Trust Transfer Deed Form California

Description

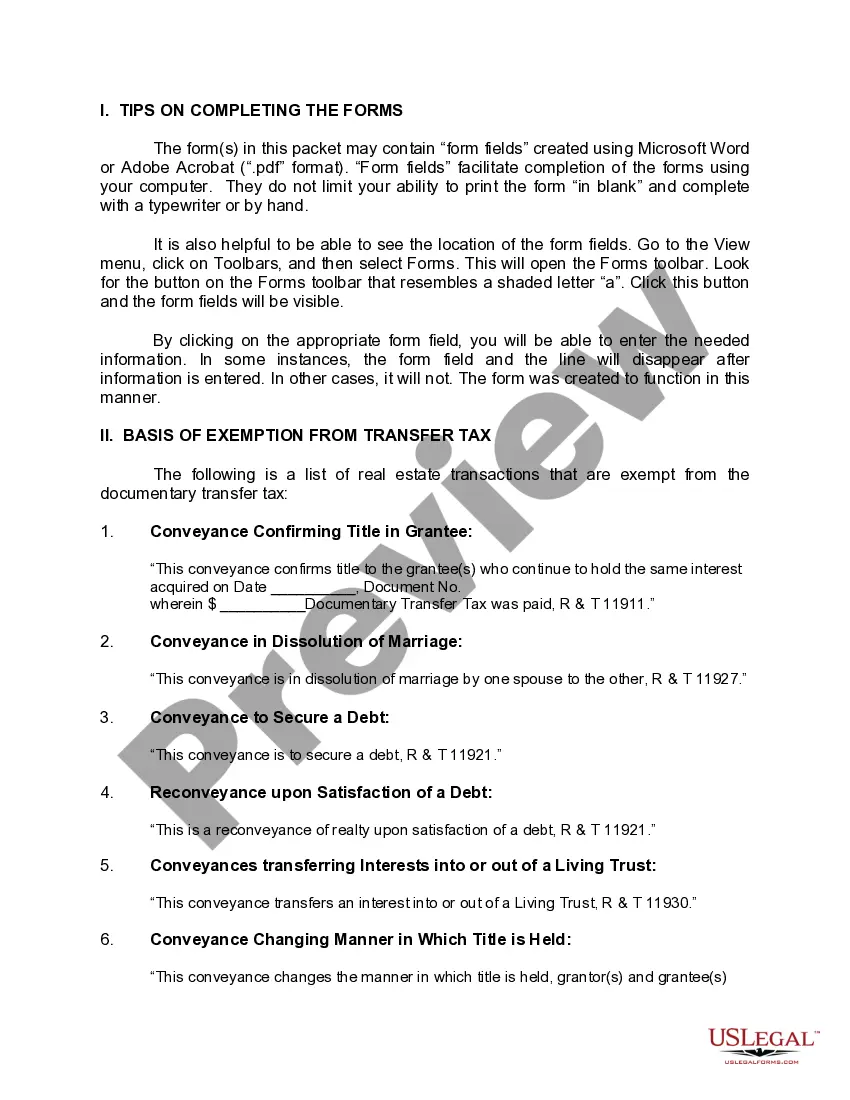

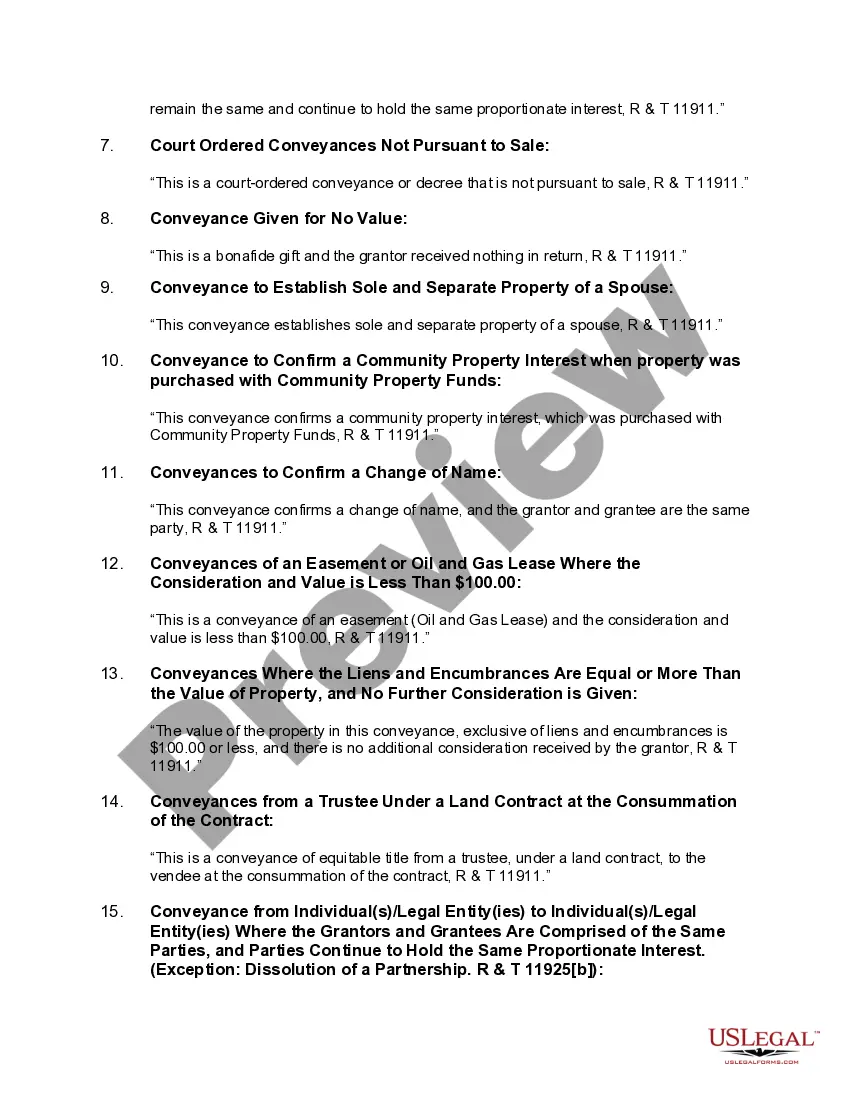

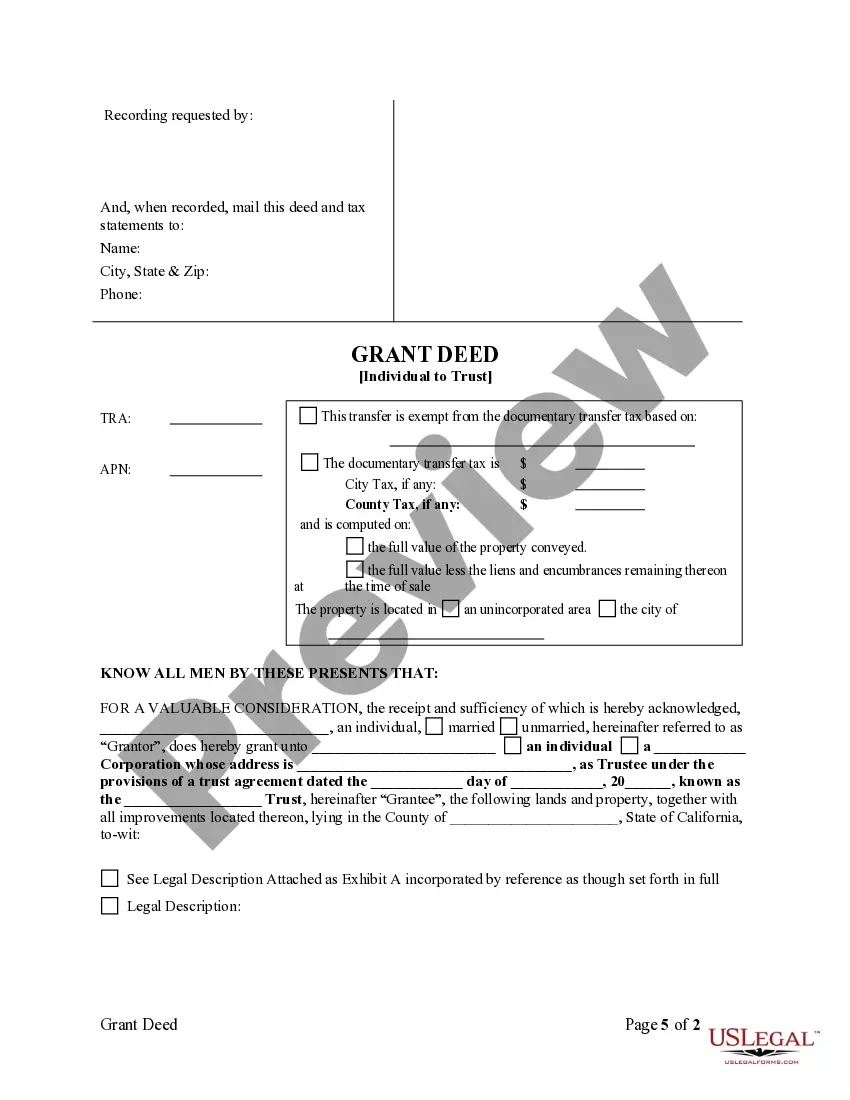

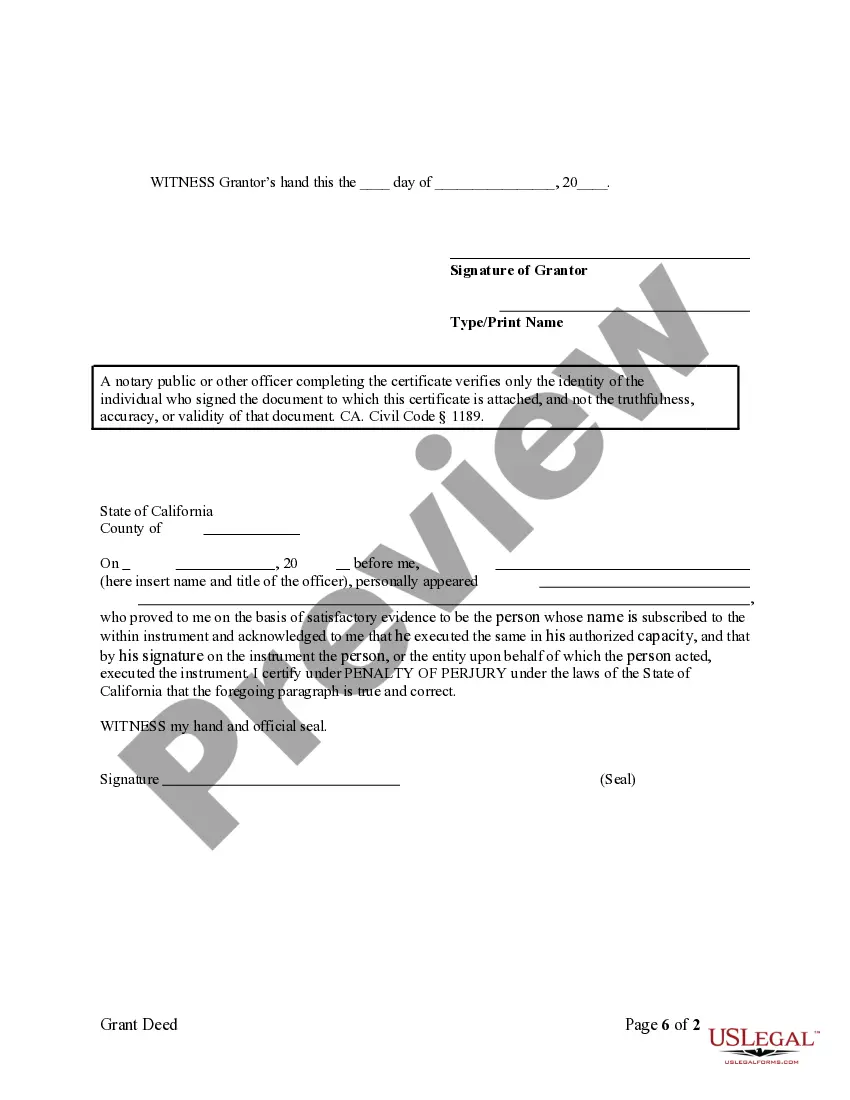

How to fill out California Grant Deed From Individual To Trust?

Legal documentation management can be daunting, even for the most experienced individuals.

When you are looking for a Trust Transfer Deed Form California and lack the time to search for the correct and current version, the process can be overwhelming.

Gain entry to a reservoir of articles, guides, and resources related to your circumstances and requirements.

Save time and energy searching for the documents you require, and utilize the advanced search and Review tool from US Legal Forms to locate the Trust Transfer Deed Form California and acquire it.

Ensure that the template is recognized in your state or county.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to review the documents you have saved and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the platform’s benefits.

- Here are the actions to take after downloading the necessary form.

- Confirm this is the right form by previewing it and reviewing its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your requirements, from personal to commercial paperwork, in one location.

- Employ sophisticated tools to fill out and manage your Trust Transfer Deed Form California.

Form popularity

FAQ

Hear this out loud PauseFile your lien with the county recorder File your lien claim with the recorder's office in the Utah county where the property is located, and pay the recording fee. Here's a full list of Utah recorder's offices that you can use to find contact information, fees, and recording requirements.

Hear this out loud PauseUniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

The Utah Division of Corporations & Commercial Code is the central filing office for financing statements and other documents provided under the Uniform Commercial Code. The intent of filings is to "perfect" or preserve security interest in named collateral.

Hear this out loud PauseEntities that have an interest in a Section 202 and/or Section 811 property must file a UCC as part of the closing process and every five years thereafter.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Hear this out loud PauseOur mailing address is 160 East 300 South, P.O. Box 146705, Salt Lake City UT, 84114-6705.

1 filing is good for five years. After five years, it is considered lapsed and no longer valid.

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.