Escrow Instructions - Short Form: This document is a list of intructions when dealing with the escrow account, attached to the buying/selling of property. This form outlines the duties to be performed by the Buyer, Seller and Escrow Agent in conjunction with the buying and selling of the land or home. It is available for download in both Word and Rich Text formats.

Escrow Instructions

Description

How to fill out Arizona Escrow Instructions In Short Form?

- If you're an existing user, log in to your account and check if your subscription is active. Download the escrow instructions template by clicking the Download button.

- For new users, begin by reviewing the Preview mode and form description to confirm you've selected the appropriate escrow instructions for your needs based on your jurisdiction.

- If adjustments are needed, utilize the Search tab to locate the correct template that best fits your requirements.

- Next, select the Buy Now option and choose a subscription plan that suits you. You'll need to create an account to access the full library.

- Complete your purchase by entering your payment information, either via credit card or PayPal, to finalize your subscription.

- Finally, download the form to your device and access it anytime through the My Forms section of your profile.

By following these steps, you can efficiently acquire your escrow instructions with confidence. US Legal Forms offers an extensive library of over 85,000 legally sound forms and packages.

Empower your document preparation today with US Legal Forms and ensure that your legal needs are met accurately. Don't hesitate—start your journey with us!

Form popularity

FAQ

Items typically included in escrow can be funds, property titles, and any necessary legal documents related to the transaction. Escrow also secures any contingencies agreed upon in the contract, such as inspections or clear title. Having a comprehensive list of items in the escrow instructions ensures that nothing essential is overlooked during the process.

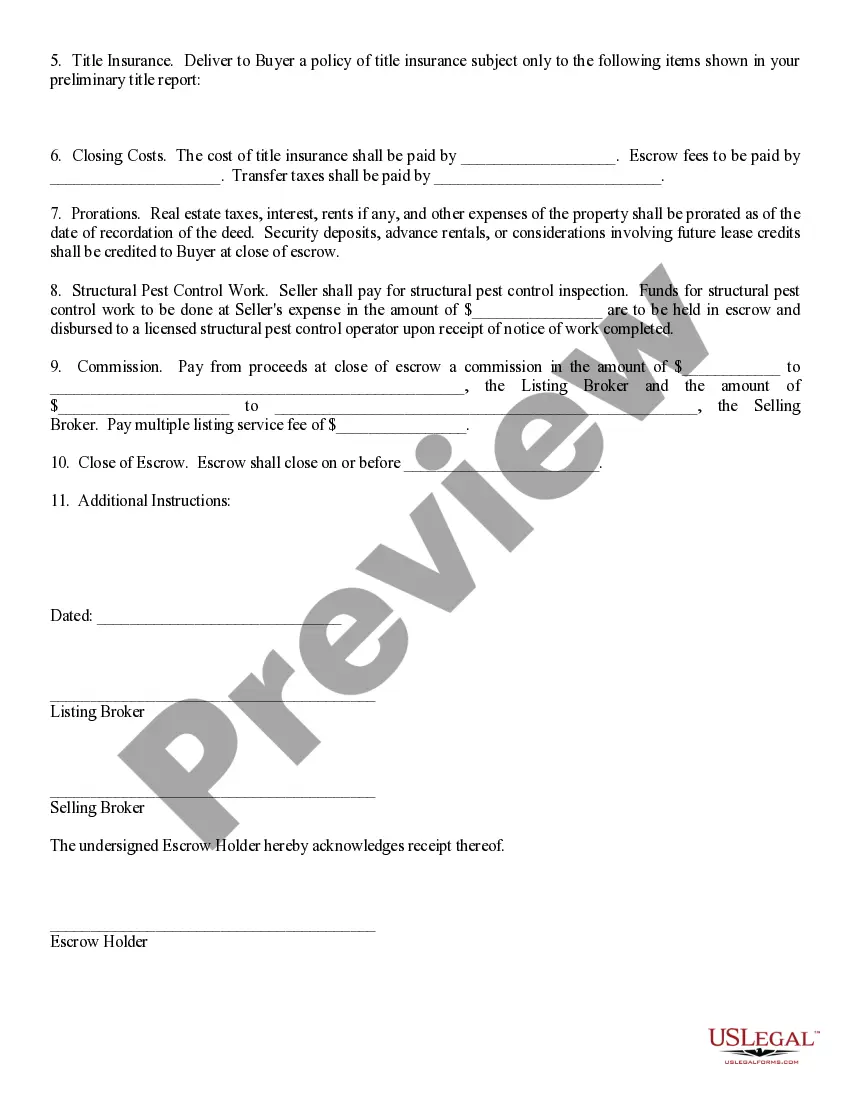

Escrow instructions are the written guidelines that outline the terms and conditions of an escrow arrangement. They serve as a roadmap for all parties involved, detailing what actions need to be taken before funds or assets change hands. By following clearly defined escrow instructions, all parties can avoid potential disputes and ensure a successful transaction.

Escrow instructions usually include details about the transaction, such as payment terms, timelines, and any necessary contingencies. They also specify who will manage the escrow account and the conditions that must be met for release of funds or property. Properly crafted escrow instructions can minimize misunderstandings and facilitate a faster closing.

An escrow agent typically uses a document called the escrow agreement as escrow instructions. This agreement outlines the specific terms and conditions for the transaction, detailing the responsibilities of all parties involved. It provides the agent with the necessary guidelines to manage the funds and ensure compliance with the transaction. By clearly defining the escrow instructions, the process becomes smoother and more efficient for everyone.

Escrow instructions are definitive guidelines that outline how an escrow agent must handle a transaction. They detail the responsibilities of each party and the conditions required for the release of funds or assets. These instructions act as a roadmap for the transaction, ensuring all parties are aligned. A well-articulated set of escrow instructions minimizes the risk of disputes and allows for a smoother transaction.

Typically, escrow instructions can be altered by mutual agreement from all parties involved in the transaction. If both the buyer and seller consent to the changes, they can work with the escrow agent to modify the existing instructions. This collaboration helps manage any adjustments needed due to changing circumstances or preferences during the transaction. Ensuring transparency in these alterations is vital for maintaining trust.

Escrow instructions are given by the parties involved in the transaction, mainly the buyer and seller. They collaborate to define the terms that the escrow agent will follow. These instructions help in safeguarding the interests of all parties throughout the transaction. Clear communication during this phase makes the process more efficient and reliable.

The escrow agent or officer is responsible for providing the escrow instructions related to handling and disbursing funds. They will dictate how funds are to be managed according to the terms agreed upon by the buyer and seller. This role is essential for ensuring that financial transactions take place smoothly and transparently. Consider leveraging tools like US Legal Forms to streamline this process with properly formatted instructions.

The primary document that serves as escrow instructions is the escrow agreement. This agreement outlines the responsibilities of the escrow agent, as well as the conditions under which funds will be released. In addition, it includes provisions for the buyer, seller, and any other parties involved in the transaction. Clear escrow instructions are critical for protecting everyone’s interests.

Escrow instructions are usually prepared by the escrow officer or agent involved in the transaction. This professional gathers the necessary information from all parties and formalizes it into instructions. They ensure that all details comply with legal requirements and that the document meets industry standards. Utilizing a reputable platform like US Legal Forms can simplify the creation of these instructions.