California Gift Deed With Reservation

Description

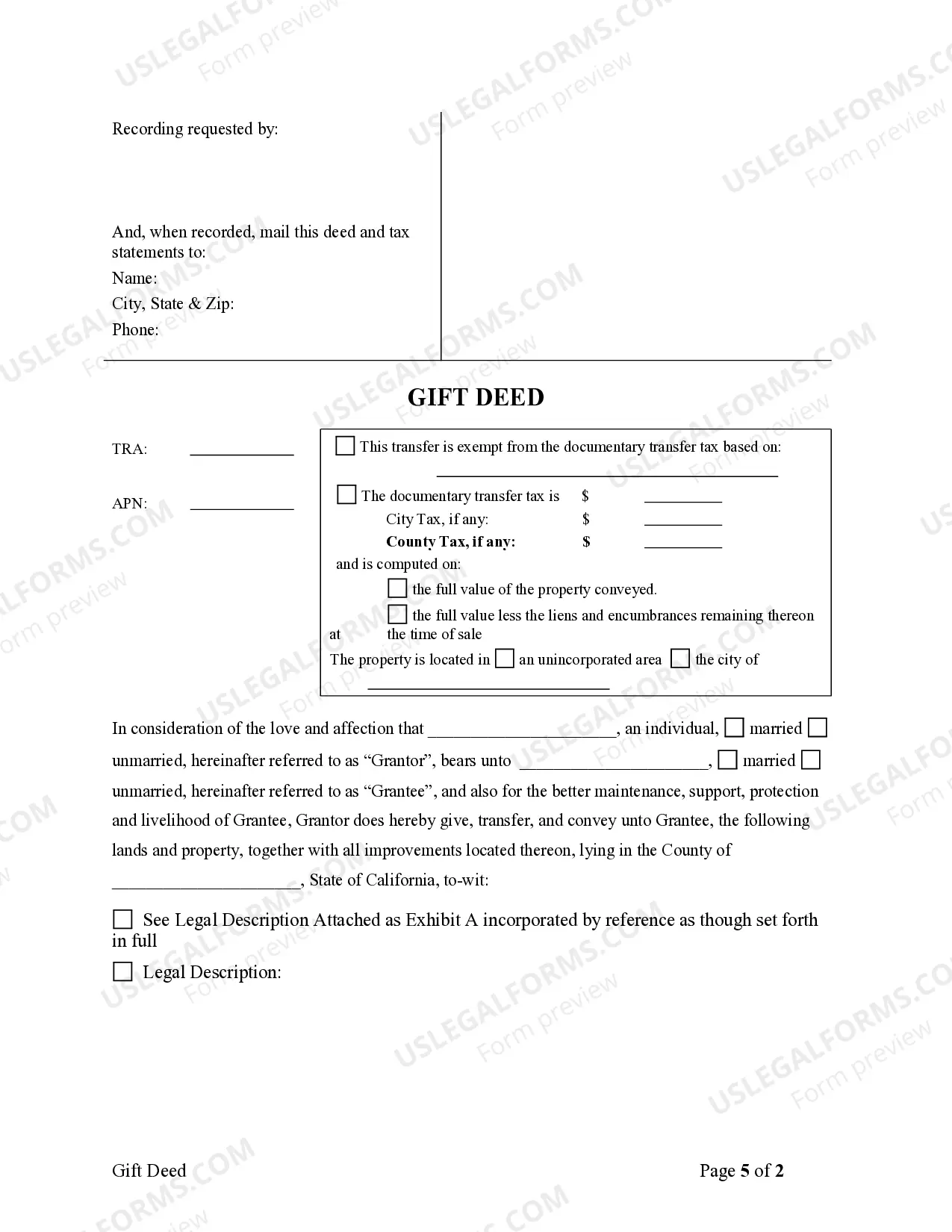

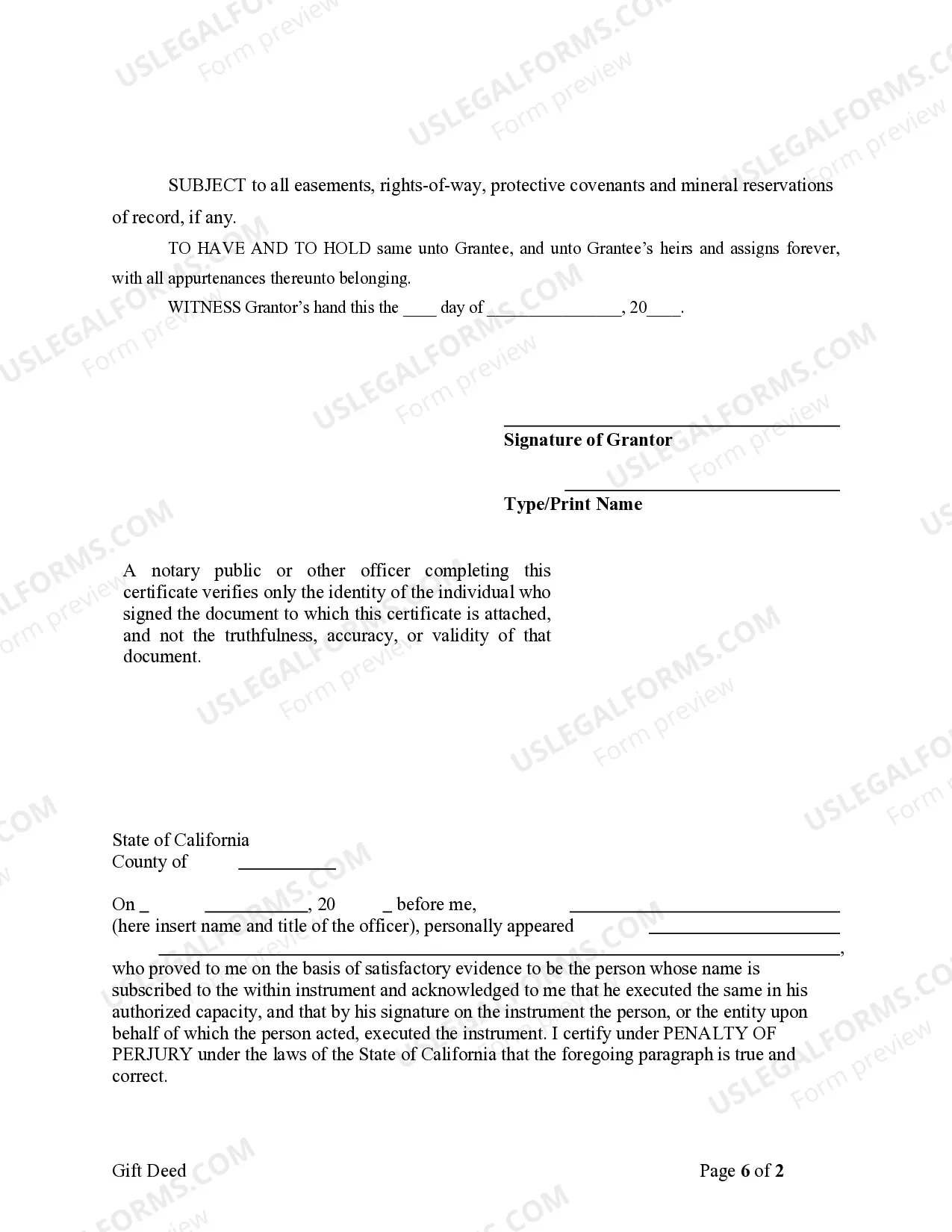

How to fill out California Gift Deed For Individual To Individual?

Accessing legal templates that comply with federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the appropriate California Gift Deed With Reservation sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal scenario. They are easy to browse with all papers collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when obtaining a California Gift Deed With Reservation from our website.

Getting a California Gift Deed With Reservation is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the steps below:

- Examine the template utilizing the Preview option or via the text outline to make certain it meets your needs.

- Locate another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your California Gift Deed With Reservation and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Most documents are recorded within two (2) business days of receipt of the document. The average turnaround time for a document submitted for recording is 30 days.

Gift Deed ? A gift deed is a special type of grant deed that ?gifts? ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

To transfer ownership, disclaim ownership, or add someone to title, you will choose between a ?grant deed? and a ?quitclaim deed.? Spouses/domestic partners transferring property between each other may choose an ?interspousal deed.? Blank deeds are available at saclaw.org/forms.

A property can be gifted during the owner's lifetime, or written into an estate plan to transfer the property upon the owner's death. Title can change hands with some routine paperwork and filings with the county recorder's office.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.