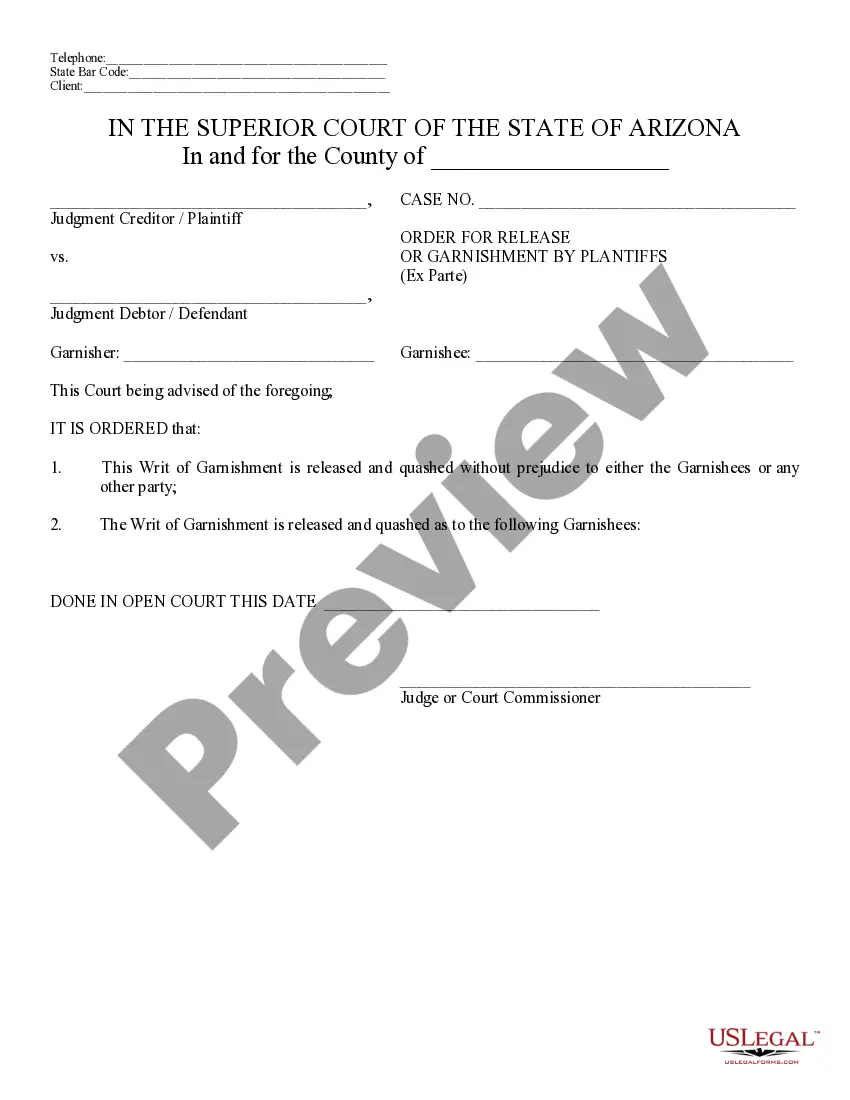

Arizona Garnishment Without Notice

Description

How to fill out Arizona Notice Of Release Of Garnishment And Order?

Legal document management might be overpowering, even for knowledgeable specialists. When you are interested in a Arizona Garnishment Without Notice and don’t have the a chance to commit looking for the appropriate and up-to-date version, the procedures may be nerve-racking. A strong online form library could be a gamechanger for anybody who wants to manage these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you might have, from personal to enterprise documents, all-in-one place.

- Make use of advanced resources to complete and deal with your Arizona Garnishment Without Notice

- Gain access to a useful resource base of articles, guides and handbooks and resources relevant to your situation and requirements

Save effort and time looking for the documents you will need, and utilize US Legal Forms’ advanced search and Review feature to get Arizona Garnishment Without Notice and download it. In case you have a subscription, log in for your US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to view the documents you previously downloaded as well as deal with your folders as you see fit.

If it is the first time with US Legal Forms, make an account and acquire unrestricted use of all advantages of the library. Listed below are the steps to take after getting the form you need:

- Confirm it is the correct form by previewing it and reading its description.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Choose a subscription plan.

- Find the file format you need, and Download, complete, sign, print out and send out your document.

Benefit from the US Legal Forms online library, supported with 25 years of experience and trustworthiness. Change your day-to-day document administration in a smooth and user-friendly process today.

Form popularity

FAQ

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

Hear this out loud PauseUp to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25%* of your non-exempt disposable earnings to be paid to a single judgment creditor.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

If after December 5, 2022, then the new law which only allows for 10% garnishment is in place. The employer should look at the garnishment package to see when the judgment was effective as that will dictate whether 25% or 10% of the employee's non-exempt disposable earnings can be garnished.

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.