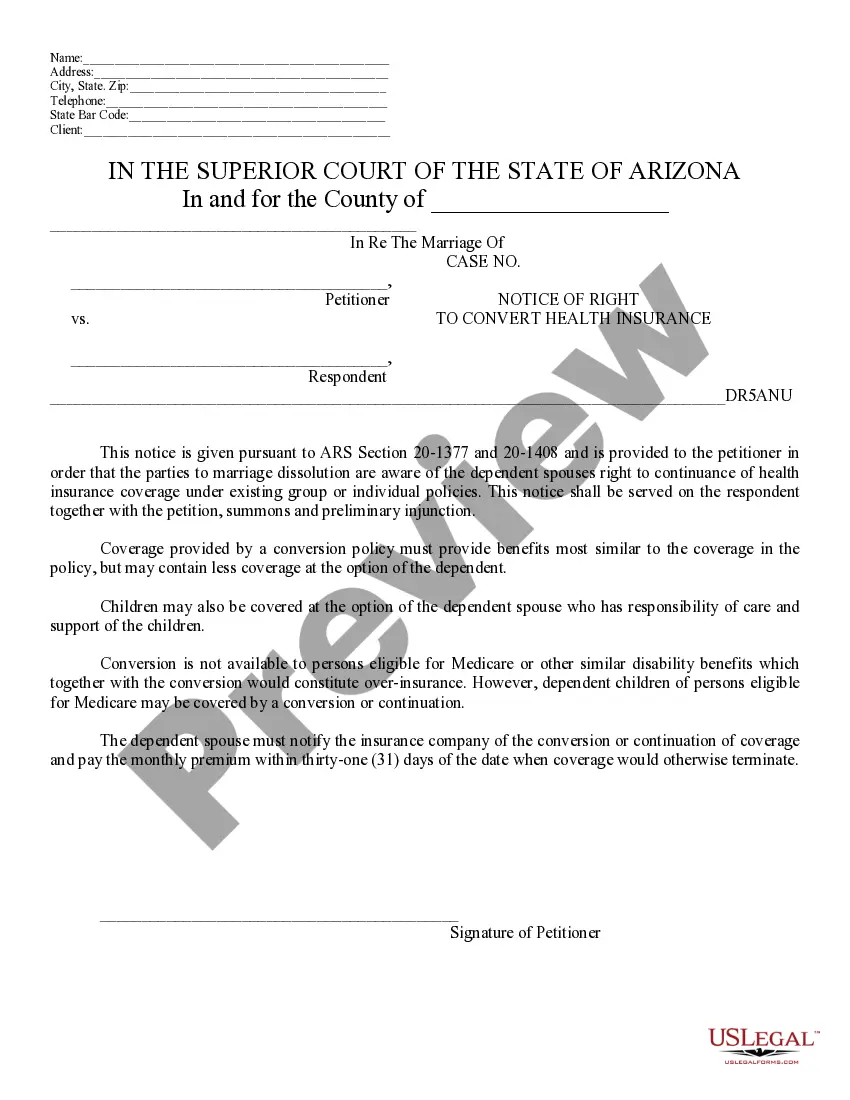

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Right to Convert Health Insurance, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Nch Notice To Convert Health Ins For Self Employed

Description

How to fill out Arizona Notice Of Right To Convert Health Insurance?

Accessing legal documents that adhere to federal and state laws is crucial, and the web provides numerous choices to select from.

However, why waste time searching for the properly drafted Nch Notice To Convert Health Ins For Self Employed example online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms stands as the largest online legal repository with over 85,000 fillable documents prepared by lawyers for any business and personal circumstance.

Examine the template using the Preview function or through the text outline to confirm it satisfies your requirements.

- They are straightforward to navigate with all files organized by state and intended usage.

- Our specialists keep up with legal changes, ensuring you can always trust that your form is current and in compliance when obtaining a Nch Notice To Convert Health Ins For Self Employed from our site.

- Acquiring a Nch Notice To Convert Health Ins For Self Employed is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document example you need in the appropriate format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

Yes, a self-employed person can write off health insurance premiums on their taxes, thanks to the Nch notice to convert health ins for self employed. This deduction can significantly reduce taxable income, providing financial relief. It is essential to keep detailed records of your premiums and any related expenses. Tools like uslegalforms can help you navigate the paperwork and maximize your tax benefits.

Form 7206 is necessary for self-employed individuals who need to document their health insurance coverage under the Nch notice to convert health ins for self employed. This form helps ensure that you meet the requirements for health insurance deductions on your taxes. By completing it accurately, you can protect your eligibility for these benefits. Using platforms like uslegalforms can simplify the process, allowing you to focus on your business.

To enter self-employed health insurance, you first need to choose a plan that suits your needs. Consider options available to you, such as private health insurance or marketplace plans. Ensure you have the Nch notice to convert health ins for self employed, which allows you to switch or enroll in a plan. Once you decide on a plan, complete your application and provide necessary documentation to finalize your coverage.

17 Page 3 2 The Health Insurance Marketplace® uses annual household income and other information to decide if you qualify for help paying for health coverage through the Marketplace, like premium tax credits and plans with lower copayments, coinsurance, and deductibles.

You'll find the deduction on your personal income tax form, and you can file for it if you were self-employed and showed a profit for the year. If you're also eligible for a premium tax credit (premium subsidy), you can only deduct the part of the premiums you pay yourself.

Medicaid applicants generally have to provide documentation of their monthly income (earned and unearned) with their Medicaid application. Examples include copies of dividend checks, social security check or award letter, pay stubs, alimony checks, and VA benefits check or award letter.

You get a tax deduction only when the insurance is linked to self-employment. TurboTax doesn't know it only from the 1095-A form. You have to tell TurboTax it's linked to your self-employment. This is important but easy to miss.

Liability insurance for the self-employed Owning your own company has risks, and that's why liability insurance is a great place to start for self-employed business owners.