Arizona Minimum Wage For Servers

Description

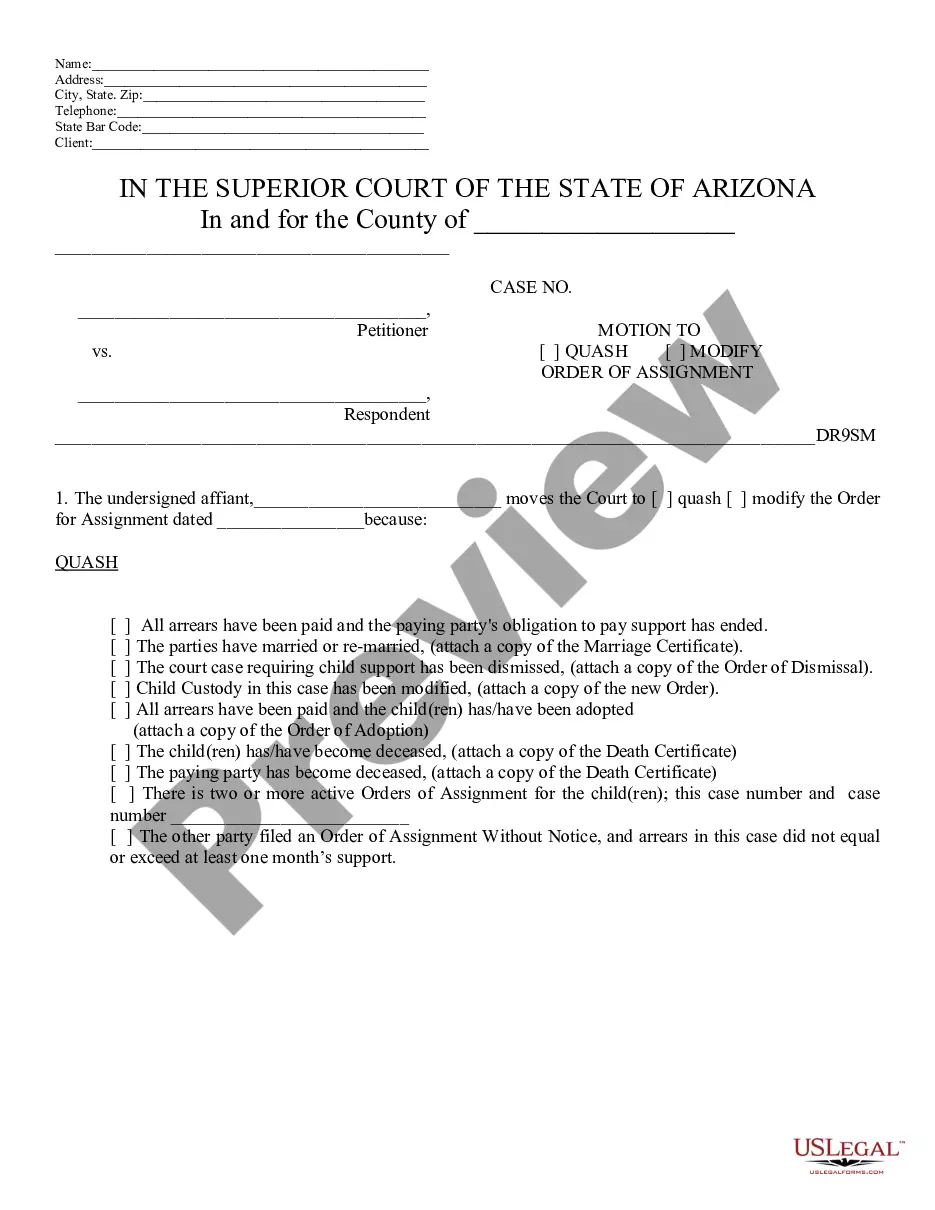

How to fill out Arizona Order To Stop Wage Assign.?

Securing a reliable location to obtain the latest and most pertinent legal templates is half the challenge of managing bureaucracy. Locating the appropriate legal documents necessitates precision and meticulousness, which is why it's crucial to source samples of Arizona Minimum Wage For Servers only from credible providers, such as US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have minimal worries. You can access and review all the information regarding the document’s applicability and significance for your situation and in your state or locality.

Consider the outlined steps to complete your Arizona Minimum Wage For Servers.

Eliminate the complications that come with your legal paperwork. Explore the extensive US Legal Forms collection where you can discover legal templates, verify their relevance to your circumstances, and download them instantly.

- Utilize the catalog browsing or search function to locate your sample.

- Examine the form’s details to determine if it meets the criteria of your state and region.

- Review the form preview, if available, to confirm the template is indeed the one you are seeking.

- Return to the search and look for the appropriate template if the Arizona Minimum Wage For Servers does not fulfill your requirements.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Select the payment plan that suits your requirements.

- Proceed to the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Arizona Minimum Wage For Servers.

- Once the form is on your device, you can modify it using the editor or print it and complete it by hand.

Form popularity

FAQ

As of , the average hourly pay for a Waiter in Arizona is $15.07 an hour.

Minimum wage for servers in California is the same as it is elsewhere in the state ? regardless of the fact that waiters and waitresses receive tips. Tips don't count toward minimum wage for servers in California. Employers must pay them the state's standard minimum wage.

1, 2023, the minimum wage in Arizona is $13.85 per hour for standard employees and $10.85 per hour for tipped employees.

Minimum Wages for Tipped Employees JurisdictionBasic Combined Cash & Tip Minimum Wage RateState requires employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal Fair Labor Standards Act ($2.13/hour)Arizona$13.85Arkansas$11.00Colorado$13.6568 more rows

Arizona law allows employers to claim a tip credit of $3.00 an hour. This means tipped employees can be paid as little as $9.00 an hour, as long as they earn enough in tips to bring their compensation up to at least $12.00 an hour, total.