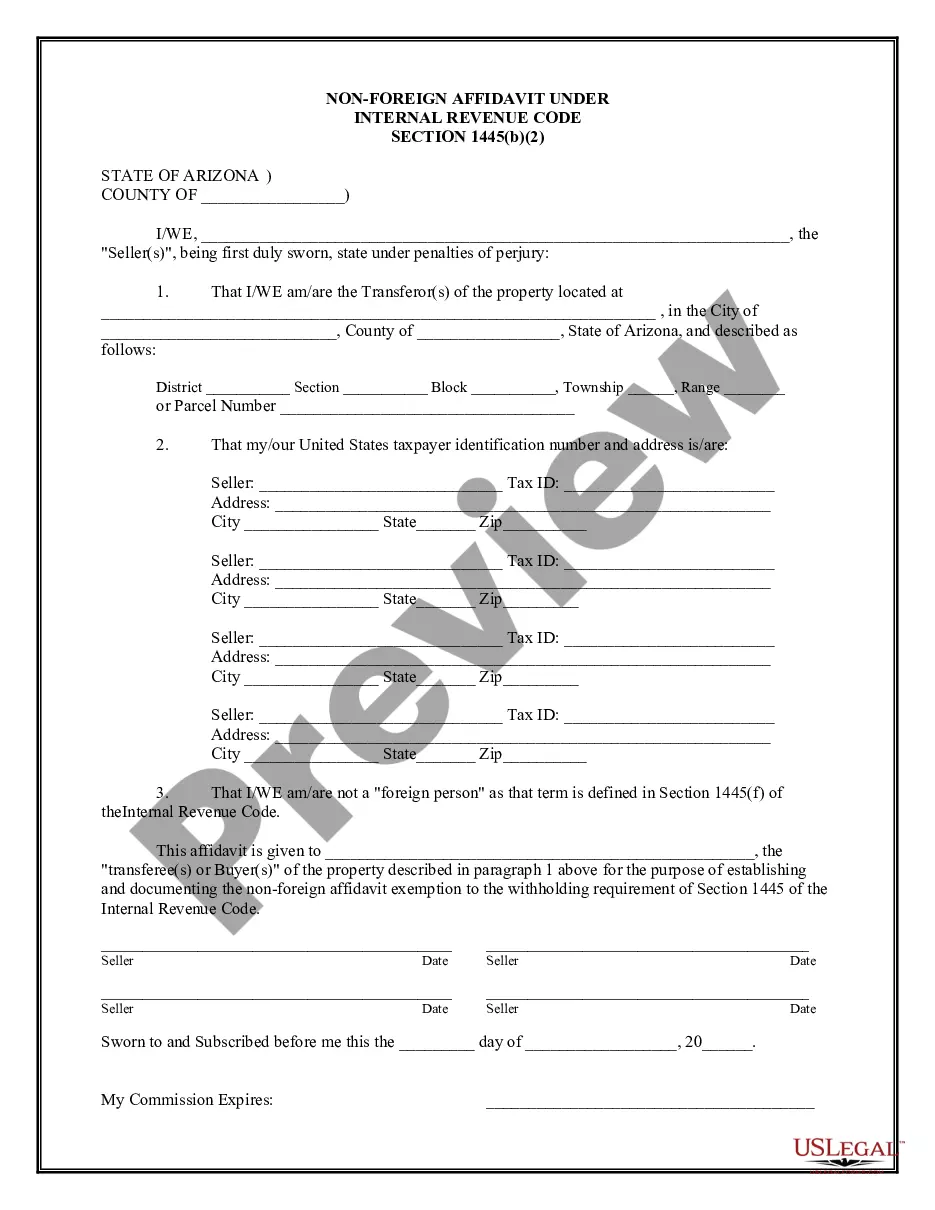

Arizona Non Foreign Affidavit Form

Description

How to fill out Arizona Non-Foreign Affidavit Under IRC 1445?

Individuals frequently connect legal documentation with something complicated that solely an expert can manage.

In some respects, it's accurate, as constructing the Arizona Non Foreign Affidavit Form requires in-depth knowledge of subject matter criteria, including state and county laws.

However, with US Legal Forms, the process has become simpler: pre-formulated legal templates for various personal and business circumstances, tailored to state regulations, are compiled in a unified online directory and are now accessible to all.

Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they are saved in your account. You can access them whenever required via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Evaluate the content of the page carefully to ensure it complies with your needs.

- Review the form details or view it through the Preview option.

- Find another template using the Search bar in the header if the previous option doesn't suit you.

- Click Buy Now when you identify the appropriate Arizona Non Foreign Affidavit Form.

- Select a pricing plan that aligns with your preferences and budget.

- Create an account or Log In to proceed to the payment portal.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

To get started on domesticating the foreign judgment in Arizona (sometimes referred to as registering the foreign judgment in Arizona), you must procure an authenticated copy or exemplified copy of your original foreign judgment. Please note that this is different from a certified copy of the judgment.

The process requires registering a certified copy of the foreign judgment with the clerk of the court in the jurisdiction where you want to enforce the judgment. You will also need to file an affidavit attesting to certain facts, as specified in the court's procedural rules.

AFFIDAVIT OF NON-FOREIGN STATUS. Exhibit 10.6. AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

To get started on domesticating the foreign judgment in Arizona (sometimes referred to as registering the foreign judgment in Arizona), you must procure an authenticated copy or exemplified copy of your original foreign judgment. Please note that this is different from a certified copy of the judgment.

You may file the protected address form with your Register Foreign Order format the Clerk of Court filing counter. This form serves as a cover or transmittal letter to state your request to the Court and to accompany the documents required to register the foreign order in Arizona.