Arizona Motion Az Form Az-8879

Description

How to fill out Arizona Motion For Dismissal?

Securing a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires meticulousness and careful consideration, which is why it's essential to obtain samples of Arizona Motion Az Form Az-8879 exclusively from trustworthy sources, such as US Legal Forms. An incorrect form could squander your time and delay your proceedings.

Eliminate the stress involved in your legal paperwork. Explore the extensive US Legal Forms library where you can discover legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library search or navigation tools to locate your template.

- Review the document's details to ensure it complies with your state's and region's requirements.

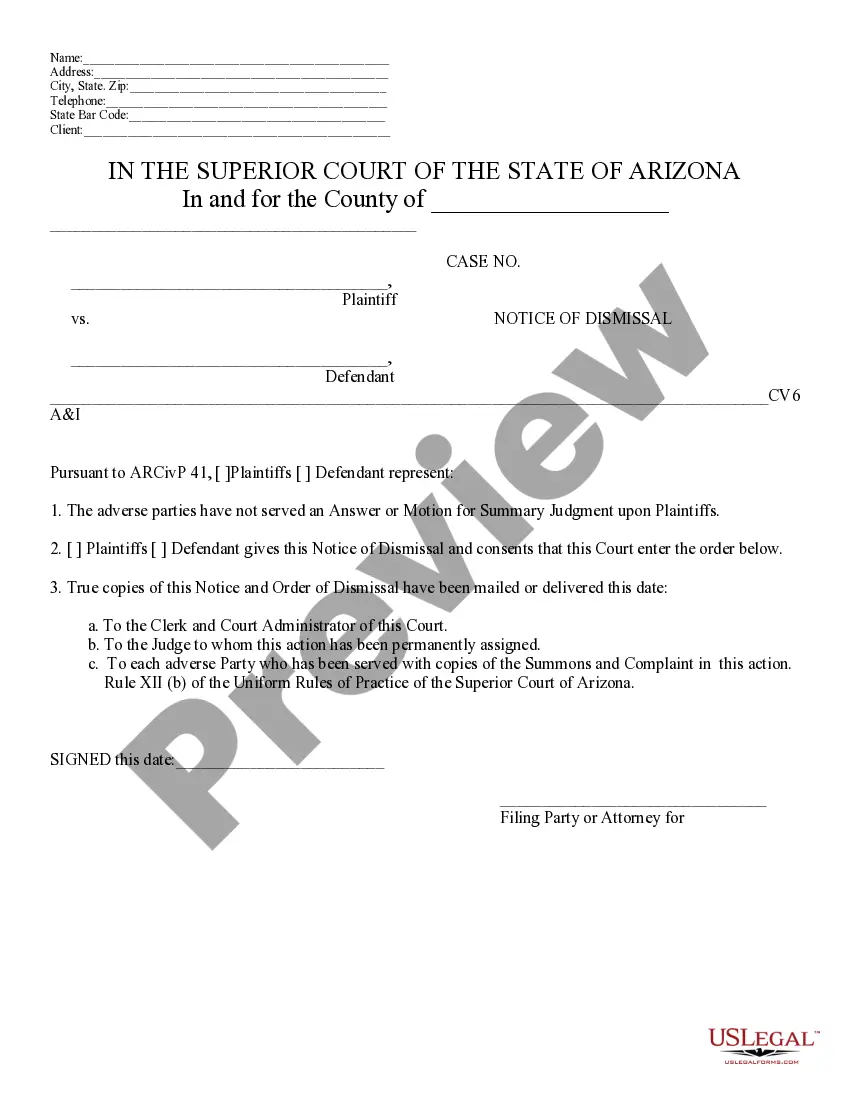

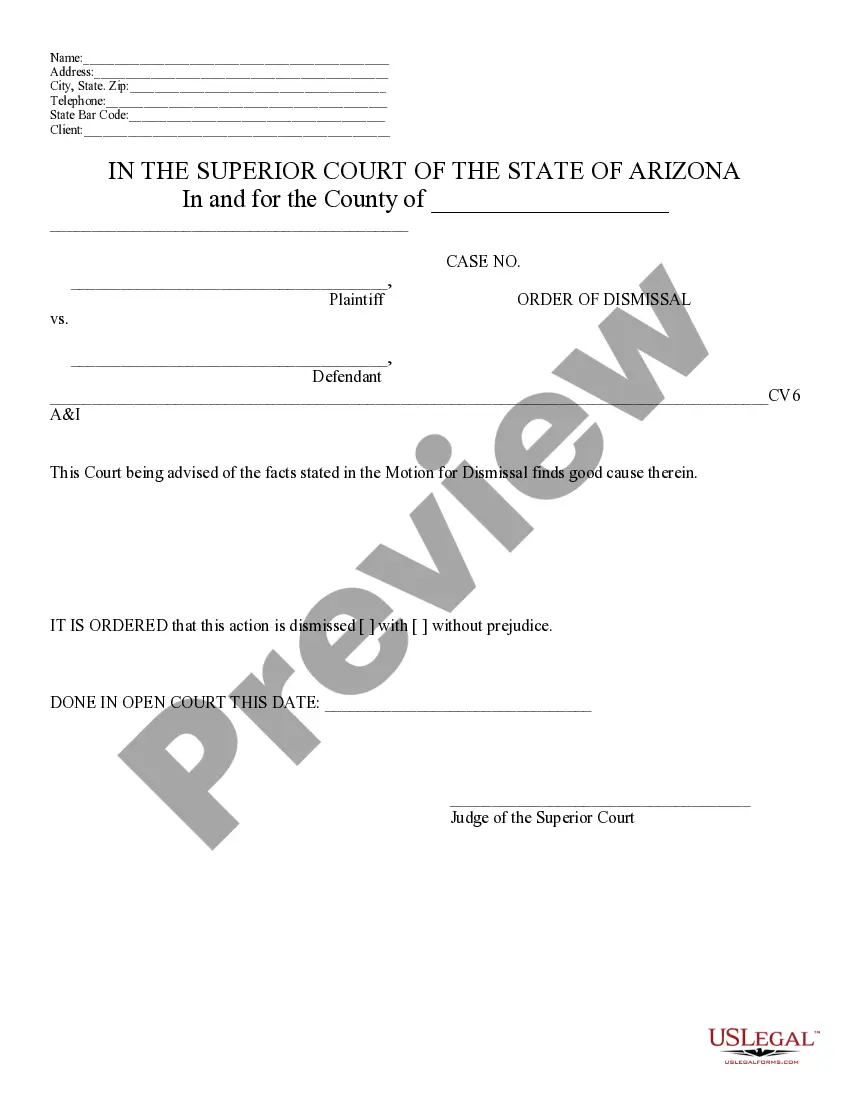

- Access the form preview, if available, to confirm that the template meets your needs.

- Return to the search function to look for the correct document if the Arizona Motion Az Form Az-8879 does not fulfill your requirements.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected documents in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Choose the pricing plan that best fits your needs.

- Continue with the registration process to finalize your transaction.

- Complete your purchase by selecting a payment option (credit card or PayPal).

- Select the document format for downloading Arizona Motion Az Form Az-8879.

- Once you have the form on your device, you can edit it with the editor or print it for manual completion.

Form popularity

FAQ

Individuals who move to Arizona or live in the state temporarily also have tax filing requirements. Nonresident individuals must file income tax returns in both Arizona and their home state.

Arizona Form 8879 - Electronic Signature Authorization This form is to certify the truthfulness, correctness and completeness of the taxpayer's electronic income tax return.

Electronic Signatures ? Arizona will permit a taxpayer to sign Arizona Form AZ-8879 using any electronic signature method authorized by the Internal Revenue Service (IRS) for signing federal Form 8879 as outlined in IRS Publication 1345. The use of a signature pads to sign AZ-8879 is acceptable.

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO). Complete this form when: The Practitioner PIN method is used.

Nonresidents are subject to Arizona tax on any income earned from Arizona sources. Nonresidents may also exclude income Arizona law does not tax.