Arizona Trust Az Form 141az

Description

How to fill out Arizona Revocation Of Living Trust?

Identifying a reliable source for obtaining the most up-to-date and suitable legal forms is a significant part of navigating bureaucracy. Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is vital to obtain samples of Arizona Trust Az Form 141az exclusively from trustworthy providers, such as US Legal Forms. An erroneous form could squander your time and prolong your situation. With US Legal Forms, you can be at ease. You can access and verify all the details regarding the document’s applicability and significance for your circumstances and within your locality.

Follow these outlined steps to finalize your Arizona Trust Az Form 141az.

Once the form is saved on your device, you can modify it using the editor or print it out to complete it manually. Eliminate the stress linked with your legal paperwork. Explore the extensive US Legal Forms collection to discover legal templates, assess their applicability to your case, and download them without delay.

- Utilize the library navigation or search function to find your sample.

- Examine the form’s description to confirm it meets the requirements of your state and county.

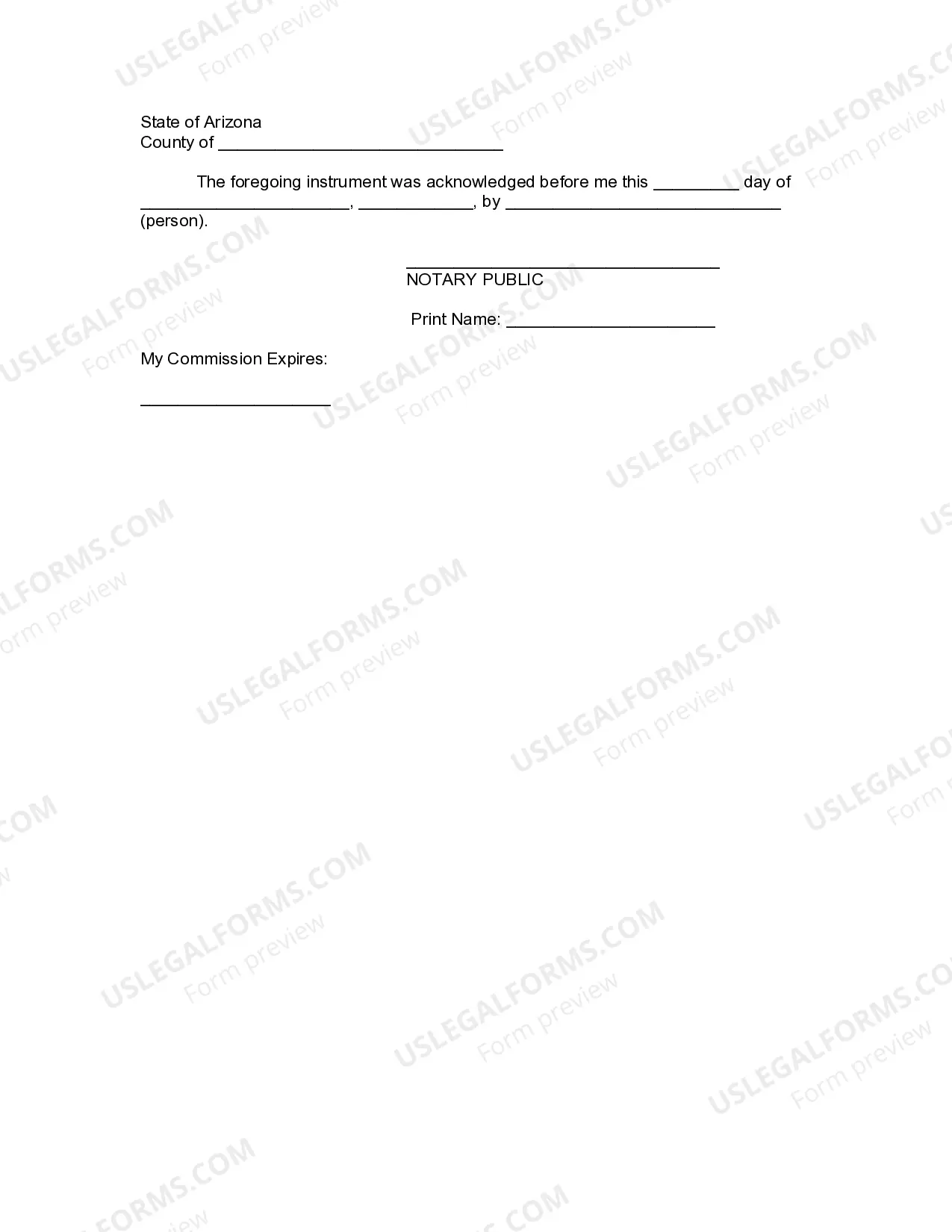

- View the form preview, if accessible, to verify that the template is what you need.

- Return to the search and identify the correct document if the Arizona Trust Az Form 141az does not meet your criteria.

- If you are confident about the form’s suitability, download it.

- As an authorized user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not possess a profile yet, click Buy now to secure the form.

- Select the pricing plan that aligns with your needs.

- Proceed to the registration to complete your order.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Arizona Trust Az Form 141az.

Form popularity

FAQ

Form F941 is the Employer's Quarterly Federal Tax Return, used to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks. Businesses in Arizona should be aware of how these forms interact with state regulations. If you are setting up a business trust, consider utilizing the Arizona trust az form 141az to ensure compliance with tax-related obligations.

Form 8915F is used to report distributions from retirement plans or pensions, particularly due to a disaster-related situation. This form can help you understand how to manage your distributions appropriately. If you are considering creating a trust, you may want to explore how the Arizona trust az form 141az can integrate with your overall tax planning strategy.

The Arizona state tax form you should use depends on your specific tax situation, such as your income type and reporting needs. Common forms include the Arizona Form 140 for individual income tax and Arizona trust az form 141az for trusts. It's crucial to select the correct form to ensure accurate reporting and compliance with state tax laws.

Setting up a trust in Arizona involves several key steps, including deciding on the type of trust you want to create, drafting the trust document, and funding the trust. You may want to consult with a legal professional to ensure proper documentation. Utilizing the Arizona trust az form 141az can streamline this process and provide clarity in managing your assets.

The Arizona family tax credit is a tax benefit designed to support families in Arizona. It helps reduce the amount of tax owed based on eligible expenses. If you're setting up a trust to manage family assets, consider how the Arizona trust az form 141az could be beneficial in tax planning and protecting your family's financial future.

You can easily pick up Arizona tax forms at your local Arizona Department of Revenue office or access them online. The official Arizona Department of Revenue website provides downloadable forms for your convenience. For any specific forms, including the Arizona trust az form 141az, ensure you get the latest version to avoid delays in processing your tax returns.

Arizona form A4 is used for employee's withholding allowances, helping employers calculate the correct amount of state income tax to withhold from wages. It is important to fill this out accurately to ensure proper withholding. If you are handling trusts or similar entities, the Arizona trust AZ form 141AZ can guide you through your responsibilities for state compliance.

Filling out the EZ tax form involves entering your income, tax withheld, and required personal information. While the process was simplified, the IRS recommends you check for any updates or changes. For state-related tax forms, the Arizona trust AZ form 141AZ provides a streamlined approach, making sure you cover all essential aspects.

The 1040EZ was considered straightforward compared to other tax forms, but it is no longer available since the IRS updated its forms. Many find the new 1040 form simple as well, with clear instructions. For residents managing trusts, the Arizona trust AZ form 141AZ offers a user-friendly way to navigate state-specific requirements without added complexity.

Filling out Arizona form 5000A requires you to provide specific details about your income and deductions for state tax purposes. Be sure to follow the guidelines closely and use accurate figures to avoid mistakes. If you are also dealing with trust-related documents, consider referencing the Arizona trust AZ form 141AZ for comprehensive coverage of your obligations.