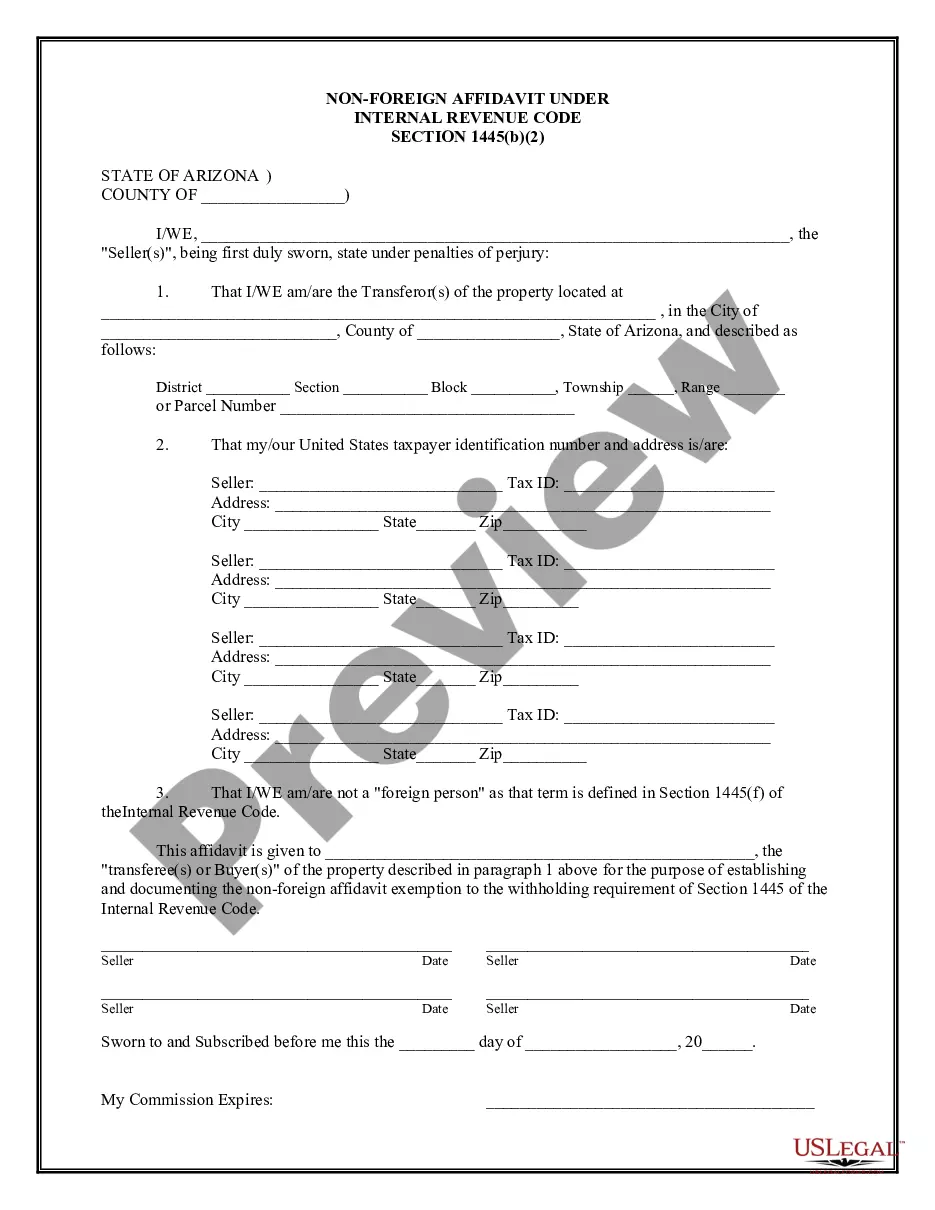

Arizona Non Foreign Affidavit For Corporation

Description

How to fill out Arizona Non-Foreign Affidavit Under IRC 1445?

Precisely composed official documentation is one of the crucial assurances for preventing problems and legal disputes; however, acquiring it without a lawyer's assistance may require time.

Whether you seek to swiftly obtain an up-to-date Arizona Non Foreign Affidavit For Corporation or any other forms for employment, family, or business events, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Moreover, you can access the Arizona Non Foreign Affidavit For Corporation at any time later since all the documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official documentation. Try US Legal Forms immediately!

- Ensure that the form is appropriate for your circumstances and area by examining the description and preview.

- Search for another example (if necessary) through the Search bar in the page header.

- Hit Buy Now once you find the suitable template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Arizona Non Foreign Affidavit For Corporation.

- Press Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

FIRPTA stands for Foreign Investment In Real Property Tax Act (26 USC §1445). It is a tax law designed to ensure payment of tax to the Internal Revenue Service (IRS), as may be due, when US property is sold by any foreign person.

FIRPTA applies to foreign corporations, partnerships and other entities selling U.S. real properties. It also applies to individual sellers who are considered non-residents.

Form 8288-AThe IRS has to stamp your copy B and will then get it sent to the person who is withholding your file. That person is the one who will be filing a US income tax return and will then have to attach it to the stamped form 8288-A so that they receive any credit for the withheld tax.

Buyers (transferees), who are generally the withholding agents, must use Forms 8288 and 8288-A to report and pay to the IRS any tax withheld on the acquisition of U.S. real property interests from foreign persons.

foreign person affidavit is made by a seller of a real property stating that s/he is a nonforeign seller as defined by the Internal Revenue Code Section 26 USC 1445. The nonforeign affidavit is required to afford the buyer with guarantee that the seller is not a foreign person.