Trust Transfer Deed Without Consideration

Description

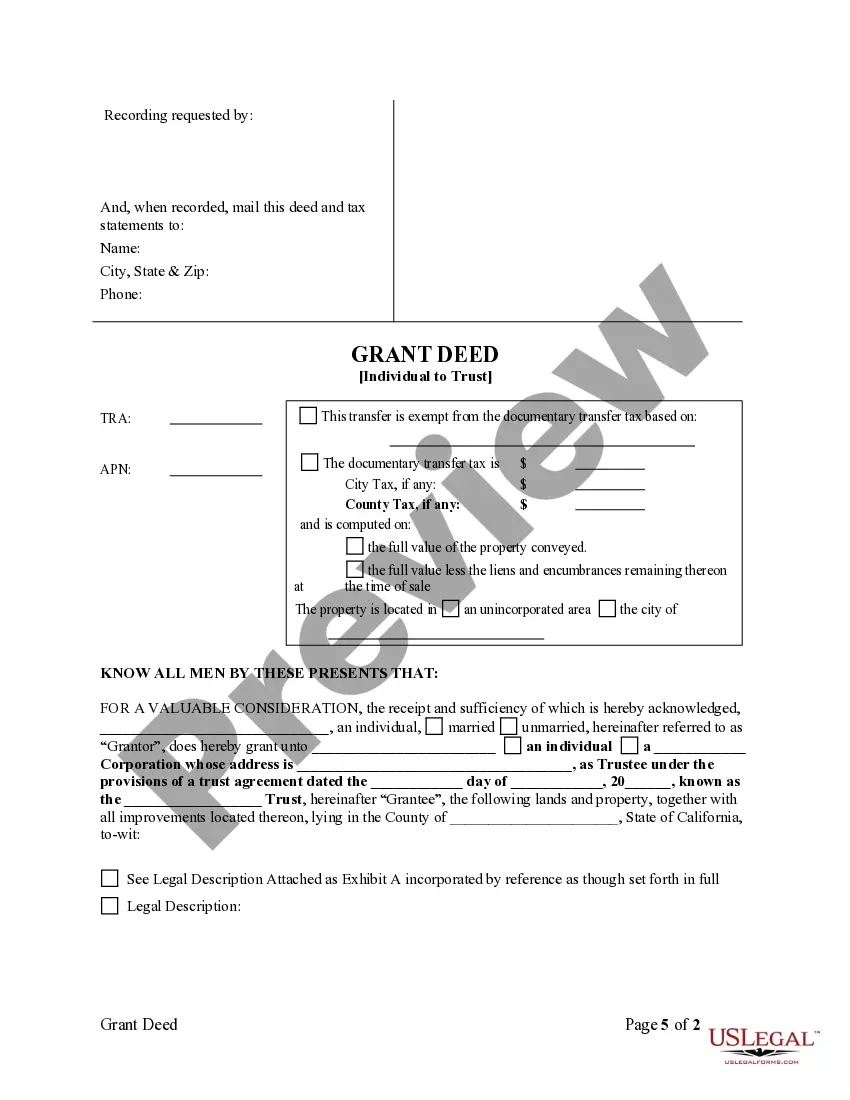

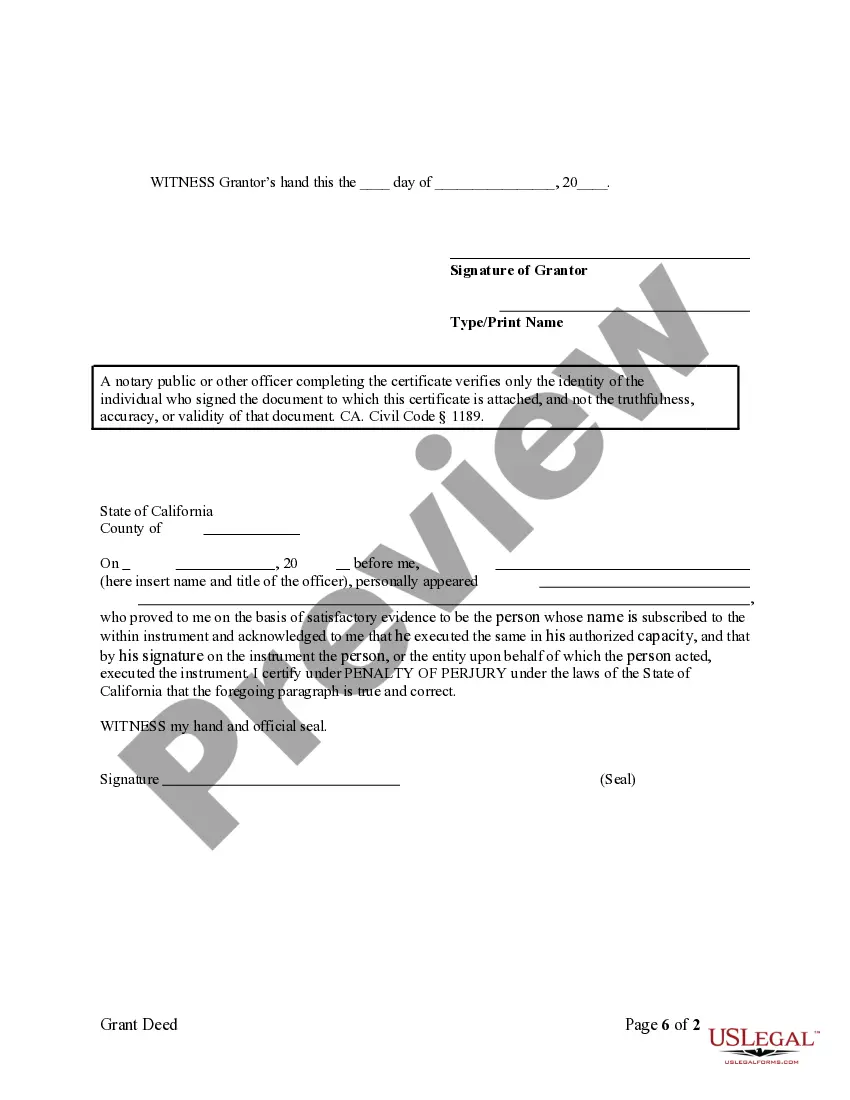

How to fill out California Grant Deed From Individual To Trust?

Locating a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to obtain samples of Trust Transfer Deed Without Consideration solely from reputable providers, such as US Legal Forms.

After downloading the form to your device, you can modify it using the editor or print it to complete it manually. Eliminate the challenges associated with your legal documentation. Explore the comprehensive US Legal Forms library to find legal samples, evaluate their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Examine the form’s details to ensure it aligns with the requirements of your state and locale.

- Check the form preview, if available, to confirm the template is indeed the one you seek.

- Return to the search if the Trust Transfer Deed Without Consideration does not meet your criteria.

- If you are confident about the form’s applicability, proceed to download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you have yet to create an account, click Buy now to obtain the template.

- Select the pricing package that fits your needs.

- Continue to the registration process to complete your purchase.

- Finalize your order by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Trust Transfer Deed Without Consideration.

Form popularity

FAQ

As a matter of contract law, a deed must have consideration to be valid. Consideration is defined as something of value given for the deed. Usually the consideration is money, but it could be for services or anything of value.

Voluntary conveyance refers to an elective transfer of title from one individual to another without adequate consideration. Consideration refers to compensation which is expected in return for the property. Without it, the conveyor should be prepared to offer a legal explanation for the transfer.

This is on the condition that no other chargeable consideration is given. If you get property as a gift, you won't pay Stamp Duty Land Tax as long as there's no outstanding mortgage on it. Do I need to pay tax or stamp duty on gifting a property to a family member? taxcare.org.uk ? do-i-need-to-pay-tax-or-stamp-d... taxcare.org.uk ? do-i-need-to-pay-tax-or-stamp-d...

The recorded Deed is public knowledge, so by using the language of "Ten Dollars, and other good and valuable considerations" we effectively can limit the knowledge of prying eyes as to how much you just bought or sold a house for.

When someone says ?no consideration? deed, what does it mean? Does it mean no transfer and recordation taxes? No. It actually means that the property is being transferred via deed without money exchanging hands.