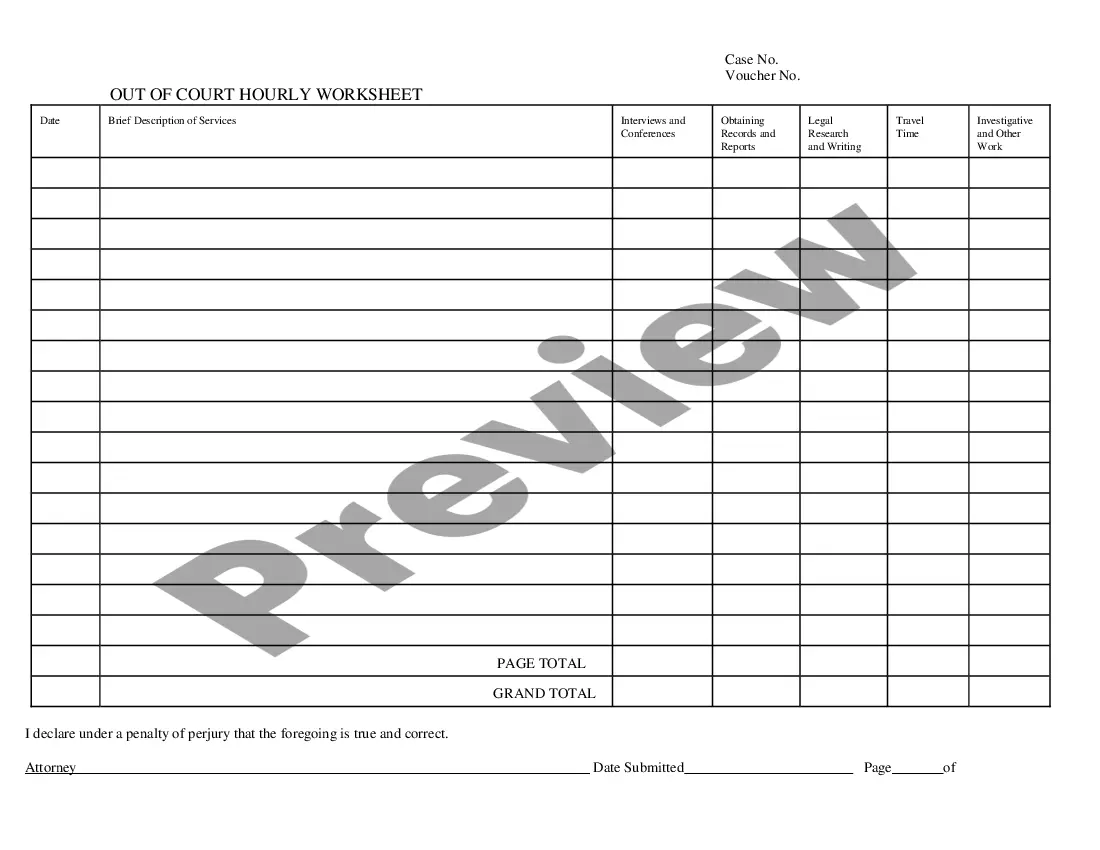

The Kentucky Expense Ledger is a financial document used to record all expenses incurred in the state of Kentucky. The ledger is organized by fiscal year, and typically includes transaction details such as type of expense, date, amount, and the purpose of the expense. It is used to document the financial activities of Kentucky state government agencies, departments, and offices, and is also applicable to political subdivisions such as counties and cities. There are three types of Kentucky Expense Ledger: Statewide, County, and City. The Statewide Ledger includes expenses from all state government agencies, departments, and offices. The County Ledger includes all expenses incurred by a county in Kentucky, while the City Ledger includes all expenses incurred by a city in the state. All three Kentucky Expense Ledgers are important for tracking and monitoring expenditures, as well as ensuring compliance with state laws and regulations.

Kentucky Expense Ledger

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Expense Ledger?

Managing legal documents necessitates diligence, accuracy, and utilizing properly designed templates. US Legal Forms has been assisting individuals nationwide in achieving this for 25 years, ensuring that when you select your Kentucky Expense Ledger template from our service, it adheres to federal and state guidelines.

Engaging with our service is uncomplicated and efficient. To obtain the necessary document, all you require is an account with an active subscription. Here’s a concise overview for you to locate your Kentucky Expense Ledger quickly.

All forms are created for multiple uses, such as the Kentucky Expense Ledger you see on this page. If you need them again, you can complete them without additional payment - just access the My documents section in your account and finalize your document whenever necessary. Try US Legal Forms and prepare your business and personal documents swiftly and in complete legal compliance!

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or reading its summary.

- Seek an alternative official template if the previously accessed one does not suit your circumstances or state regulations (the link for that is located at the upper corner of the page).

- Log in to your account and download the Kentucky Expense Ledger in your desired format. If it’s your initial experience with our service, click Buy now to proceed.

- Sign up for an account, choose your subscription option, and make a payment using your credit card or PayPal account.

- Select the format in which you wish to save your document and click Download. Print the template or upload it to a professional PDF editor to manage it without paperwork.

Form popularity

FAQ

Your operating expenses are those you incur to run the business. These are typically recorded in the general ledger as they are incurred. Your general ledger might break these down into accounts for rent, merchant fees, software subscriptions, telephone and internet, cleaning, and so on.

These five categories are assets, liabilities, owner's equity, revenue, and expenses.

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts payable or cash, depending on whether you've paid for the expense at the time you recorded it.

As with assets and liability items, items of income and expense are recorded in nominal ledger accounts ing to set rules. Expenses are always recorded as debit entries in expense accounts and income items are always recorded as credit entries in income accounts.

General Ledger Accounts (GLs) are account numbers used to categorize types of financial transactions. Most commonly used GLs are revenues, expenses and transfers.

Put your assets and expenses on the left side of the ledger. Your liabilities, equity, and revenue go on the right side. Both sides must have equal values for your ledger to balance. At the end of each period, transfer your journal entries into your general ledger for small business.

An expenses ledger is used for booking expenses. It can be created by selecting the Nature of Payment during ledger creation.

Accountants record expenses through one of two accounting methods: cash basis or accrual basis. Under cash basis accounting, expenses are recorded when they are paid. In contrast, under the accrual method, expenses are recorded when they are incurred.