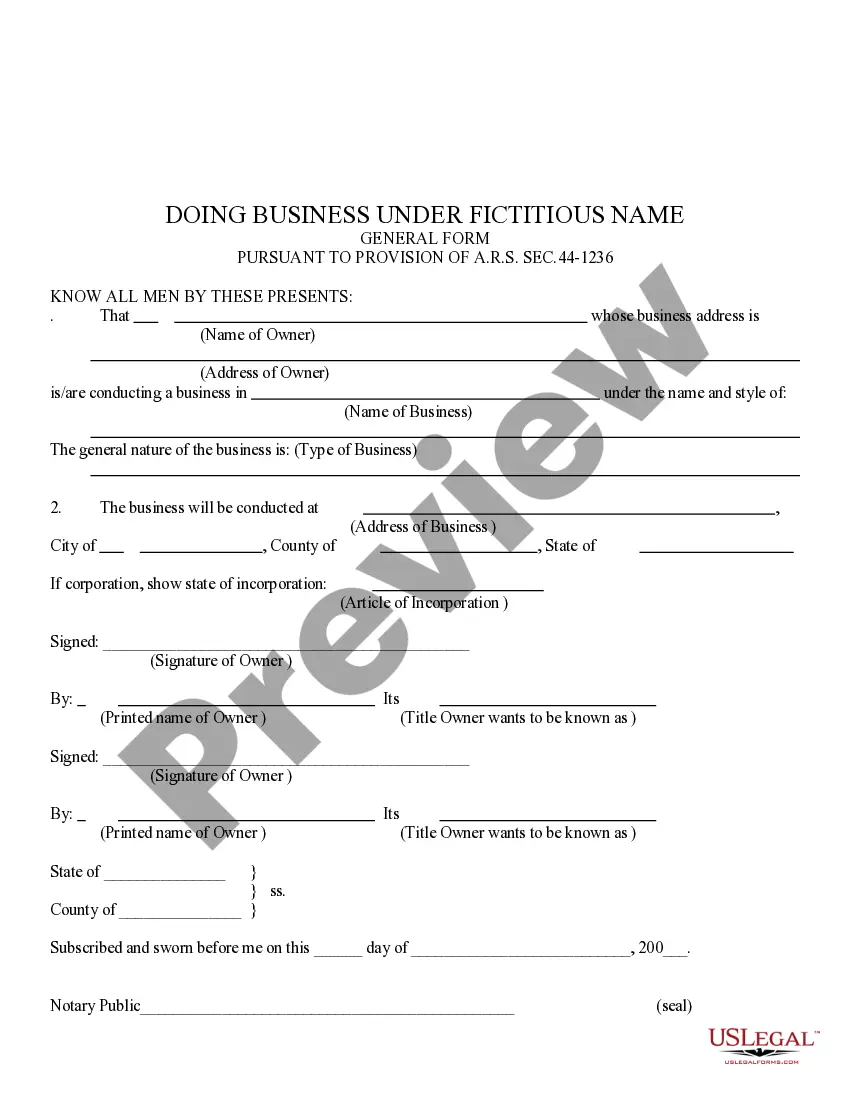

Arizona Doing Business Formula

Description

How to fill out Arizona Doing Business Under Fictitious Name?

Managing legal documentation and processes can be a lengthy addition to your entire day.

Arizona Doing Business Formula and similar forms often necessitate you to search for them and comprehend how to fill them out accurately.

For this reason, whether you are handling financial, legal, or personal matters, possessing a thorough and user-friendly online library of forms when you require it will greatly assist.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and a range of tools that will aid you in finishing your documentation swiftly.

Is this your first time using US Legal Forms? Sign up and create an account in a few minutes, and you’ll gain access to the form library and Arizona Doing Business Formula. Then, follow the steps outlined below to complete your form: Ensure you have the correct document by utilizing the Review feature and checking the form description. Click Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download then fill out, eSign, and print the form. US Legal Forms has 25 years of experience assisting clients with their legal documentation. Find the form you need now and simplify any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms ready for download at any moment.

- Protect your document management processes by utilizing a high-quality service that allows you to prepare any form within minutes without extra or hidden charges.

- Simply Log In to your account, find Arizona Doing Business Formula, and obtain it directly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Sales Factor Only Apportionment Formula All non-air carrier taxpayers may use Arizona's SALES FACTOR ONLY apportionment formula, which is determined by dividing Arizona Sales by Everywhere Sales.

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.

Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. The new default withholding rate for AZ is 2 percent, so now is the time to review if this amount is appropriate for you. If you want to change this percentage, you can do so at any time during the year.

Arizona has a 4.90 percent corporate income tax rate, a 5.60 percent state sales tax rate, a max local sales tax rate of 5.30 percent, and a 8.37 percent combined state and local sales tax rate. Arizona's tax system ranks 19th overall on our 2023 State Business Tax Climate Index.