Arizona Specific Form Application With 500

Description

How to fill out Arizona Revocation Of Living Trust?

Whether for business purposes or for personal matters, everyone has to deal with legal situations sooner or later in their life. Filling out legal documents requires careful attention, beginning from picking the proper form sample. For instance, if you pick a wrong version of the Arizona Specific Form Application With 500, it will be turned down once you submit it. It is therefore crucial to have a dependable source of legal documents like US Legal Forms.

If you have to obtain a Arizona Specific Form Application With 500 sample, follow these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it suits your situation, state, and county.

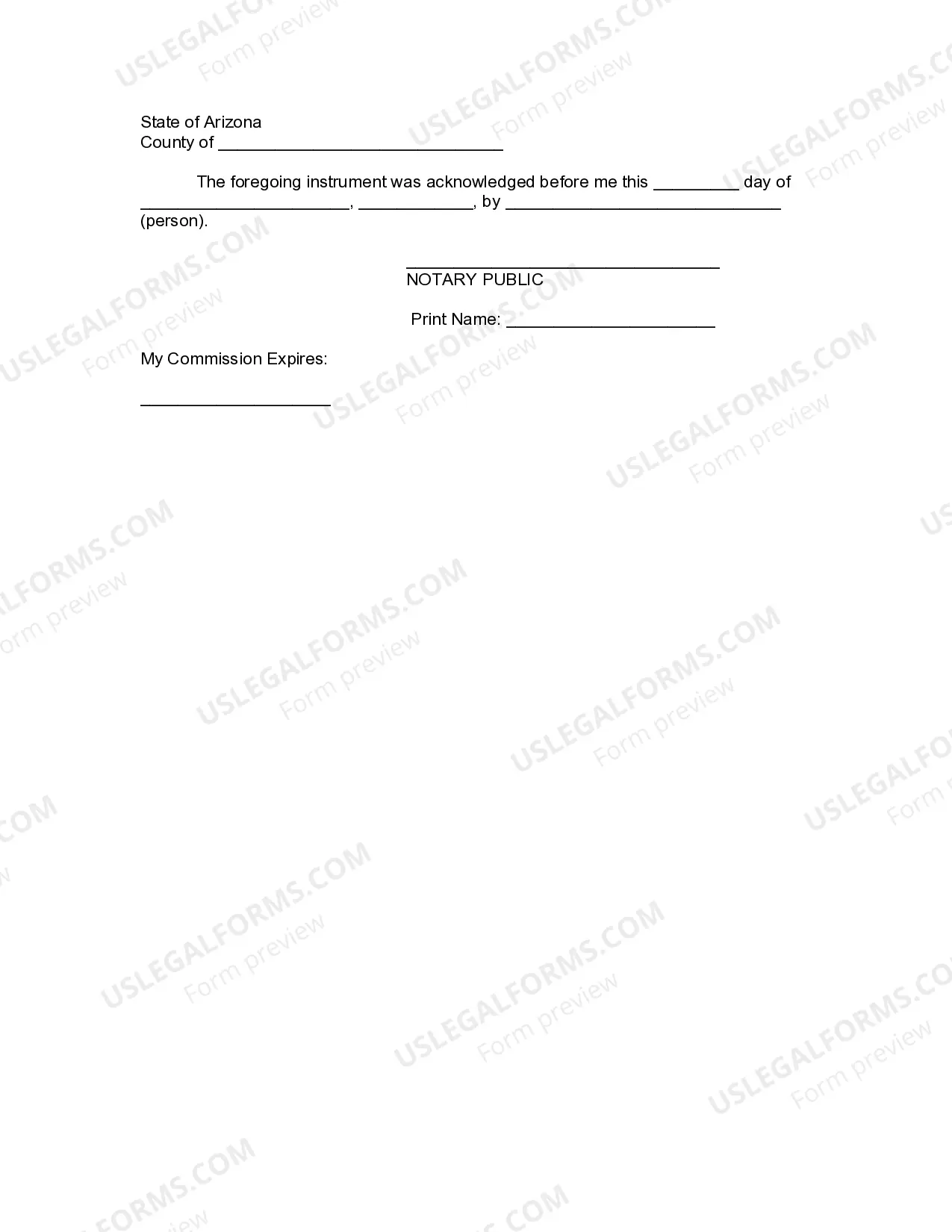

- Click on the form’s preview to examine it.

- If it is the wrong form, go back to the search function to find the Arizona Specific Form Application With 500 sample you require.

- Download the file when it matches your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Arizona Specific Form Application With 500.

- After it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the web. Take advantage of the library’s easy navigation to find the appropriate form for any situation.

Form popularity

FAQ

The exemption application process for individuals and organizations is described in A.R.S. 42-11152 . In almost every case, the taxpayer must file an application with the county assessor, which provides the information required by the assessor to make an exemption determination.

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.

Common Arizona Income Tax Forms & Instructions The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

As a senior in Arizona, you may be eligible for a Tax Freeze on the taxable market value of your home. This includes Phoenix's active adult communities, as well as, homes outside of those communities.

Arizona Form 5000 is used to claim Arizona TPT (sales tax) exemptions from a vendor. The Certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the University in these cases, or for the vendor to refund the sales tax already billed to the University.