters and remains in Florida exclusively for flight training, repairs, alterations, refitting, or modifications. The days the aircraft remains in Florida for these purposes are not included in the nonresident's 20-day period.

This law generally applies a tax of up to 10% of the value of certain passenger aircraft and automobiles having a value of over $100,000, and boats having a value of over $250,000, upon the sale, importations and leases of such vehicles, unless a specific exemption applies under the law.

20% of the amount of the total sale price in excess of $100,000 for subject vehicles and subject aircraft and in excess of $250,000 for subject boats. 10% of the total sale price.

Only a portion of Social Security benefits is subject to Minnesota income taxes. The exclusion from tax is the result of two separate policies?the federal exclusion from gross income for a portion of Social Security benefits, and the Minnesota Social Security Subtraction.

Check and Direct Deposit Payments We may still mail a paper check in some cases to ensure you receive the payment, such as: If a direct deposit is returned due to a banking error or incorrect bank account information.