Arizona Trust And Will

Description

Form popularity

FAQ

Yes, you can create a will and trust yourself, particularly with resources available for Arizona trust and will. However, it's crucial to ensure that all legal requirements are met to make your documents valid. Many people find it helpful to use a professional platform like US Legal Forms, as it provides templates and guidance specifically designed for Arizona residents. This approach allows you to save time while ensuring your estate planning is both effective and legally sound.

To set up a will and trust in Arizona, start by defining your goals for asset distribution. Draft each document meticulously, ensuring they reflect your wishes. US Legal Forms offers comprehensive resources and templates that can assist you throughout this process, making it easier to create an effective Arizona trust and will that meets your needs.

In Arizona, a trust does not generally have to be filed with the court unless there is a specific legal reason to do so. Your trust remains private, allowing you to maintain control over your assets without court intervention. This privacy is one of the compelling reasons to create an Arizona trust and will, providing peace of mind for you and your family.

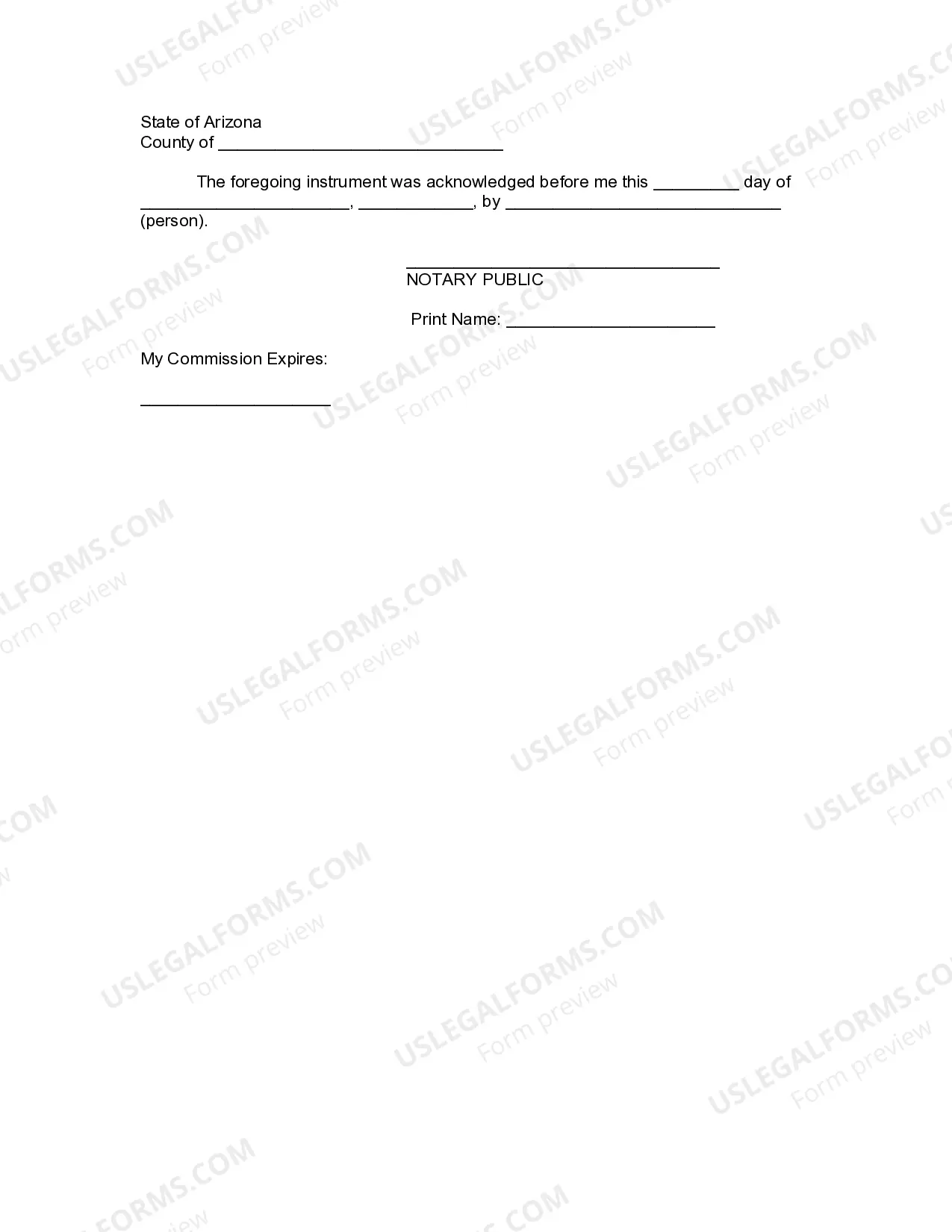

Filing a trust in Arizona involves organizing and completing relevant paperwork, which typically includes signing the trust document and transferring assets into the trust. While you can handle this independently, using a service like US Legal Forms can simplify the process. They offer user-friendly templates and guidance, making it easier to establish your Arizona trust and will correctly.

You do not necessarily need an attorney to set up a trust in Arizona, but having one can offer significant benefits. An attorney can guide you through local laws, ensuring your trust aligns with your goals effectively. If you prefer a more straightforward process, platforms like US Legal Forms provide resources and templates to help you manage this task confidently.

Deciding whether a will or a trust is better in Arizona depends on your personal goals and circumstances. If you prioritize privacy and want to avoid probate, a trust may be the better option. Conversely, if you require a simpler and straightforward plan, a will might suffice. Ultimately, it’s wise to assess your estate planning objectives and consult experts to choose between an Arizona trust and will.

Using a trust instead of a will may be a good idea in specific situations in Arizona. If you have significant assets, want to protect against probate, or wish to provide for minor children with specific instructions, a trust can be more effective. By carefully considering your needs, you can determine when an Arizona trust and will are appropriate for your estate planning.

Arizona has specific rules governing trusts that you need to be aware of. Generally, a trust must have a legal purpose, be funded with assets, and have a designated trustee. Additionally, Arizona requires that certain formalities be followed for a trust to be valid. Understanding these rules can help you set up your Arizona trust and will correctly.

Whether a trust is better than a will in Arizona depends on your unique circumstances. Trusts often help avoid probate, which can save time and costs for your loved ones. They also allow for detailed management of your assets during your lifetime and after your passing. Evaluating your situation can guide you toward an effective choice between an Arizona trust and will.

You might choose a trust over a will in Arizona for several reasons. Trusts often provide privacy because they do not go through probate, allowing for a smoother transition of assets. They can also provide more control over how and when assets are distributed to beneficiaries. By utilizing the benefits of an Arizona trust and will, you can ensure that your estate plan aligns with your wishes.