Limited Liability Partnership For

Description

Form popularity

FAQ

The difference between a limited liability partnership and a general partnership primarily lies in liability protection. In a general partnership, all partners are personally liable for business debts, exposing their assets to risk. However, a limited liability partnership for offers protection, ensuring that individual partners are not personally liable for the LLP's obligations. This key distinction makes LLPs particularly attractive for professionals looking to collaborate without exposing themselves to additional risk.

The main feature of a limited partnership is its combination of general partners who manage the business with unlimited liability and limited partners who have liability protection. This dual structure enhances fundraising opportunities while providing a safety net for those who wish to invest without full involvement. It also fosters collaboration and shared expertise among partners. To navigate this arrangement smoothly, consider utilizing US Legal Forms.

In a limited partnership, the role of the general partner is to manage daily operations while bearing unlimited liability, whereas limited partners play a more passive role with liability limited to their contributions. This dynamic encourages a clear division of responsibilities and liabilities in the business. The structure is particularly useful for attracting investors, as they can enjoy profit-sharing without significant risk. Use US Legal Forms to streamline the formation of a limited partnership.

The purpose of a limited partnership revolves around fostering joint ventures with a blend of risk management and investment opportunities. This setup allows for active partners to run the business and limited partners to invest without risking personal assets beyond their investments. Essentially, it provides a balanced approach to entrepreneurship. If this model interests you, consider forming a limited partnership for efficiency and effectiveness.

The main purpose of a limited partnership is to engage in business while limiting the liability of certain partners. In a limited partnership, one or more partners manage the business and have unlimited liability, while limited partners contribute capital but have liability restricted to their investment. This structure helps raise funds while providing some liability protections for investors. If you are considering this option, US Legal Forms can assist with the necessary paperwork.

A limited liability partnership and a limited company differ in structure and operation. An LLP provides a flexible partnership framework with personal liability protection for its partners, while a limited company (LTD) is a separate legal entity that holds its own assets and liabilities. Choosing a limited liability partnership for your business allows you to maintain some partnership dynamics while enjoying liability benefits. Understanding these differences can help you make informed decisions about your business structure.

The primary purpose of a limited liability partnership is to combine the collaborative benefits of a traditional partnership with the legal protections of a corporation. With an LLP, partners enjoy liability protection, safeguarding their personal assets from business debts. This structure allows professionals to work together while minimizing risks, making it an appealing choice for many. Explore options for forming a limited liability partnership for your business with US Legal Forms.

When considering a limited liability partnership for your business, it often comes down to the level of liability protection you want. A partnership generally offers shared responsibilities but exposes all partners to personal liability. On the other hand, a limited liability partnership for protects individual partners from being personally liable for the LLP's debts or misconduct of other partners. Thus, many choose an LLP for its distinct benefits in liability protection.

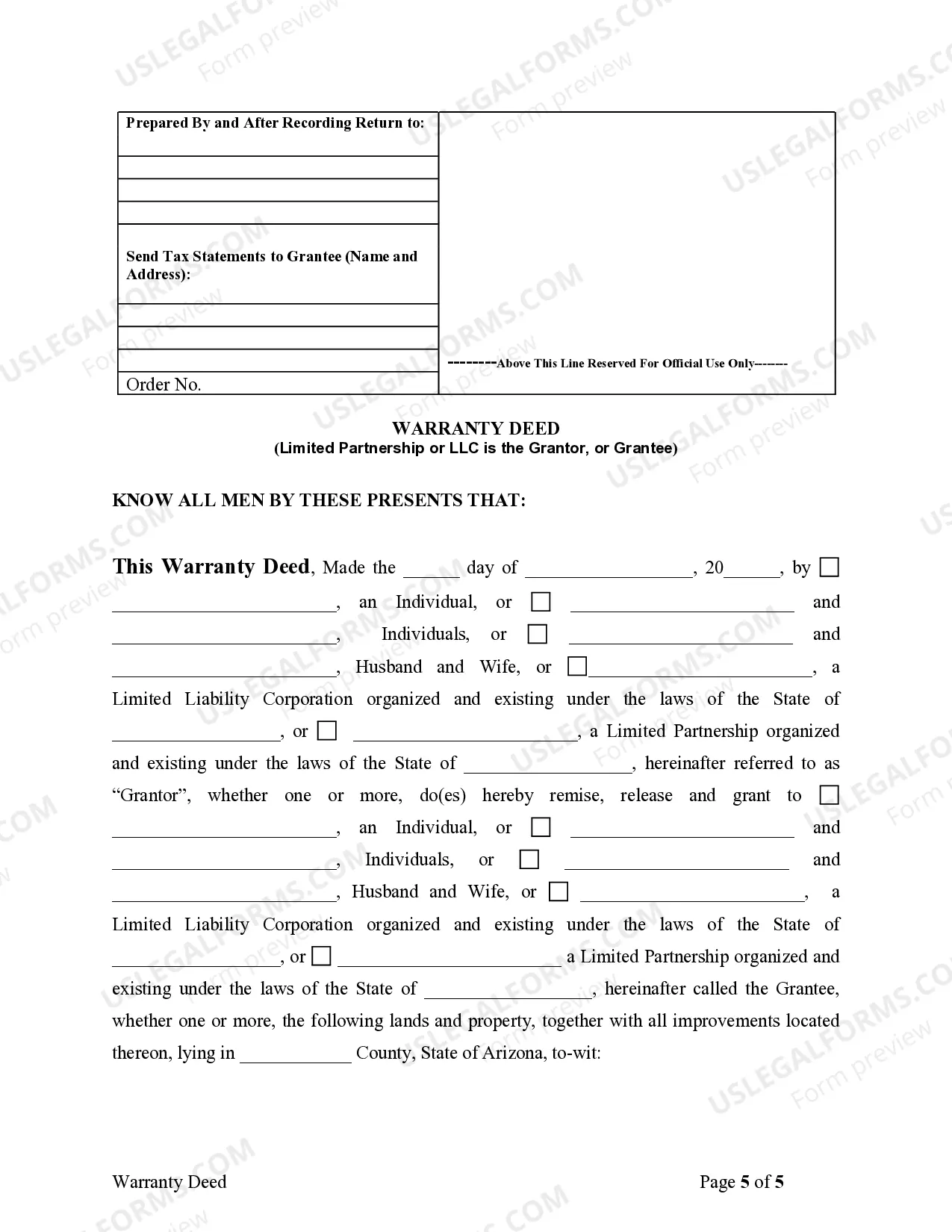

Forming a limited liability partnership involves several steps. First, create an LLP agreement that outlines the structure and operation of the partnership. Next, register the partnership with the appropriate state entity by submitting the required forms. Using US Legal Forms can help you navigate these requirements and get your limited liability partnership for business up and running successfully.

Filling out an LLP form requires careful attention to detail. Begin by providing essential information about your partnership, such as its name, business address, and the identities of all partners. Using clear headings and consistent formats can guide your completion. For convenience, you can also check the user-friendly templates available at US Legal Forms.