Arizona Garnishment Withholding

Description

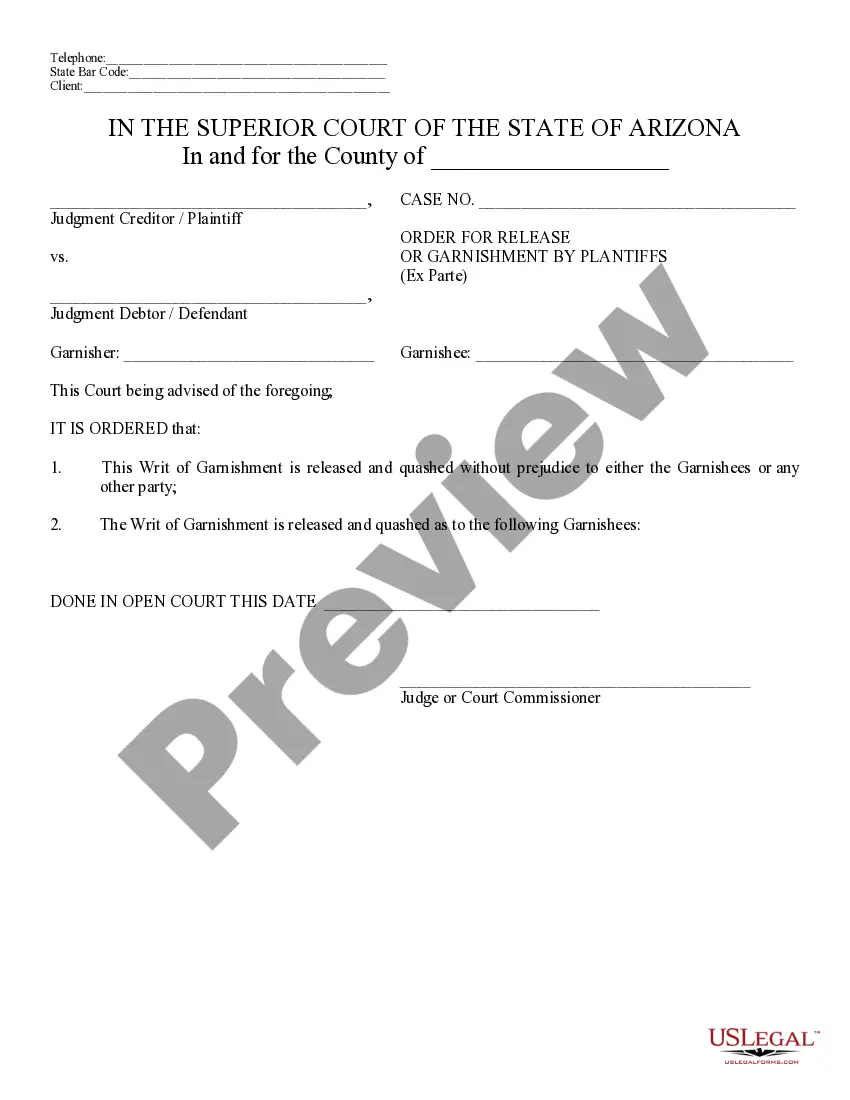

How to fill out Arizona Notice Of Release Of Garnishment And Order?

Obtaining legal templates that meet the federal and state laws is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the correctly drafted Arizona Garnishment Withholding sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal scenario. They are easy to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when obtaining a Arizona Garnishment Withholding from our website.

Obtaining a Arizona Garnishment Withholding is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

- Examine the template using the Preview option or through the text description to make certain it fits your needs.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Arizona Garnishment Withholding and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25%* of your non-exempt disposable earnings to be paid to a single judgment creditor.

You may object to the garnishment or file a claim of exemption by requesting a hearing with this court, if you believe any of the following is true: 1. The judgment creditor does not have a valid provisional remedy order or support order or judgment against you or that the debt or judgment has been paid in full. 2.

Before Proposition 209, creditors could garnish up to 25% of a debtor's non-exempt disposable earnings. Now, the law has reduced this maximum limit to 10% of an individual's disposable income or 60 times the highest applicable minimum wage (whichever is less).

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.

Impact on Wage Garnishments ? Medical Debt Before Proposition 209, creditors could garnish up to 25% of a debtor's non-exempt disposable earnings. Now, the law has reduced this maximum limit to 10% of an individual's disposable income or 60 times the highest applicable minimum wage (whichever is less).