Arizona Foreign Judgment Enrollment

Arizona Revised Statutes

CHAPTER 9 - SPECIAL ACTIONS AND PROCEEDINGS TO ENFORCE CLAIMS

OR JUDGMENTS

Article 11 - Revised Uniform Enforcement of Foreign Judgments

Act

Definition

In this article, unless the context otherwise requires: "Foreign

judgment" means any judgment, decree, or order of a court of the United

States or of any other court which is entitled to full faith and credit

in this state. Chap. 9, Art. 11, §12-1701.

Filing and status of foreign judgments

A copy of any foreign judgment authenticated in accordance with

the act of Congress or the statutes of this state may be filed in the office

of the clerk of any superior court of this state. The clerk shall treat

the foreign judgment in the same manner as a judgment of the superior court

of this state. A judgment so filed has the same effect and is subject to

the same procedures, defenses and proceedings for reopening, vacating,

or staying as a judgment of a superior court of this state and

may be enforced or satisfied in like manner. Chap. 9, Art. 11, §12-1702.

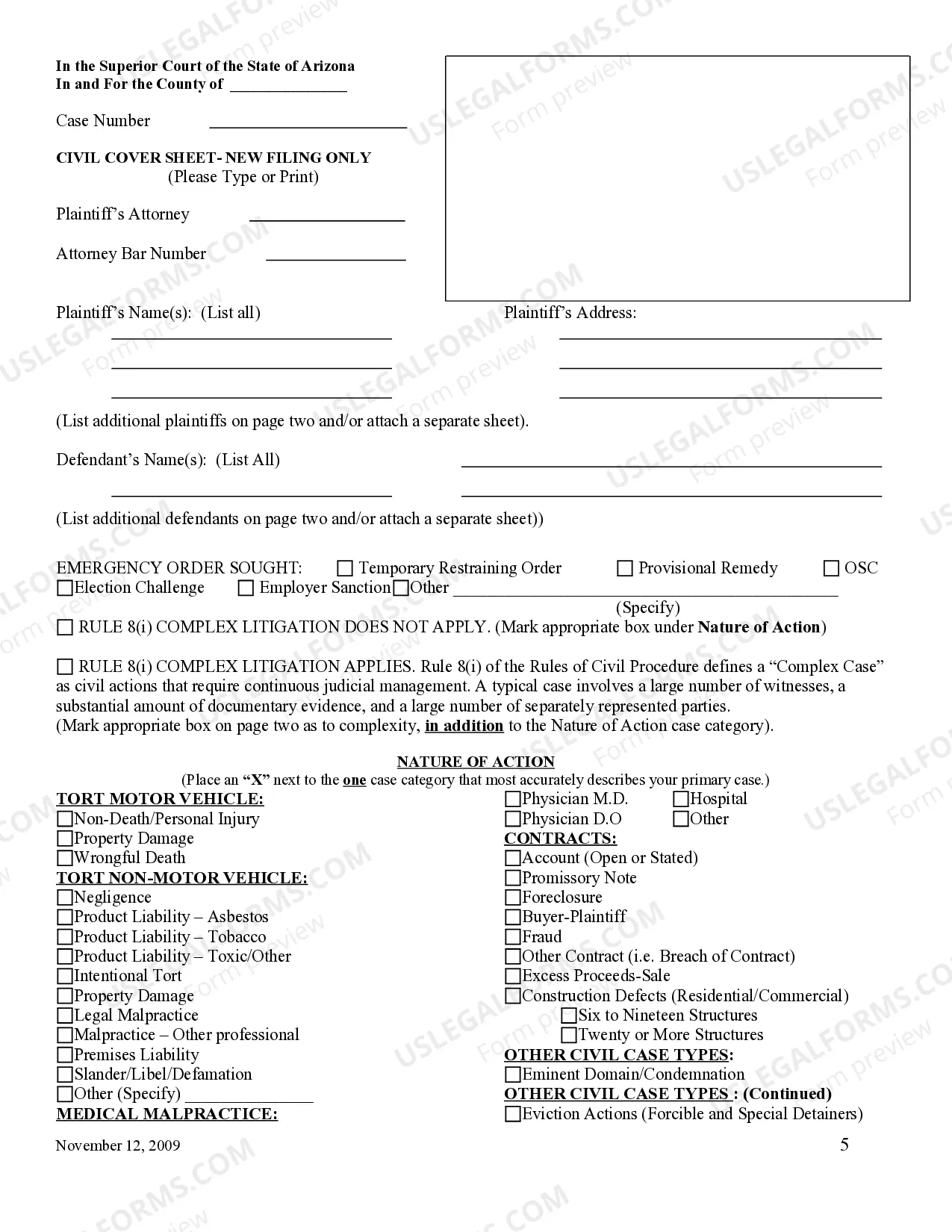

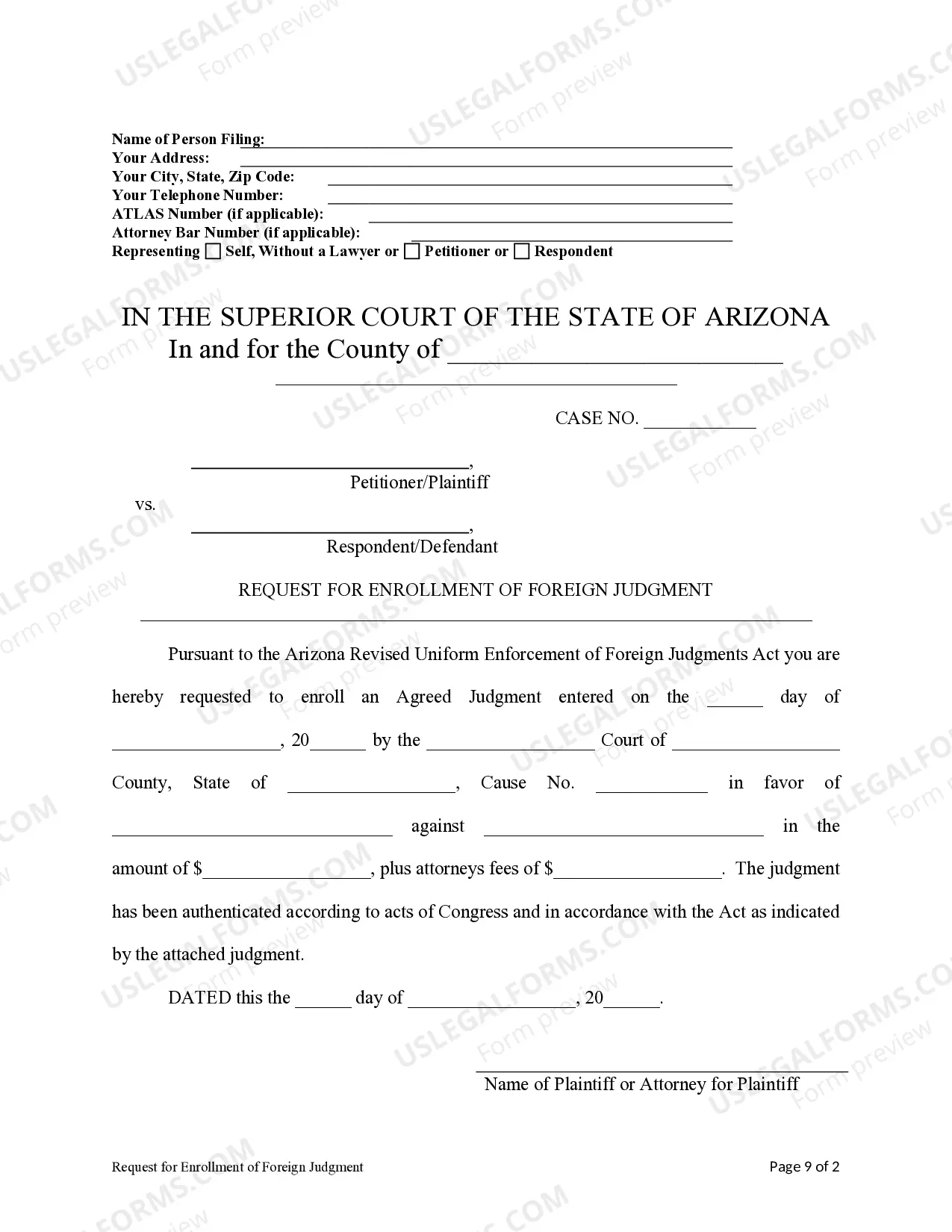

Notice of filing

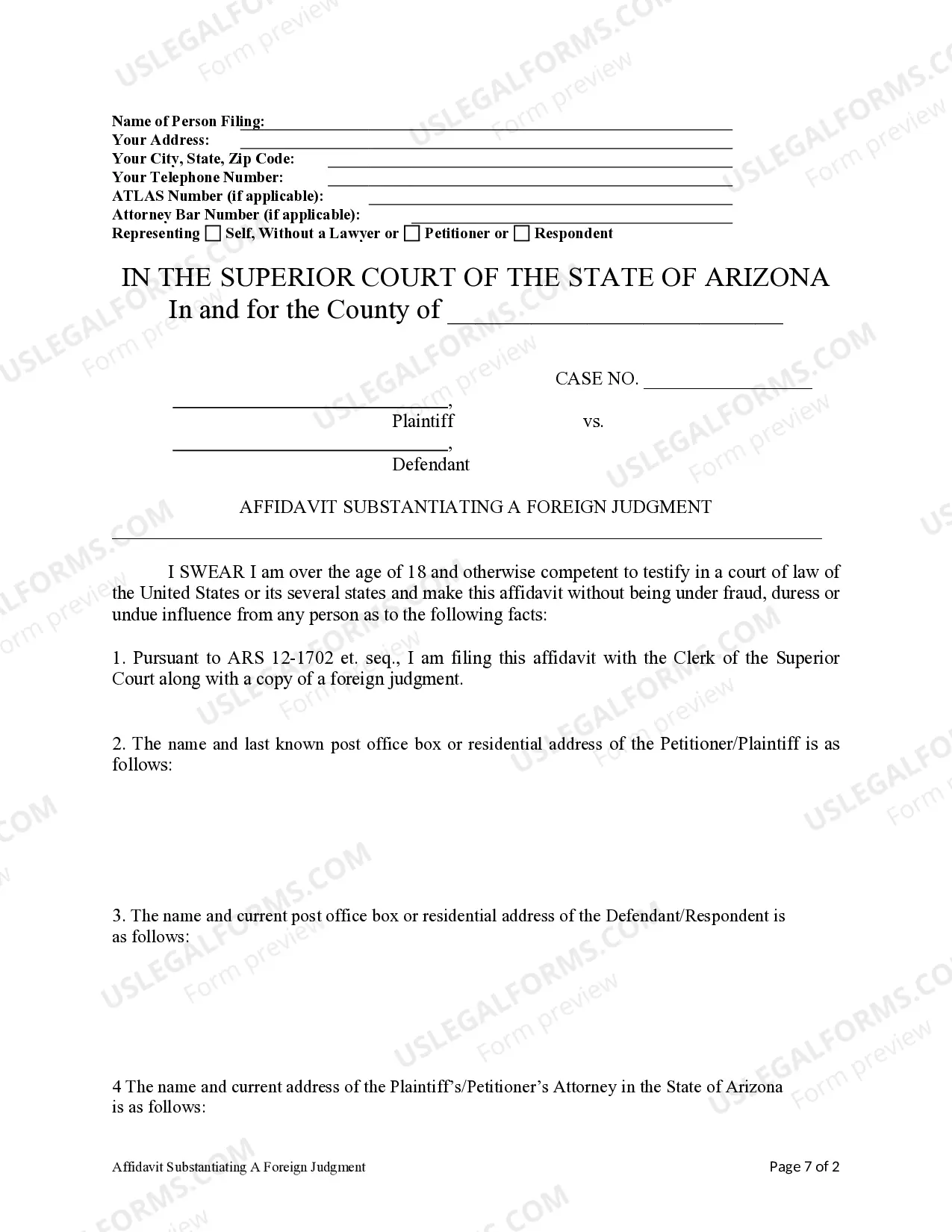

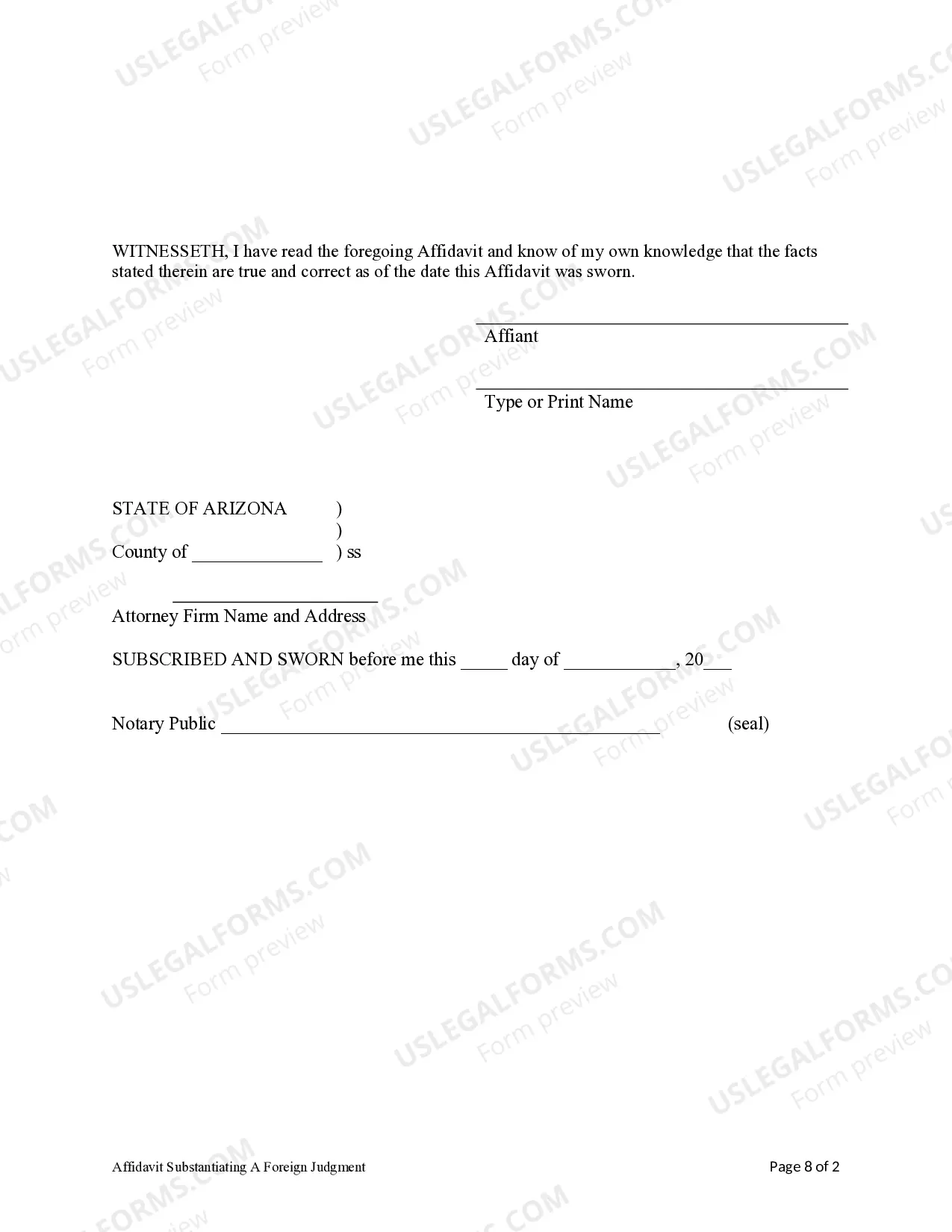

A. At the time of the filing of the foreign judgment, the

judgment creditor or the judgment creditor's lawyer shall make and file

with the clerk of the superior court an affidavit setting forth the name

and last known post office address of the judgment debtor, and the judgment

creditor.

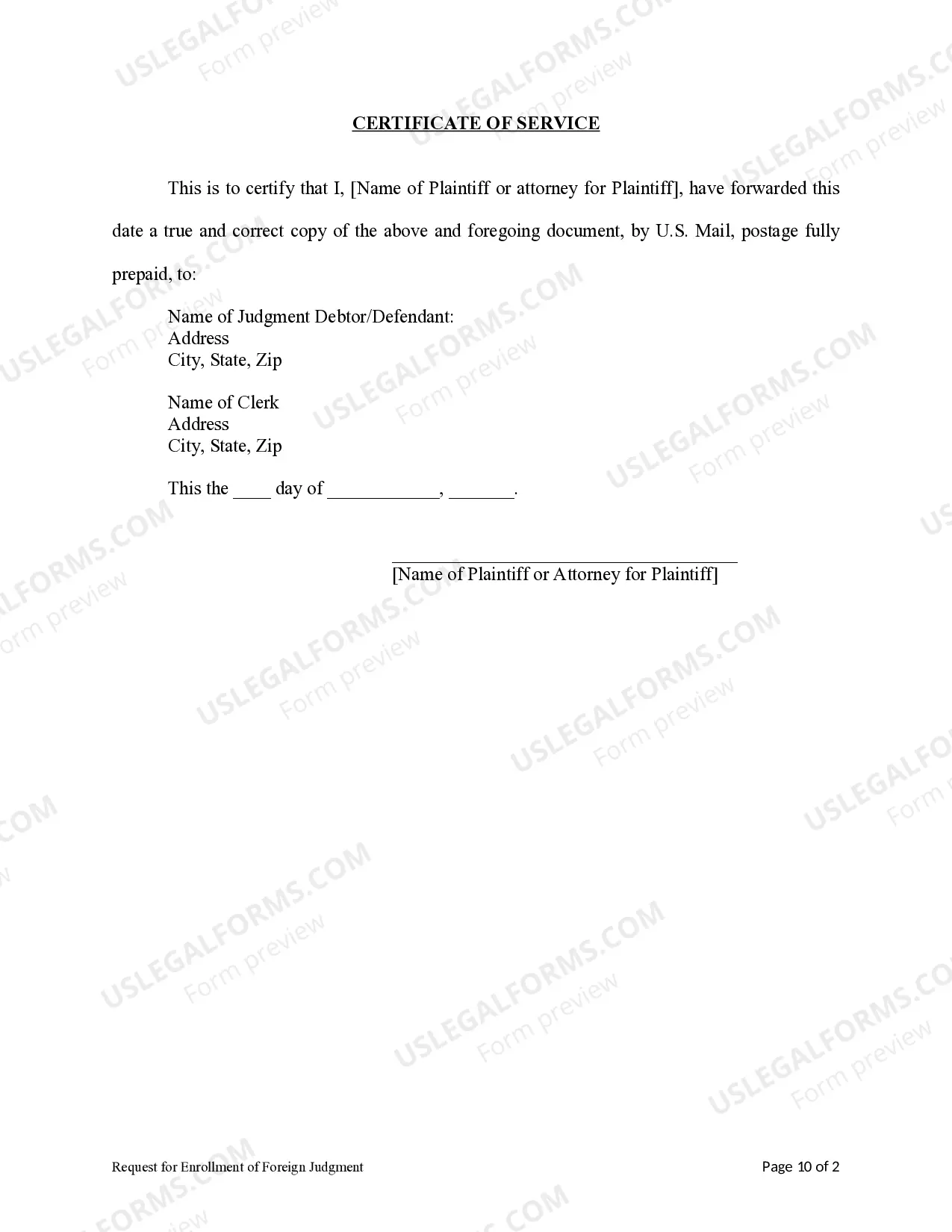

B. Promptly upon the filing of the foreign judgment and the affidavit,

the judgment creditor shall mail notice of the filing of the foreign judgment

and a copy of the foreign judgment to the judgment debtor at the address

given and shall file proof of mailing with the clerk. The notice shall

include the name and post office address of the judgment creditor and the

judgment creditor's attorney, if any, in this state. Chap. 9, Art.

11, §12-1703.

Stay of enforcement of judgment

A. If the judgment debtor shows the superior court that

an appeal from the foreign judgment is pending or will be taken, or that

a stay of execution has been granted, the court shall stay enforcement

of the foreign judgment until the appeal is concluded, the time for appeal

expires, or the stay of execution expires or is vacated, upon proof that

the judgment debtor has furnished the security for the satisfaction of

the judgment required by the state in which it was rendered.

B. If the judgment debtor shows the superior court any ground upon

which enforcement of a judgment of any superior court of this state would

be stayed, the court shall stay enforcement of the foreign judgment for

an appropriate period, upon requiring the same security for satisfaction

of the judgment which is required in this state.

C. No execution or other process for enforcement of a foreign judgment

filed under section 12-1702 shall issue until twenty days after the date

the judgment creditor mails the notice of filing of the foreign judgment

and files proof of mailing with the clerk as required under section 12-1703.

Chap. 9, Art. 11, §12-1704.

Filing fees

Any person filing a foreign judgment shall pay to the clerk a fee

pursuant to section 12-284. Fees for docketing, transcription or other

enforcement proceedings shall be as provided for judgments of the superior

court. Chap. 9, Art. 11, §12-1705.

Other rights of enforcement

The right of a judgment creditor to bring an action to enforce

his judgment instead of proceeding under this article remains unimpaired.

Chap. 9, Art. 11, §12-1706.

Uniformity of interpretation

This article shall be so interpreted and construed as to effectuate

its general purpose to make uniform the law of those states which

enact it. Chap. 9, Art. 11, §12-1707.

Short title

This article may be cited as the uniform enforcement of foreign

judgments act. Chap. 9, Art. 11, §12-1708.