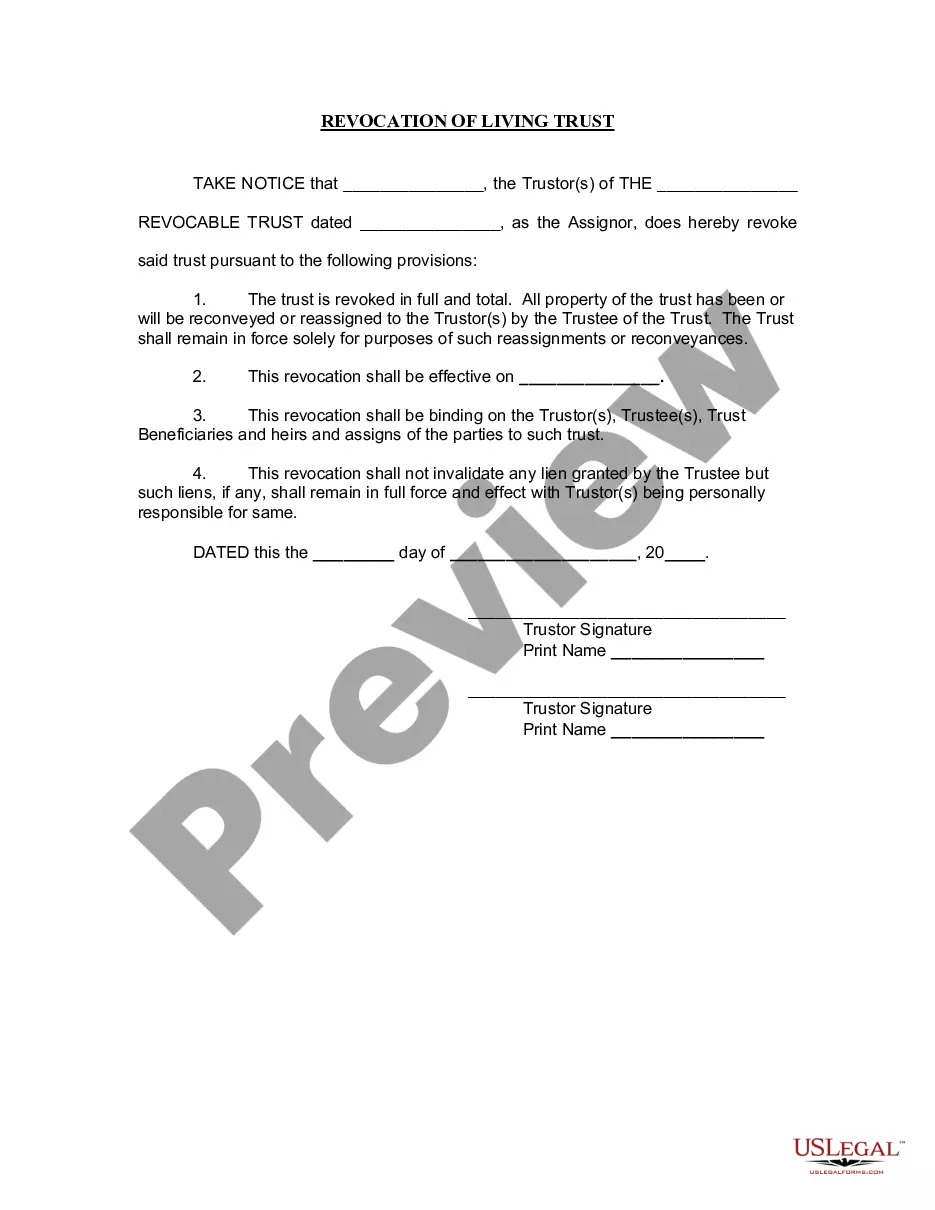

Arizona Revocation Form Az Withholding

Description

How to fill out Arizona Revocation Of Living Trust?

The Arizona Revocation Document Az Withholding you observe on this site is a reusable legal model created by expert attorneys in accordance with federal and local laws. For over 25 years, US Legal Forms has supplied individuals, entities, and legal experts with more than 85,000 validated, state-specific templates for any business and personal situation. It’s the fastest, simplest, and most dependable method to acquire the documentation you require, as the service ensures bank-level data protection and anti-malware safeguards.

Obtaining this Arizona Revocation Document Az Withholding will require only a few straightforward steps.

Select the format you prefer for your Arizona Revocation Document Az Withholding (PDF, DOCX, RTF) and download the template to your device.

- Search for the document you require and evaluate it.

- Browse through the file you searched and preview it or examine the form description to confirm it meets your requirements. If it doesn’t, utilize the search feature to locate the correct one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for a quick transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Arizona Form 285, which is used for the power of attorney, should be sent to the Arizona Department of Revenue at the address specified in the form's instructions. Ensure you complete the form correctly and include all necessary information to avoid delays. Submitting this form correctly helps facilitate communication between you and the department regarding your tax matters. Additionally, the Arizona revocation form az withholding may streamline related processes, making it easier to manage your tax filings.

To request a penalty waiver in Arizona, you must submit a written request to the Arizona Department of Revenue, explaining the reasons for your request. Make sure to include any supporting documentation that justifies your situation, such as unexpected circumstances or errors. The department will review your request and decide whether to grant the waiver based on your explanation. If you're dealing with withholding issues, the Arizona revocation form az withholding can assist in clarifying your status.

Arizona Form 140 is the individual income tax return used by residents to report their income and calculate their tax liability. This form allows you to detail your income sources, claim deductions, and determine your tax credits. Completing Form 140 accurately is essential for compliance with Arizona tax laws. If you encounter issues, the Arizona revocation form az withholding can be a helpful tool in managing your tax responsibilities.

When completing your Arizona tax withholding form, you need to provide your personal information, including your name, address, and Social Security number. Additionally, indicate your filing status and the number of allowances you are claiming. This information helps ensure accurate withholding from your paycheck, aligning with your tax obligations. If you need assistance, consider using the Arizona revocation form az withholding available on USLegalForms to streamline the process.

Yes, a penalty can be waived in Arizona if you demonstrate reasonable cause or specific circumstances justifying the waiver. This process typically requires a formal request to the Arizona Department of Revenue. To simplify your request, consider using the Arizona revocation form az withholding, which can help present your case clearly.

When writing a penalty waiver request letter, start by clearly stating your request and include your personal information. Explain the circumstances that led to the penalties, and provide any supporting evidence. Using the Arizona revocation form az withholding can help structure your request effectively, increasing your chances of a favorable outcome.

To change your Arizona state tax withholding, you need to submit a new Arizona Form W-4 to your employer. This form allows you to adjust the amount of tax withheld from your paycheck based on your financial situation. Leveraging the Arizona revocation form az withholding can help clarify your withholding preferences and ensure accurate adjustments.

A voluntary withholding request allows Arizona residents working in other states to request withholding for Arizona taxes from their paychecks. This ensures that you meet your tax obligations while residing outside Arizona. Consider using the Arizona revocation form az withholding to facilitate this request, ensuring proper compliance with state laws.

To waive off penalties in Arizona, you must demonstrate reasonable cause for the penalties incurred. This typically involves submitting a formal request along with supporting documentation. Utilizing the Arizona revocation form az withholding can streamline this process, making it easier to present your case to the Arizona Department of Revenue.

A 4c request allows Arizona taxpayers to request reduced withholding amounts, specifically to allocate funds for tax credits. This request is submitted to your employer and helps manage your tax payments throughout the year. By using the Arizona revocation form az withholding, you can ensure that your request is processed accurately and promptly.